Independent survey with over 1,000 business representatives from Europe shows the potential of Banking-as-a-Service (BaaS) which is expected to reach mainstream adoption within five years

Source: vodeno.com

Vodeno and Aion Bank have jointly commissioned an independent survey with over 1,000 business decision-makers across various industry sectors from the UK, Belgium, and the Netherlands to illustrate the potential of Banking-as-a-Service (BaaS).

Over half of European business leaders expect BaaS to ultimately substitute traditional banking. Moreover, 64% of decision-makers believe that BaaS will achieve mainstream adoption within the next five years. Some expert reports are even suggesting that the market will become mainstream within two years. The majority (56%) reckon the cost-of-living crisis will act as a catalyst.

Factors facilitating BaaS adoption

Additionally, the survey discovered that having the necessary licence and compliance expertise will play increasingly prominent role in BaaS adoption. Most businesses recognise that contracting the right BaaS provider is crucial in delivering compliant financial services. Therefore, 58% respondents believe BaaS providers that offer their licence alongside a tech solution will shape the BaaS market in the future.

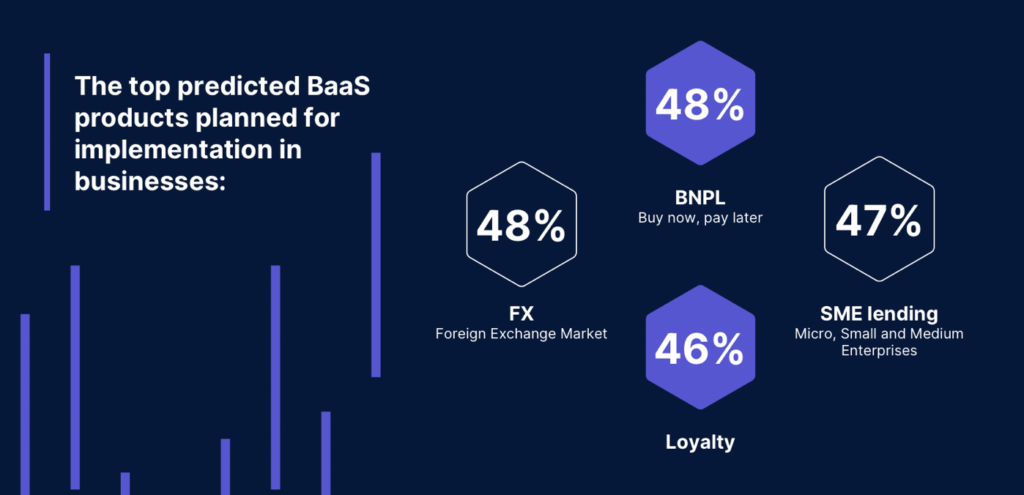

At this time, 39% of respondents have already implemented BaaS services and products. Meanwhile, another 38% are considering using BaaS in 2023. The most sought-after BaaS products were identified as foreign exchange (48%), Buy Now, Pay Later (48%), SME lending (47%), and loyalty schemes (46%).

Furthermore, business representatives urge for greater regulatory expertise over BaaS products. A large part (28%) of surveyed businesses that have already implemented BaaS products would like to see their provider offer access to a banking licence.

Besides, 32% of those who have not implemented BaaS solutions said they don’t know enough about BaaS, while 29% had a lack of understanding about the products available. Finally, 27% of these respondents cited compliance and security concerns as key barriers to adoption.

Innovating the checkout experience is the key desired outcome for many businesses adopting BaaS. Thus, businesses that previously implemented embedded financial products were motivated by new revenue streams (41%), growth in customer basket (40%), and improved customer loyalty (40%).

Predictions

Looking to the future, 59% of business leaders expect the lines between e-commerce platforms and traditional banking services to blur in 2023 due to increased BaaS adoption.

Vast majority (65%) expect to see more consumers using BaaS offered by non-financial brands. In addition, 65% of those surveyed predict that more Big Tech firms will move to deliver financial services. A further 60% predict a decline in traditional branch-based banking.

SEE ALSO:

SBM Bank India Seeks Funding to Promote BaaS