![]()

Bader Al Hussain

PaySpace Magazine Analyst

The state of the economy in 2020

With the advent of a COVID-19 pandemic, the year 2020 proved to be a catastrophe for the global economy. Traditional sectors especially related to tourism and travel took the biggest hit as the lookdown imposed by the governments around the world dried up the demand for such industries. However, there were some sectors such as technology that blossomed throughout the year. Hence, after the lookdown restrictions softened, K-shape recovered can be witnessed in the global economy at large.

Global economic forecast for 2021. Source: pexels.com

During the pandemic, many small- and medium-sized businesses in multiple countries were seriously disrupted, with a large number going out of business. Other companies remained in business, in part with government help. Meanwhile, many workers lost their jobs. Yet in some countries, new businesses were established either to take the place of those that exited the market or to take advantage of new opportunities that were driven by the pandemic.

In some countries, such startups benefitted from government support. The process of business turnover was long ago dubbed “creative destruction” by the great economist Joseph Schumpeter. What is interesting about the pandemic is that such action accelerated sharply in some countries, while it declined in others.

Bourse in the year 2020

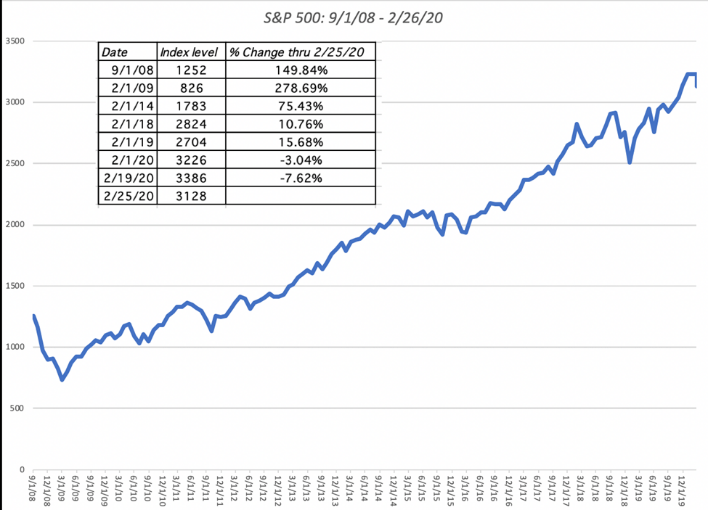

The meltdown in the global financial markets started at the beginning of February when the cases related to COVID-19 started to appear in different parts of the world. This resulted in heightened volatility in the global stock exchanges. The following graph depicts the situation of the S&P 500 index when the fears of viruses increased the risk in the valuations of the companies.

The world’s appetite to invest in risky assets reduced sharply, resulting in a flight to safety. This means that demand for US treasuries and bonds skyrocketed, hence considerably reducing the yields on these fixed income securities.

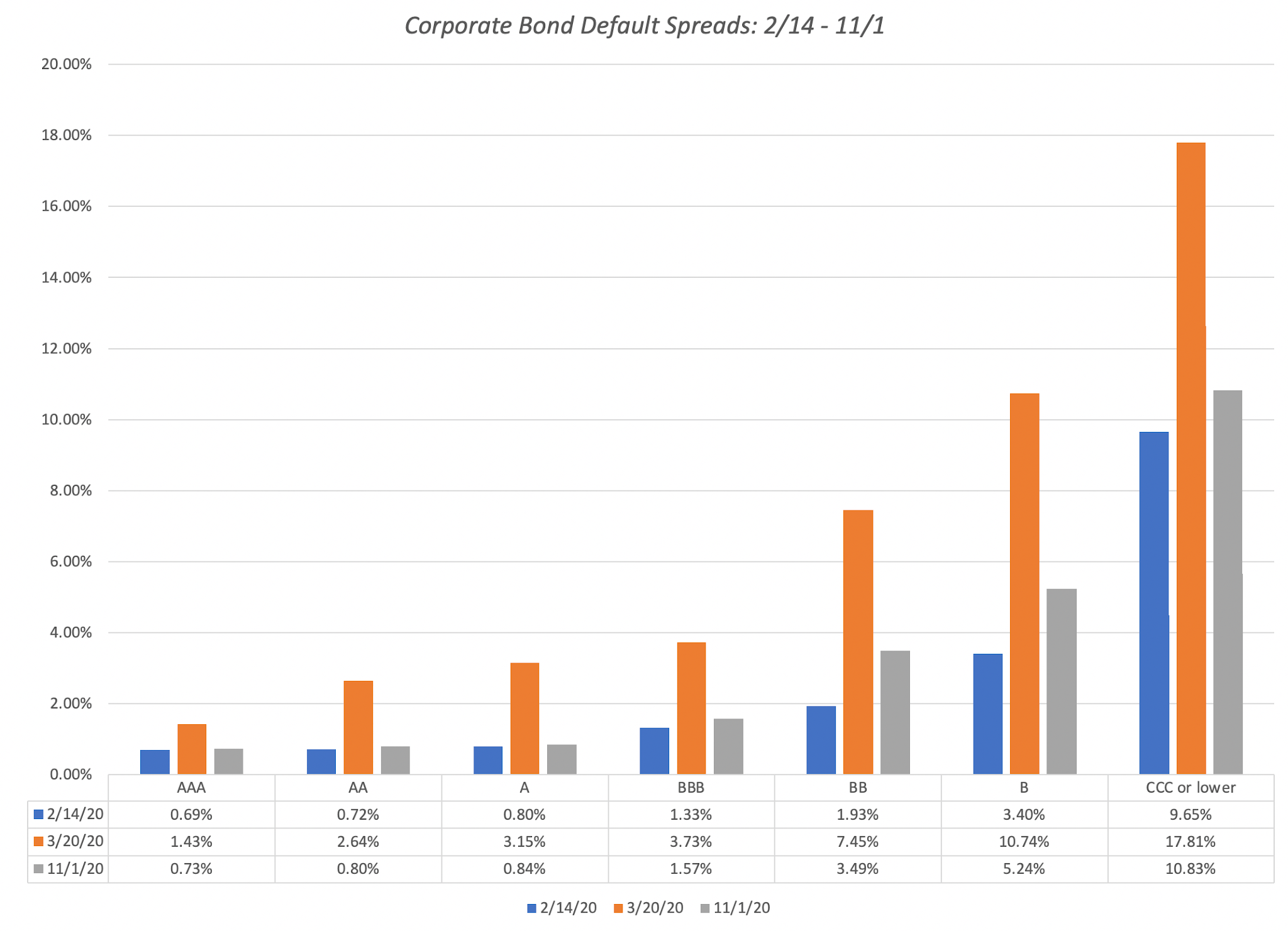

Further, the credit spreads on the corporate bonds widened amidst the selling spree of non-government securities. However, the situation later normalized to a large extent. The following graph summarizes the level of corporate bond default spreads in the year 2020.

However, after the government’s all over the world announced stimulus packages and the central banks drastically cut their policy rates, the appetite for risk rejuvenated especially in the US stock market.

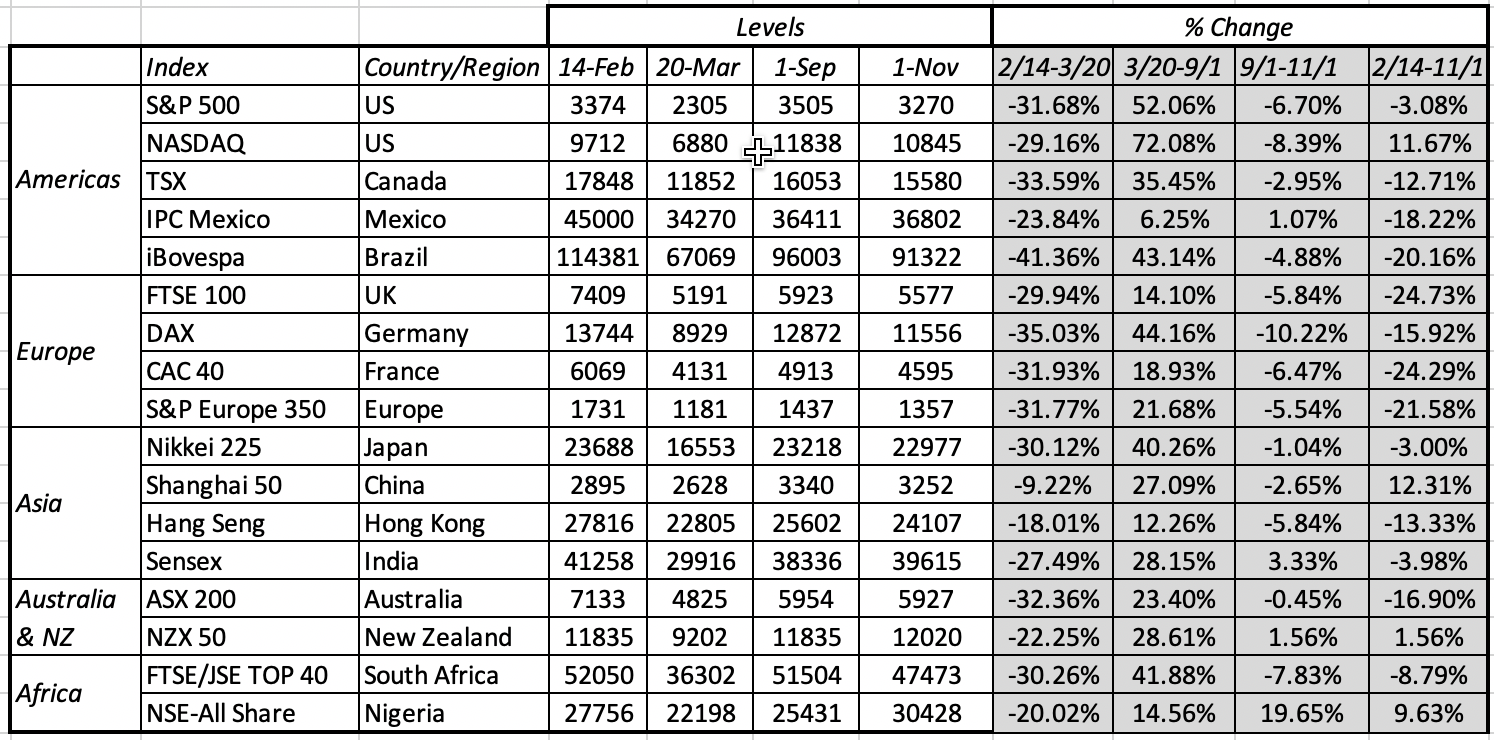

The effect of the above-mentioned policies can be seen in the subsequent rallies in the equity markets all over the world. Further, the following table encapsulates the return of capital markets over the period of 2020.

Owing to the large stimulant packages undertaken by governments all over the world, the excess of liquidity in the financial sectors coupled with dwindling yields on investment-grade bonds has incentivized the investors to take large positions in risky equity positions. Consequently, the markets are now offering historical high multiples on the risk stock or other financial instruments. Such factors have raise eyebrows of some of the participants as according to them an impending crash is in the marking.

Commodity Prices and supply chain constraints

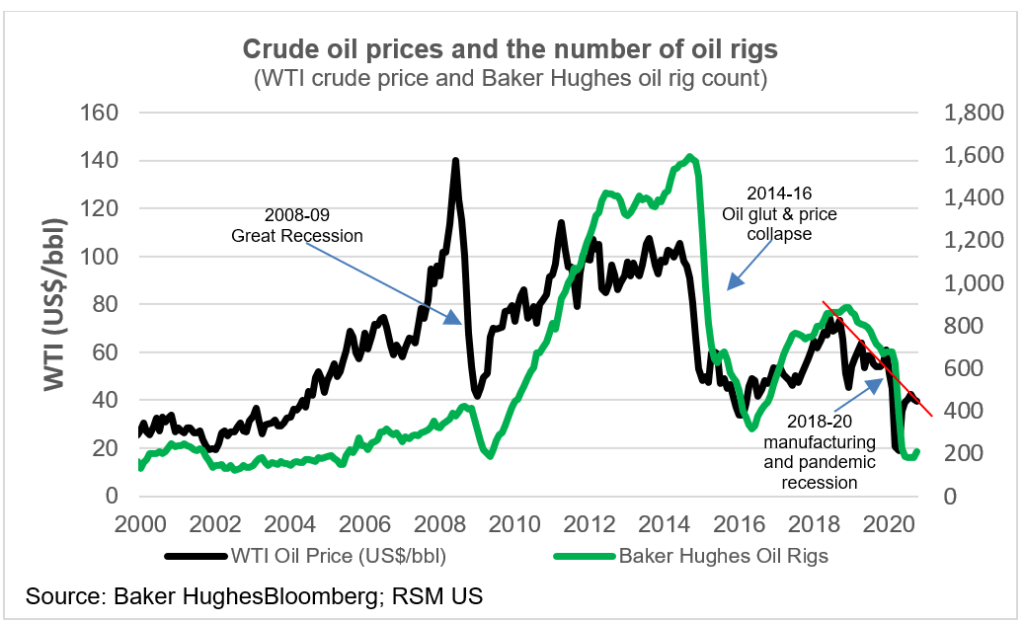

Owing to government restrictions on global and local travel amidst lockdown, the demand for oil and allied products decreased radically, resulting in a sharp drop in the prices of energy products. The following graph depicts the prices of oil across time since 2000.

Nevertheless, after the economic activity started to rebound amidst the easing of the lockdown, the effects of the cracks in the global supply chain began to appear. The prices of precious metals such as gold, copper, and silver started to kick-off. Similarly, the global prices of coal, scrap metal, oil, and allied products reached a new high by the end of the year 2020.

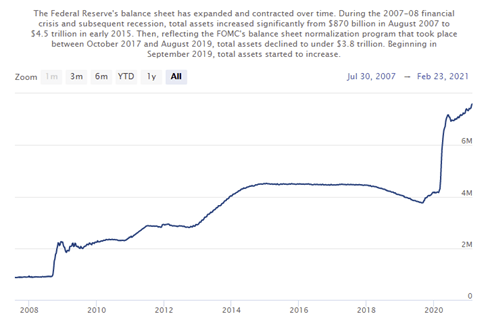

The exponential rise in the balance sheet Federal Reserve

The exponential rise in assets on the balance sheet of central banks has jittered the markets as the investors’ concerns related to inflation have increased. Such expected trends in an economy foretell a rise in the interest rates by the central banks of respective countries. The following graph depicts the exponential rise in the assets on the federal reserve balance sheet:

The concerns for the expected inflation germinate from the fact that the yield on the 10-year US Treasury bond is approximately 1.4%, the highest in a year. Generally, a bond yield has two vital components: an expected rate of inflation, and a real (inflation-adjusted) yield. The real (inflation-adjusted) yield reflects supply and demand conditions in the bond market.

The expected rate of inflation can be inferred from the so-called breakeven rate. The breakeven rate is calculated by subtracting the yield on Treasury Inflation-Protected Securities (TIPS) from the headline bond yield. This is because the principal on the TIPS moves in line with inflation and the difference between the headline yield and the TIPS yield is the expected rate of inflation, also known as the breakeven rate.

Federal Reserve Chairman Jay Powell testified in Congress and concluded his hearing in the following words:

“The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved. We will continue to clearly communicate our assessment of progress toward our goals well in advance of any change.”

Thus, the chairman expects lower interest rates and continued assets purchase for a foreseeable future. So, the concerns over rising interest rates over higher inflation (i.e. above 2% per annum) are unwarranted.

The present state of the global economy and the scenario at the end of 2021

Owing to the K-shape recovery, the following sectors of the world economy have improved since the advent of the COVID-19 pandemic. The following sectors have flourished during the pandemic:

- Online Education

- Health care

- E-commerce

- Delivery and transportation

- Cybersecurity

- Remote work and digital platforms

- Drone technology

Moreover, the pandemic did not materially impact the financial situation of the following sectors:

- Utility companies

- Food delivery services

On the other hand, the financial conditions of the following sectors deteriorated to a large extend:

- Oil and gas

- Energy companies

- Hospitality

- Travel

- Tourism

- Automobile

Further, the rebound in the global economy has increased the prices of key raw materials and essential commodities all over the world. This is because the rebound in the aggregate demand was swifter and quicker than the aggregate supply, thereby creating a global shortage of imperatives such as semiconductor chips for automobile manufacturing and other electronics.

Conclusion

COVID-19 has an immutable structural impact on the global economy. The businesses have carved out innovative ways to carry out their operations and the technology sector has an integral role to play in this regard. Work from home or remote work is expected to become a permanent feature of the workplace in one form or another, hence, the concept of work office will take a new form.

To conclude, the future economies are going to witness a surge in digital services and the advent of 5G will spur the exponential growth of IoT (Internet of Things) related industries. Therefore, technology sectors such as cloud services, AI IoT are going to fare better than traditional industries such as construction materials, food, and chemical industries.

SEE ALSO: