Average contactless payment increases by nearly 30% since new £100 limit was introduced. Source: pexels.com

According to December 2021 card spending data from UK Finance, the average amount spent per contactless card transaction rose by almost 30% following the contactless spending limit increasing from £45 to £100 in October last year.

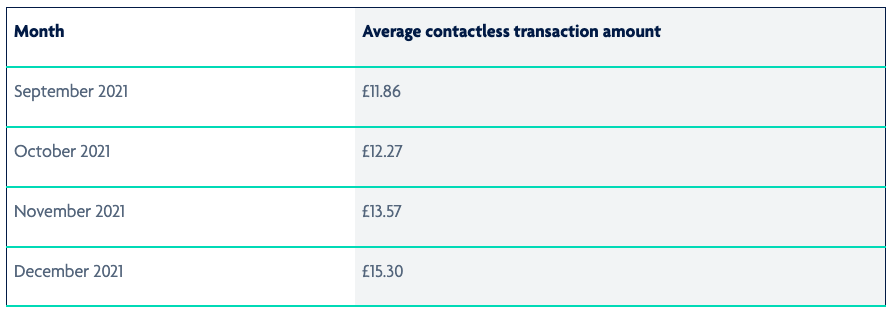

In September, prior to the contactless limit increase, the average spend per contactless payment was £11.86, which increased to £15.30 in December.

The increased limit came into effect on 15 October, but it took a period of time for retailers and payment providers to update their systems and offer the new £100 limit, which means the increase in the average payment took time to show up.

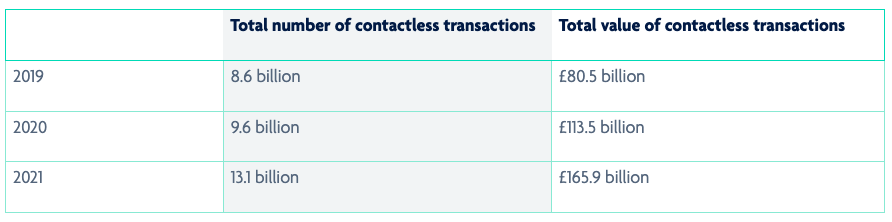

For 2021 as a whole, the card spending data shows a total of 13.1 billion contactless payments were made in the year – equivalent to 415 transactions every second. This is up 36% compared with 2020 and 52% higher than pre-pandemic levels in 2019.

The total value of contactless transactions in 2021 also increased, reaching £165.9 billion. This is 46% higher than in 2020 and 106% more than 2019.

The proportion of card payments that were contactless continued to increase in December 2021 and reached its highest recorded level, accounting for 69% of all debit card transactions and 56% of all credit card transactions.

SEE ALSO: