![]()

Bader Al Hussain

PaySpace Magazine Analyst

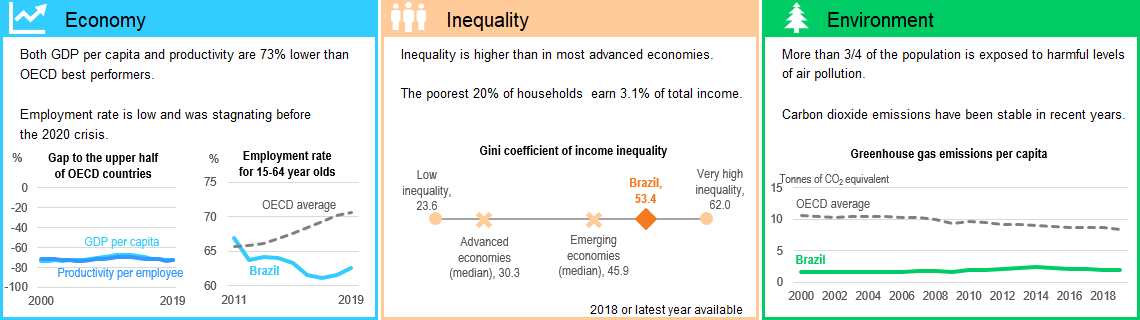

Brazil is the largest economy in South America and is also considered to be one of the fastest-growing major economies of the world. It is part of BRICS (Brazil, Russia, India, China, South Africa) and this acronym is associated with the five major emerging economies around the globe. The country has witnessed numerous booms and bust cycles and the reforms together with political stability are the only way out for the sustainable economic development of the country. Recently, the performance of the country has largely been lackluster on the economic front, however, the government is undertaking measures to raise overall productivity.

Brazil’s economic forecast 2021: what’s coming next? Source: unsplash.com

Economy at glance

With the total economic output of USD 1.49 trillion per annum, Brazil has the twelfth largest economy in the world. Based on its income per capita, Brazil is categorised as the middle-income country, having a GDP per capita of approximately USD 7,011 Further, as far as its sector contribution is concerned, services sector contributes 58.5% to the total income generated by the country, where as industry and services sector account for 32.1% and 5.5% respectively.

The primary trading partners of the country are China, United States, European Union, and Argentina.

Currently, the country is stuck in the middle-income trap and is facing high unemployment rates across the region. Since 2013, the country’s economy entered into a recession phase and the COVID-19 pandemic only exacerbated the situation. Resultantly, the country has not fully recovered from the recession phase.

Economy in COVID-19

According to the World Bank, the COVID-19 pandemic exposed the country to a host of unprecedented health and economic challenges. It is pertinent to note that COVID-19 hit when the country was on its way to recovery from the 2014 – 2016 recession. The government’s response to the pandemic resulted in the reduction of external demand for goods and services in the economy. Nevertheless, in response to the reduction it was a timely and targeted fiscal package to stimulate the demand in the country’s economy. The total budget amount of the package was USD 156.8 billion (11% of GDP). This large fiscal stimulus was successful in curbing the contraction of the economy to 4.1 percent in 2020.

According to the experts, the impending rebound in an economy could prop up the country’s economic growth to 3% in 2021. However, experts are also quick to cite significant downside risks attached to this growth estimate as the sustained resurgence in the economy is largely dependent on the success of the vaccination campaign.

Economy outlook

“Even with the second wave of the COVID-19 pandemic, GDP [gross domestic product] grew in the first quarter, given that, unlike last year, there weren’t as many restrictions that impeded economic activity in the country,″ the statistics agency’s GDP survey coordinator, Rebeca Palis, said in a statement.

In order to further increase the productivity of the economy, the country’s government has been engaged in implementing the following policy agenda:

- Social protection: Increase the effectiveness of social benefits.

- Education and skills: Enhance equity and outcomes in education and professional training.

- Competition and regulation: Reduce barriers to competition and trade.

- Tax system: Reduce distortions in the tax system.

- Environmental policy: Preserve natural assets and halt deforestation.

“Rising virus cases and the unwinding of most of last year’s fiscal support package present clear downside risks to the growth outlook,” Capital Economics analysts said in comments for the survey. The investors need to look for the following policy measures to be passed by the government as the implementation of these measures warrant for a sustainable economic growth in the country.

These policy points are as follows:

- The government has to ensure fiscal sustainability by implementing the current fiscal rules and expenditure ceiling.

- Review and revise the current civil service remuneration structures, ineffective subsidies, special tax regimes and tax expenditures.

- Review revenue earmarking, mandatory spending floors and indexation mechanisms.

- Index social security benefits to consumer prices rather than the minimum wage.

- Increase benefits and accelerate benefit concessions in the Bolsa Familia programme, while withdrawing the benefits only gradually.

Brazil stock market performance

Sao Paulo Stock Exchange of Brazil is one of the largest stock exchanges in the world. It was established in 1890 and has a total market capitalization of approximately USD 1 trillion. The bourse offers a range of products for trading such as stocks, ETFs, futures, commodities, forwards, options, corporate and government bonds etc. There are approximately 450 firms listed on Bovespa.

Brazil 100 Index (IBrX 100) is largely quoted as the benchmark index of Brazilian capital markets. The index gave a yearly and year-to-date (YTD) return of 47.62% and 10.88% respectively. Additionally, the index furnished annualised risk-adjusted return of 0.34 over the span of 3-years.

Further, as far as the fundamentals of IBrX 100 are concerned, the index is trading at a trailing P/E and projected P/E multiple of 20.87x and 11.41x respectively. It has a P/B multiple of 2.83x. As we can infer from the pie chart below, the index is heavily invested in materials and financial sectors and these sectors have high correlation with the economic growth of the country. Therefore, given the sanguine economic growth outlook, this index is well-positioned to outperform its benchmarks.

Moreover, Rio de Janeiro Stock Exchange (BVRJ) is the second-largest stock exchange in Brazil, which trades in currencies and government securities.

Further, we foresee the IBrX 100 will outperform the MSCI world index, given the government has undertaken adequate reform and policy measures to rejuvenate and stimulate the economy. Therefore, in this scenario, we have a buy call on the IBrX 100 index fund.

Conclusion

Brazil has to undertake reforms in order to unlock its intrinsic potential for economic growth. Classified as one of the major emerging economies of the world, the country needs to implement various reforms in order to unlock this potential. Additionally, one of the major concerns is the onslaught of inflationary pressures. The government needs to tame these pressures and try to balance the growth and inflation tradeoff. Further, the specter of COVID-19 is expected to stay for a while as new and virulent variants are a major hurdle to the fully-fledged opening of economies all over the world.

SEE ALSO: