During the last few years, the banking world has been undergoing a profound transformation

5 global banking trends that will continue to thrive in 2019. Source: twitter.com

Banking is considered to be one of the most conservative areas. However, in most recent years, even banking has been constantly undergoing change. Nowadays fintech startups, such as Revolut or Monzo, raise millions of dollars, hence they mushrooming. Thus, banking has no other choice but to change, in order to retain clients.

PaySpace Magazine has decided to take stock, highlighting the major trends of 2018, and anticipating what is to come from banking during 2019.

1. Segmenting

Today many banks implement segmentation of their audience according to various criteria: demographics, lifestyles, values, aspirations, needs.

Most likely, during the next years, the banks will go even further and focus on personal communication when each person will be considered as a “separate segment”. This is a very high level of innovative personalization, which is made possible by being provided with a large amount of data, advanced analytics, and digital technologies.

Having division by advanced criteria, design concepts and CRM tools, financial and lending institutions will understand customer needs and respond to them promptly in real time.

in.linkedin.com

In addition, financial institutions will probably build separate communications with segments of small and medium-sized enterprises.

2. Open Banking age

An increasing number of regulators demand that financial institutions provide their customers with an opportunity to share their data with third parties safely. This will facilitate the provision of new financial services, as well as increase competition within the banking sector.

Consumers gain more independence and control over the way they interact with their financial service providers if they provide credentials and billing information through a secure application programming interface (API).

Open Banking is able to boost innovation and collaboration, which leads to the expansion of banking ecosystems. They, in turn, can include much more than conventional financial services, which will improve consumers’ lifestyles.

Open Banking will also enable conventional financial institutions to allow customers to control their own data. Furthermore, the introduction of the system will encourage non-traditional financial firms to cooperate with traditional banks.

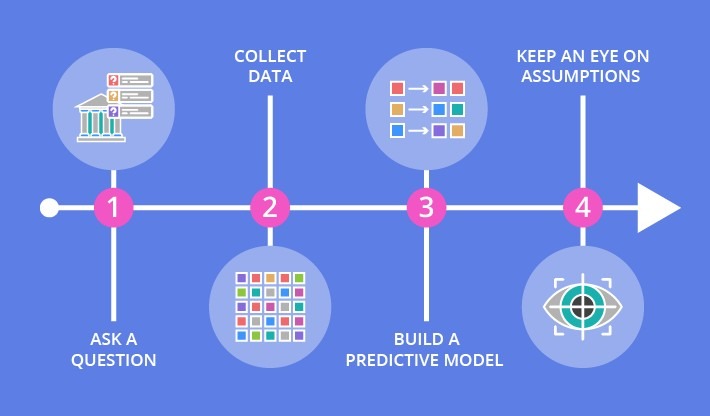

3. We know what you might like tomorrow

Anticipating (Predictive Banking) is another highly expected trend. Today, banks have broad, accessible and financially viable data. This information helps financial institutions not only know their customers well, but also gives them valuable advice for the future.

Predictive Banking. Photo: scnsoft.com

This feature will be particularly useful in collaboration with chatbots, controlled by AI or robotic consultants. The banks will considerably benefit if they integrate this functionality with Open Banking.

This «collaboration» will allow financial institutions to not only sell a product «here and now», but also offer clients possible further actions.

4. New omnipresent payment ways

The payment industry is one of the most dynamic areas in the banking sector. Influenced by changing consumer expectations and technological advances, fintech startups will continue to implement all new payment solutions.

The payment industry is one of the most dynamic areas in the banking sector. Source: shutterstock.com

Financial institutions will move away from specific products, and instead, introduce payment options for everyday-use products.

The possibility of combining the payments industry with the Internet of things, mobile wallets, cryptocurrency, and blockchain will play a significant role in this process.

5. Blockchain

It is no big secret that banks are still wary of cryptocurrencies. However, its underlying technology (blockchain) has earned much more confidence of financial institutions worldwide. No one would be surprised by the fact that banks already use or plan to implement blockchain for their services.

Blockchain in the banking industry. Source: shutterstock.com

Moreover, Ripple has already shown the benefits of blockchain use. Some specs have even surpassed those of SWIFT, such as:

- speed of payment processing

- tracing

- scalability

- liquidity.