5 reasons why real-time payments are accelerating efficiency in our financial system

The rapid growth of the digital economy has brought along a never-ending demand for innovative solutions, which are providing breakthroughs for this fast-evolving environment.

One of the most influential breakthroughs for the digital economy has been the introduction of real-time payments to our global financial system.

But what makes real-time payments so useful? And, how do they change the way we interact with money?

1. Improving efficiency in the financial system by boosting the competition

The traditional banking systems of loans and deposits are still a fundamental pillar to the way money is managed across the world, showing just how little things have changed within this sector. Today, thanks to many different technological advances, everything is being digitalized, even the way people interact with each other. This accounts for the broad use of smartphones, the internet, and all the way up to blockchain technology and smart contracts. Yet, it seems that in banking and especially in cross-border payments the changes are moving at a slower pace and that is due to the lack of supporting technology & procedures, on top of the conflicting interests of banks, to hold on to funds as long as possible, before accounting them to a private account.

The introduction of real-time payments is the leap forward that our financial systems and their infrastructure needs in order to catch up with demand. Traditional banking is still apparent in 2021, with payments and transactions usually taking 2-4 days to be released by the receiving bank. The reason for this is intended to prevent fraud, but it mostly allows for banks to withhold more capital for a longer amount of time, to their advantage.

Real-time payments solve many of these issues. Transactions are now fast, efficient, and stress-free; there is no need to wait days for funds to be released, which immediately displaces high cost and ineffective money transfer options such as checks. Also, real-time payments increase the competition, and innovation within the digital economy, it releases money that is locked up in the financial system.

Only brave moves like the implementation of real-time payments, can break down the limits of outdated financial systems and accelerate efficiency.

2. Allows the financial system to adapt itself to the new way of living

Change is inevitable and the world has moved on considerably since banks and finances were first introduced. The way people dress, communicate, socialize and commute have all advanced. Even the way we work and the way we get paid has changed. Today, people are free from borders and restrictions when it comes to where they live and can work. Especially with the recent global pandemic which has forced major workforces to create a work-from-home structure. People can work from anywhere in any time zone, while also receiving payments from anywhere fast, thanks to instant money transfers.

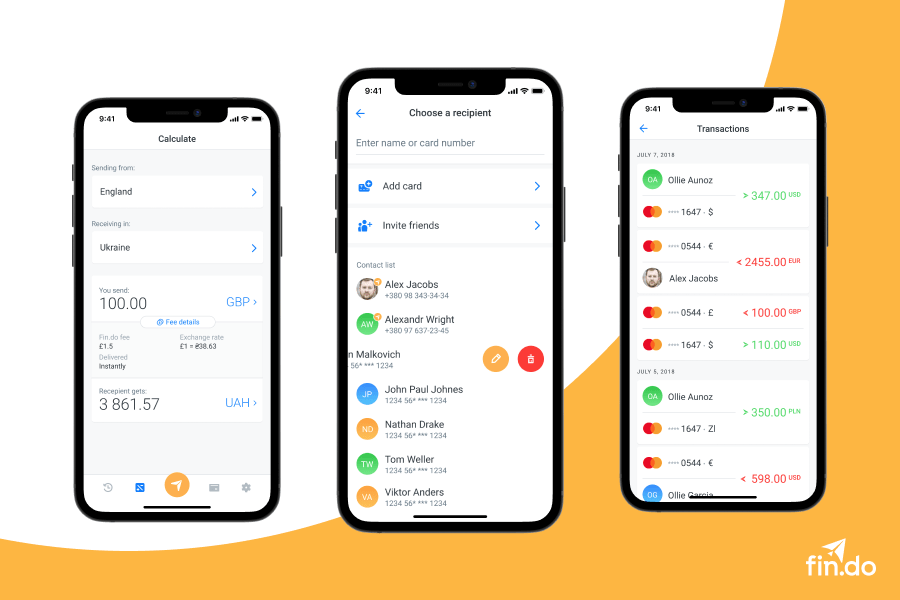

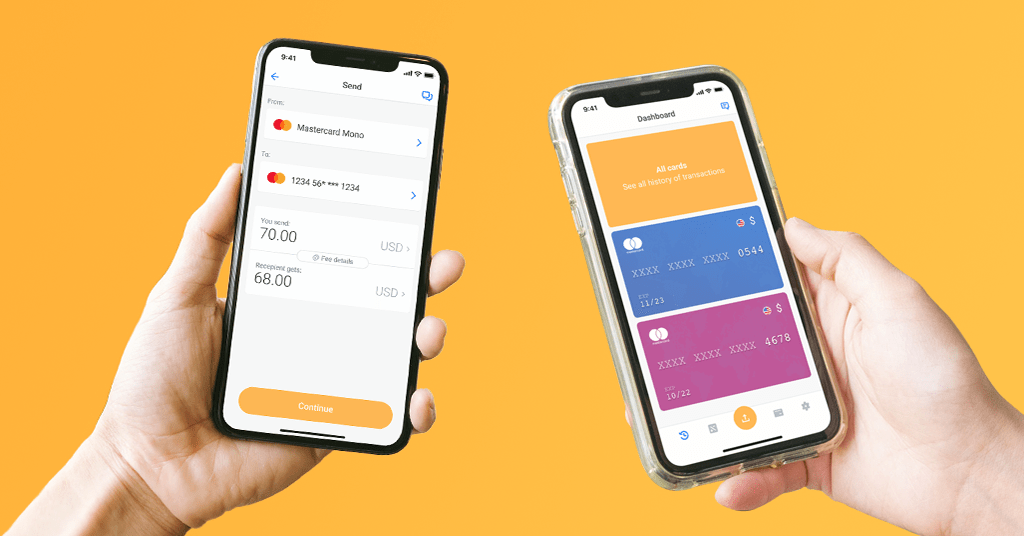

This new way of working is called the “gig economy”, and the payment method supporting it is called real-time payments. Later generations will never understand how we got by for so long without remote working and instant money transfers. Now and more so in the near future, people will start their working day by opening their laptops on a Thailand beach, or in their favorite Café in NYC, while receiving paychecks in a fraction of the time from their remote employer using apps like Fin.do. This creates a whole new world of opportunities.

3. Real-time payments allow businesses to finance working capital

Today, as it stands, many businesses have to adapt and use the current set of rules and tools which are available within the legacy payments systems. This means that in order to finance their working capital, businesses have to maneuver around the delays and inefficiencies that come with regular payment methods, such as checks, non-instant electronic transfers, and bank wires. Payments are being delayed, postponed, or held back until the very last minute.

By removing these inefficiencies, consumers and businesses will have the ability to see real-time balances, therefore avoiding unnecessary financial costs. This will improve their investment capabilities so they can make better financial decisions, all because their working capital is more accessible.

4. Regulation and control over a more formalized economy

The term “shadow economy” refers to undeclared work and\or payments, which are untaxed.

Without getting too deep into the numbers, it is mutually agreed by economists that the shadow economy is tied with slowing down economic growth and distorting competition across markets.

Cash transactions are hard to keep track of, therefore the use of cash is associated with tax evasions in the shadow economy.

The high transparency rates, combined with fast cash-like transactions, allow a preference of real-time payments over cash. This in turn will decrease the amount of evaded taxes, contributing to strong economic growth.

On a global scale, the adoption of real-time payments is on the rise, thanks to the rapid growth of digitalization and the need for a more formalized international economy and faster ways of transferring funds across borders.

5. A milestone platform for the next wave of fintech innovators

Breaking old habits is hard. Breaking down outdated systems is even harder. People have never moved, thought or reacted faster and the current financial system, in most countries, is not in sync with the pace of today’s world as it remains slow and complicated.

The digital economy is changing all of that. The adoption of real-time payments is essential for a truly digital financial revolution. People are now able to transfer money instantly, anytime, and from anywhere. Various players in the market such as Fin.do and MasterCard are now allowing peer-to-peer and cross-border real-time payments effortlessly.

The digital economy has huge potential, and the wide adoption of real-time payments would be considered the milestone platform for the next wave of fintech innovators. There is no telling what the future holds for the digital economy, but it sure looks like it is going to be revolutionary.

SEE ALSO: