China remains the leader of Asia’s retail lending market

China leads Asian retail lending market. Source: flickr.com

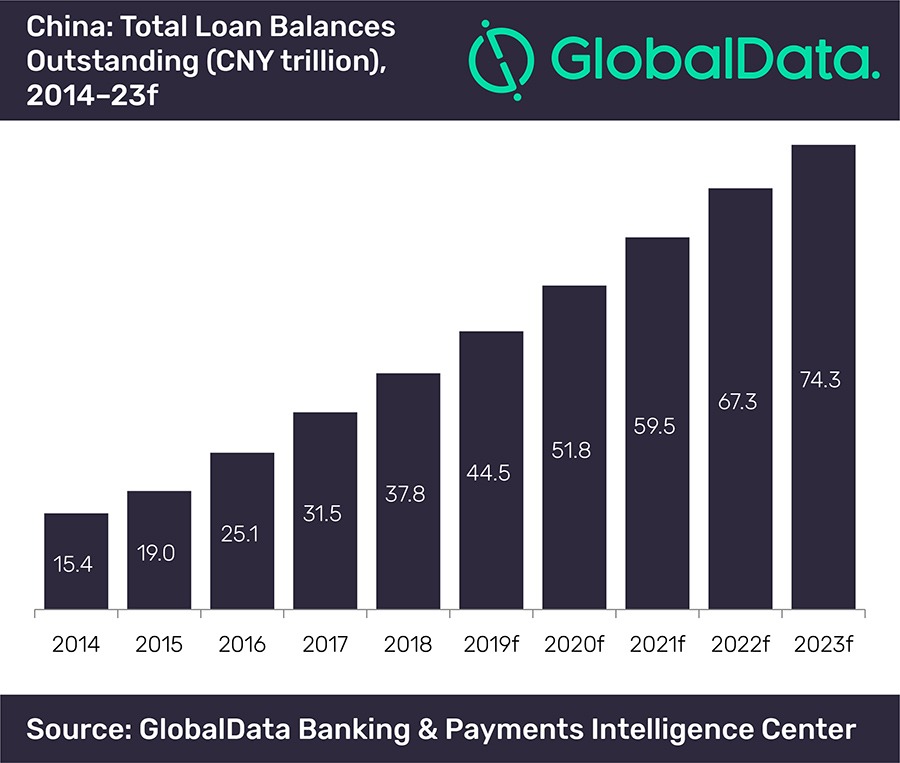

According to GlobalData’s report, the Chinese retail lending market’s strong growth was registered since 2014 and will increase with a compound annual growth rate (CAGR) of 13.7% during 2019-2023. The major part of Chinese loan balances outstanding appeared from home loans, followed by credit cards and personal loans. In 2014 China’s total loan balances outstanding recorded to be of CNY15.4 trillion ($2.2 trillion), increasing up to CNY37.8 trillion ($5.5 trillion) in 2018.

At the same time, mortgage loans remain the largest category as they increased significantly during 2014-2018.

In addition to that, China reflects one of the highest saving rates in the world, meaning that Chinese customers tend to save rather than spend.

SEE ALSO: