Let’s find out what counts towards a credit score and how you can improve that vital number

Credit score: what is it and how to improve it. Source: pexels.com

Why do some people get credit from banks and others don’t? Is it only a matter of a stable income? Not precisely. Your credit score is a very important factor. If it’s low, you are not likely to get a loan from an official financial institution.

Definition

Сredit score is the result of complex calculations aimed to reflect one’s ability to pay the money back. Such a rating system is mainly used in the US, Canada, and the UK.

The exact formulas used to define credit scores are not available to the general public. They are kept confidential by major credit data analytics companies. Nevertheless, we do know some factors that are taken into account. As per FICO, those are:

- Payment history (35%)

- Amount owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

The items on this list are sorted by relevance. They are placed in descending order, so as you can see payment history is the foremost priority in the FICO credit score model.

Vantage Score, on the other hand, considers:

- Total credit usage (utilization), balance, and available credit (extremely influential)

- Credit mix and experience (highly influential)

- Payment history (moderately influential)

- Age of credit history (less influential)

- New accounts opened (less influential)

Evaluation factors

Let’s get into more detail about those factors mentioned above.

Payment history reflects the payout pattern of your previous and existing debts.

Account types considered for credit history include:

- Credit cards

- Retail credit accounts (credit from stores where you shop)

- Installment loans

- Finance company accounts

- Mortgage loans

Those accounts are thoroughly analyzed, taking into account how overdue delinquent payments are today or have been in the past, how much money is still owed on delinquent accounts or collection items, how much time has passed since delinquencies, adverse public records, or collection items were introduced, etc.

Even if you had a couple of late payments on your credit, the overall good picture is what matters most. The number of accounts that are being paid as agreed is as important as the number of past due items on a credit report and adverse public records (e.g. bankruptcies).

Negative aspects of one’s credit history include:

- Bankruptcies – those credit killers will stay on your credit report for 7-10 years, depending on the type

- Lawsuits

- Wage attachments

The amount owed is tightly interwoven with credit utilization. While the first term is simple (how much debt you have), how you use your credit potential is very important and much more complex.

Firstly, your credit report shows all the credit card balances, even if you pay them off regularly and timely. Secondly, it considers the number of accounts with amounts owed including installment loans, mortgages, retail credits, etc.

The amount you owe is compared to the original loan amount to estimate your repayment capability. Besides, it’s very important which percentage of available credit you’re using. This indicator is called the credit utilization (usage) ratio. If the rate is low, it will have a more positive impact on your FICO score than not using any of your available credit at all. Very often, the lower your credit utilization, the higher your credit score.

Length of credit history takes into account the age of your oldest account, the age of your newest account, and the average age of all your accounts. This evaluation part also includes the time that has passed since the last account usage.

Credit mix is the combination of all credit types you have (credit cards, retail accounts, installment loans, finance company loans, and mortgage loans). If you successfully manage different types of credit, it’s a good sign of your creditworthiness. In other words, FICO does not only check the mix of credit lines you have but also asks for the payment history of these credit types.

New credit means both recently opened lines of credit and credit enquiries. Opening several new credit accounts in a short period of time represents a greater risk for the borrowing party. Those people who don’t have a long credit history on top of all that are especially unreliable. New accounts will also lower your average account age.

As for enquiries, FiCO takes into account only the last 12 months, although they remain on your credit report for two years. Moreover, not all types of enquiries matter. Some are ignored altogether, as they don’t represent any credit risks. For instance, if you order your credit report directly from the credit reporting agency or through an organization authorized to provide credit reports to consumers, such as myFICO, it won’t impact your score. After all, you have a full right to know your own credit data.

The credit balance is the amount of money that a client of a financial institution owes in their account. In some cases, that balance appears negative (i.e. when you returned your purchase and got a refund, you accidentally paid extra, or earned a statement credit). Nevertheless, it doesn’t affect your credit score since credit scoring models consider negative balances as if you have a $0 balance.

Lingering balances, on the other hand, affect your credit utilization rate. The higher your credit balance, the higher your utilization rate, which can hurt your credit score.

Get to know your credit score

Before you consider a loan application, you may wonder what your credit score is. There are several ways to find it out.

- In the USA, you can request a free copy of your credit report from each of three major credit reporting agencies – Equifax, Experian, and TransUnion. It can be done only once a year, though. If you desire to receive the reports more frequently, the agencies will charge you for them. The cost per additional report ranges from $9 to $40, depending on the agency. You can make a request at AnnualCreditReport.com or call 1-877-322-8228 toll-free.

- Temporarily, additional credit reports are available for free. Due to the harsh coronavirus economic impact, all three major credit bureaus — Experian, Equifax, and TransUnion — announced they are offering free credit reports to all Americans on a weekly basis up till April 2021.

- If you prefer old-school contact methods, you may complete the form, available from the Federal Trade Commission (FTC), and mail it to Annual Credit Report Request Service, PO Box 105281, Atlanta, GA 30348-5281.

- Most credit card issuers also provide free credit score access to their cardholders on a monthly basis. Check your credit card or other loan statements to get that information. Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

- You can find the list of authorized FICO Score retailers and lenders participating in the FICO Score Open Access program here. Free Vantage Score providers are listed on this webpage. With the help of some free credit score resources that you can access, whether you’re a cardholder or not, you can not only find out your credit score but also simulate how certain actions may affect your credit.

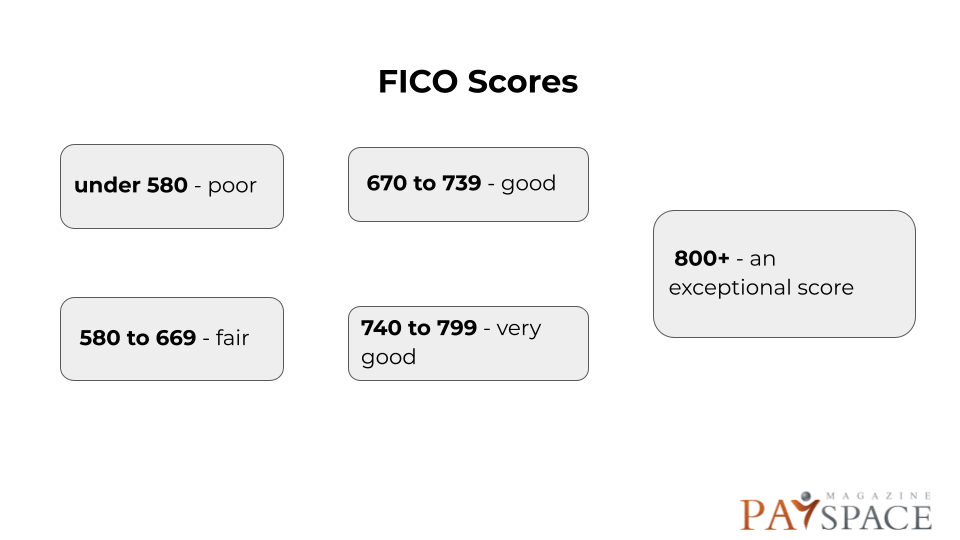

A poor score will render you a very risky borrower, unlikely to get credit. Fair and good numbers give you some chances, while those with very good credit scores are very likely to get a credit line.

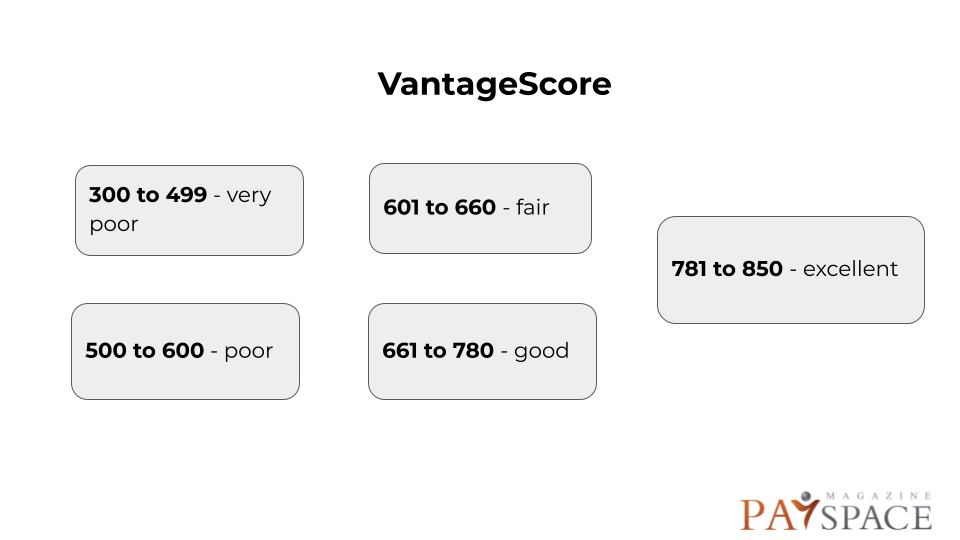

VantageScore ranges from 300 to 850. The numbers have the following division:

Although the majority of lenders will use the FICO model for their lending decisions, it’s better to check both scores, just in case.

How to improve your credit score

To begin with, your credit scores may get lower due to a technical mistake made by one of the credit bureaus. If you spot an error in your credit report, contact the responsible agency and request to modify your data accordingly.

You should keep an eye out for common credit report errors and signs of fraud when checking your annual credit report, including:

- New accounts that you didn’t open

- Identity errors (wrong name, phone number, or address)

- Incorrect reporting of account status (late payments when you’ve paid on time, closed accounts reported as open, or being listed as the owner of an account when you’re just an authorized user)

- Reinsertion of incorrect information after it was corrected

- Balance errors

If the scores are low due to your own credit habits, try the following:

- pay your bills on time from now on – the longer you’ll do that, the better;

- contact your creditors or see a legitimate credit counselor to revise your credit terms;

- pay off debts as soon as you can and keep your credit card balances low;

- don’t close unused credit cards and don’t open many new ones;

- set up autopay that withdraws automatically each month from your checking or savings account;

- if your credit utilisation rate is above 30% and you have no problem paying your bills on time and in full, you can call your card issuer and ask for a credit increase;

- use Experian Boost to get credit for on-time utility, telecom, and Netflix payments.

SEE ALSO: