NICHOLAS TAY

Co-founder – Merlion Review Merlion Review (Singapore)

By 2025, e-commerce is forecasted to make up break US$5.4 billion; accounting for 6.7% of all retail sales in Singapore, triple that of 2015 according to a 2017 report by Google and Temasek Holdings. How did e-commerce start in Singapore? What is the current environment? Where is e-commerce headed? I will attempt to answer these broad important questions in this article.

The Early Days of E-Commerce in Singapore

Singapore has always led South East Asia in tech infrastructure and thus was one of the first adopters of e-commerce. In 2011, online shopping in Singapore amounted to US$0.85 billion.

In particular, “Blog shops” were the champions of online selling, since it was very cheap and at times free to start such shops. In 2011, LiveJournal reported that it had over 50,000 Blog Shops and 1.2 million users in Singapore; pulling in more than US$72 million in transactions for that year.

The Current State of E-commerce in Singapore

Today, Singapore is still a tech infrastructure leader and has been ranked 2nd globally in the Smart Cities Index, behind only Copenhagen. Enabled by infrastructure, there are an estimated 4 million e-commerce users in Singapore with average revenue from each user estimated at US$1,001.

In addition, Singapore is the top cashless country according to MasterCard. Credit card payments have become the most popular online payment method; offered by almost every merchant in Singapore. The second most popular is bank transfers but offered by only 38% of merchants.

Interestingly, an Edelman Intelligence study in 2016 revealed that laptops were the most popular device for online shopping despite Singaporeans using smartphones more frequently. This reflects global trends, with 57% of consumers preferring computers for online shopping according to KPMG.

With robust tech infrastructure and a digitally enabled population, Singapore has become a key battleground for control over the South East Asian e-commerce market. Earlier this year, Alibaba invested US$2 billion into Lazada; a Singapore-based e-commerce startup, bringing its total investment to US$4 billion. Last year Amazon officially entered Singapore, launching the full-fledged Amazon Prime Service. Other notable platforms such as Shoppee, JD.com and qoo10 have also said that they will be investing heavily in Singapore to use the nation as a spring board to the region.

Online Store Lazada Source: unsplash.com

The Singaporean government has taken a welcome approach to e-commerce and aims to grow the e-commerce share of retail receipts to 10% by 2020. As a sign of the government’s commitment to this target, the Ministry of Trade and Industry has unveiled a “Retail Industry Transformation Map” which brings various government agencies together to help local retailers develop omnichannel capabilities and access to global e-commerce markets. Additionally, a suite of new policies has been rolled out to help the retail industry workforce acquire skills in digital marketing and e-commerce.

The Future of E-Commerce in Singapore

E-commerce in Singapore Source: flickr.com

Population Limitations

A key challenge for e-commerce growth is Singapore’s relatively small population. By 2020, the population of Singapore will only be 5.9 million, much smaller than that of her neighbours. Even so, the GDP per capita PPP in Singapore is ranked 4th globally by the IMF. In this regard, BMI research foresees that e-commerce in the premium goods and value-added services segment will continue to grow. Moving forward we will see services to customers improve in Singapore as companies innovate new ways to compete for the attention of Singapore’s small but affluent population.

Cross-Border E-Commerce

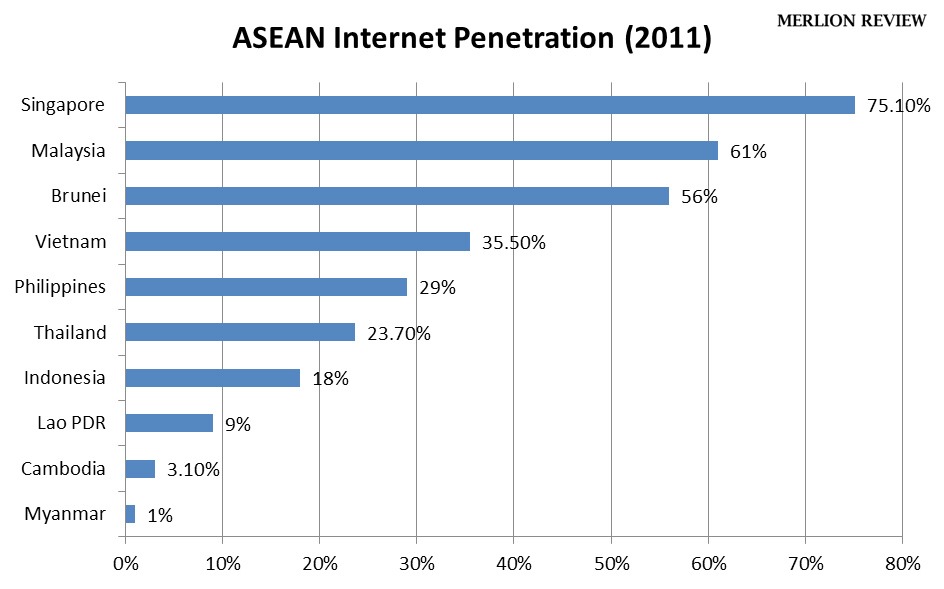

55% of all Singaporean e-commerce transaction are cross-border according to PayVision. Moving forward, cross-border e-commerce will continue to be critical given Singapore’s small population and the growing economic significance of the Association of South East Asian (ASEAN) region.

In terms of economic and population size, ASEAN is 5th and 2nd globally. With regards to e-commerce growth, the region is expected to see a CAGR of 32%, growing from $5.5 billion in 2015 to $88 billion in 2025 according to Business Insider.

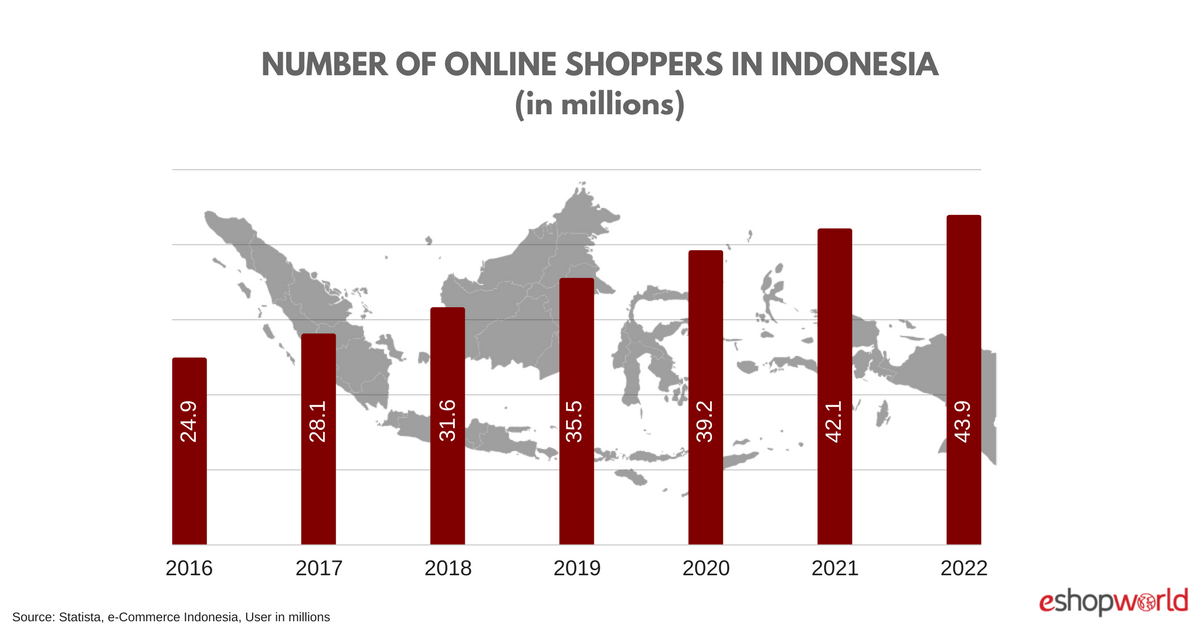

Case Study: Indonesia

Mr Joseph Koh; COO of MC Payment (a Singapore-based fin-tech company enabling e-commerce merchants to expand into South East Asia) says that ASEAN is unique in that the population is huge but lacks the technological infrastructure to participate in Western-style e-commerce.

For example, of the more than 261 million people living in Indonesia, only 5% have a credit card. However, around 55% of the population has access to the internet. Therefore they can browse for products and services online but are unable to pay by credit card.

Unsurprisingly, e-commerce penetration stands at only 40%. Here, Mr Koh sees an opportunity for Singaporean innovation. For example, MC Payment works with online e-commerce merchants and local convenience stores to enable people to purchase coupon codes from convenience stores which can then be used on online stores; solving the problem of not having a credit card.

Like Indonesia, other countries in ASEAN also have similar infrastructure weaknesses and thus present a huge untapped market for Singaporean e-commerce companies to expand into.

Technology

With platforms like Alibaba offering nearly unbeatable prices, e-commerce platforms will have to compete on user experiences. Augmented Reality (AR) and Artificial Intelligence (AI) have been generating much buzz in Singapore and will undoubtedly shape the future of e-commerce.

Augmented Reality

A key challenge in selling wearables online is that customers are unable to try them on. In the UK and US, this has led to customers buying multiple variants of the same pieces of clothing, trying them on and then returning the variants that they do not like. This is extremely costly to merchants and thus e-commerce companies are starting to harness AR. Even for something as intricate as jewellery, Tanzire; an e-commerce platform for jewellery, has perfected AR to the point where customers can virtually try on pieces of jewellery through the Tanzire mobile app.

Artificial Intelligence

Going beyond replicating the comforts of a physical store, AI allows merchants to develop an understanding of customers at a level which cannot be attained offline. Speaking with the founder of Tanzire; Ms Suhani Batwara, she says that the best jewellers take time to understand clients and curate pieces of jewellery that are just right for them. With AI, far more data can be processed; from the client’s calendar to previous jewellery choices. With this data, the AI can identify insights which jewellers can use to curate the right jewellery for clients.

Singapore is the undisputed leader in e-commerce infrastructure; from technology to logistics. As a result, this country of only 5.6 million has attracted international behemoths like Alibaba and Amazon to invest billions of dollars here. To continue being the hub for e-commerce, companies need to expand internationally and continually invent new ways to augment online interactions.

SEE ALSO: How will blockchain change retail business: TOP-5 options