Foreign travelers need guidance on converting currency in the US

How Americans prepare financially for traveling abroad. Source: unsplash.com

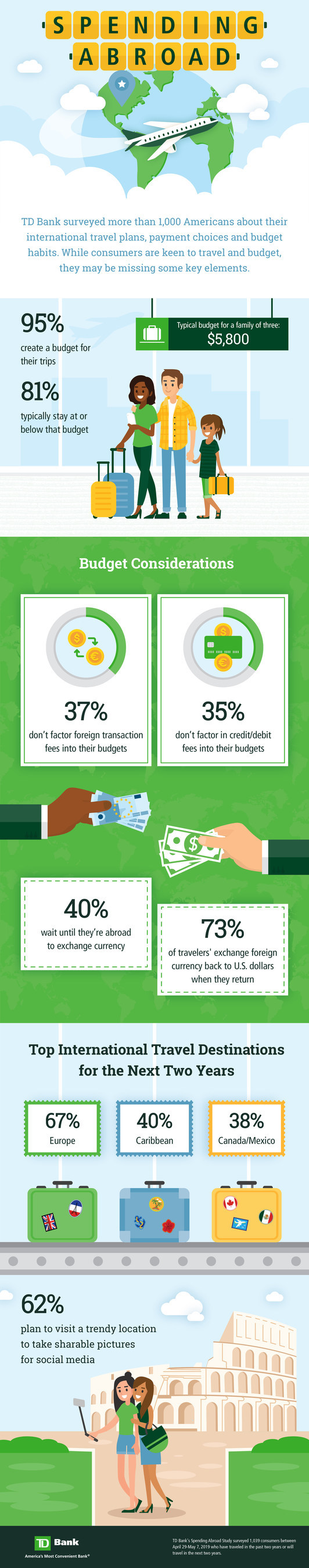

The majority of American travelers (95%) plan to create a budget for international trips. However, despite their financial preparation, many travelers do not have foreign currency on hand when they arrive at their destination. Accordingly, 40% wait to exchange currency abroad and nearly eight-in-ten (78%) use their credit card to pay for international travel purchases.

TD Bank’s Spending Abroad Survey, a national survey of more than 1,000 consumers, examined American’s international travel plans, payment choices and budget habits.

The top three travel destinations travelers plan to visit in the next two years are Europe (67%), the Caribbean (40%) and North America (38%), excluding the U.S.

International travelers create a budget for personal trips. Respondents report their average travel budget is $5,800 and will cover a family of three. The top three expenses in a vacation budget include food and entertainment (91%), tourist activities (79%) and tips or service fees (69%).

Young travelers seem to be financially prepared for international trips. 85% of young respondents spend below or within their maximum budgets, while nearly a quarter (21%) of baby boomers exceed their budget.

The survey indicated young travelers were more likely to consider important financial factors compared to their older counterparts, including:

- Three-quarters (75%) said they monitor foreign exchange rates before traveling compared with 59% of middle-aged respondents.

- More than half (51%) of the younger generation select their travel destination based on low or affordable exchange rates, much more than travelers over age 35 (15%).

- Over three-quarters (77%) factor card exchange fees into their budget, and 74% consider foreign exchange fees.

Despite their financial preparation, travelers overlook some expenses in their budget as 37% of travelers do not factor fees on foreign transactions into their budget, and 35% do not include credit and debit card fees.

Travelers (72%) want to exchange currency with a provider that has better exchange rates. 61% of travelers who do exchange their currency, do so within a week of departure. 73% of travelers’ exchange foreign currency back to US dollars when they return. 93% of respondents consider it important for a currency provider to have foreign cash available immediately.

SEE ALSO: Flying high with low-cost airlines: budget air trip tips