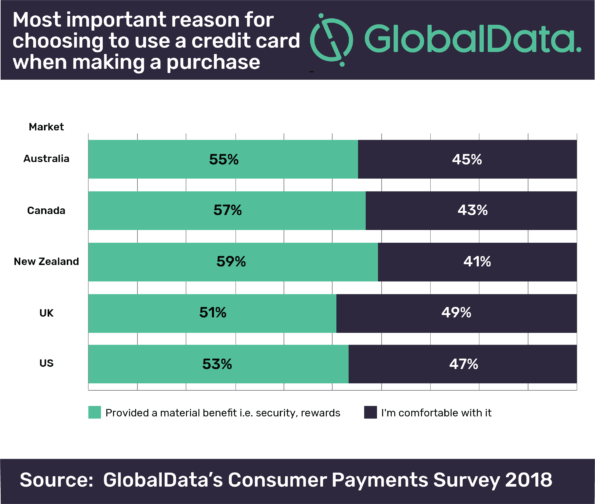

An average of 55% of consumers in Anglosphere markets said they used a credit card because it offered them a material benefit

Credit cards must offer more consumer benefits – GlobalData. Source: shutterstock.com

With point-of-sale lending continuing to grow and taking market share from credit card providers they risk losing a significant portion of their business unless more material benefits are offered to consumers to use credit cards, according to GlobalData.

POS lending is the offer of an instant-approval loan that usually takes place at the point of sale just before a purchase is made.

According to GlobalData’s Consumer Payments Survey 2018, an average of 55% of consumers in Anglosphere markets said they used a credit card because it offered them a material benefit such as help in spreading the cost, added security, or rewards, whereas the remaining 45% simply used a credit card because they were comfortable with it.

There are a number of factors driving the growth of POS lending. Technology has enabled small contractors and merchants which previously only accepted cash to offer POS lending facilities and larger merchants are increasingly offering it to customers as an alternative payment method to store cards. Store cards have a reputation for being expensive and merchants are finding that providing POS lending with some offering “interest-free” periods is a key factor for some customers in closing the sale. Rising consumer confidence levels and increased activity in the housing market over recent years is also a factor because it has driven up the purchase of big-ticket items requiring finance products for some consumers to buy them.

SEE ALSO: What is chargeback and when it is needed