Let’s learn what exactly can chatbots do in banking and how banks already use them

How banks use chatbots: outstanding examples. Source: shutterstock.com

The banking industry has been embracing digitalization with giant strides. We’re not only meaning banking apps that are key to managing finances on-the-go. The whole concept of customer support has been rearranged with the help of chatbots.

Each chatbot is programmed to simulate a natural human conversation. Users communicate with this computer program via the chat interface message or by voice (if the voice recognition function is enabled), the same way they would talk to a real person. Chatbots interpret and process the user’s words or phrases and give an instant pre-set answer.

Moreover, banks are increasingly investing in AI-empowered conversational banking. It makes chatbot support frictionless even in the omnichannel model. AI possibilities bring more sophistication and personalization to bot instructions.

So what exactly can chatbots do in banking?

Checking on your finances

The simplest task a chatbot can perform is displaying bank information in response to the customer’s request. For instance, a client can ask: “What is my account balance?” or “Show me the latest transactions.” In this scenario, the chatbot interface will reveal the requested data.

Making suggestions

Depending on the context, a chatbot can “guess” the user’s next moves, or suggest using some additional services. For example, a person who checked on their balance may be asked if they wish to top up their mobile phone, or transfer money to someone. When a new service is launched, chatbots can inform customers, who have reached out to their support, about that. They can pop up with a message like, “Did you know we have a new savings account option?” and ask if the customers are interested in more details.

A chatbot can “guess” the user’s next moves. Source: shutterstock.com

In addition, chatbots empowered by AI algorithms can use the bulk of analyzed transaction data to give helpful suggestions on how this particular individual can save some money or increase the profit from their savings.

Customize and speed up the inquiry response

When bank clients contact a chatbot from their banking app, it can analyze their geo-location in real time to give a precise answer without too many specifications on the part of the enquirers. Imagine, you travel abroad and want to withdraw cash or pay with your card. A chatbot can potentially inform you on the conversion rates and withdrawal fees without additional questions like, “What country are you in?”, “Which currencies do you wish to exchange?” etc. Getting a quick prompt answer is a great alternative to the long automated voice recordings demanding you to, “Press 1 if you want to find out the currency rate.”

Consulting

Chatbots can substitute a human bank teller, while consulting people eager to get a loan, a mortgage, choose a credit card plan, and so on. Currently, most banks use conversational programs to give prospective applicants the basics, while guiding to a live consultant for more detailed information.

However, as the AI drives the growth of chatbots, such machine consultations can rise to the new level. For instance, if a client uses the same bank’s debit account, a chatbot may use income information to analyze the available credit/mortgage plans, predict the credit score, eligibility, interest rates, etc.

Bringing competitive rates

Impressive chatbot efficiency can greatly reduce the need for human resources. Source: shutterstock.com

The success of digital neobanks all over the world clearly shows that fewer bricks-and-mortar locations allow them to keep a lower pricing rate. That inevitably drives huge waves of customers to switch some or all of their traditional bank accounts. Impressive chatbot efficiency can greatly reduce the need for human resources too. That means competitive rates even for those banks that maintain some of their physical locations.

Optimizing operations

Curtailing the activities of human call centers has gained crucial importance after the pandemic outbreak of COVID-19. Banking and retail had to furlough or lay off many people. In many organizations, support staff were the first to go. At the same time, the number of customer requests didn’t decrease. In fact, people got more concerned about their finances, long-term loans, etc. That brought out a wave of complaints from people unable to reach their banks for proper explanations, consultations, and remote services. A successful chatbot interface could solve at least part of this problem.

Some outstanding banking chatbot examples

Back in 2017, some of the major banks in the US released their chatbots and virtual assistants. They all had different approaches to this service. Bank of America deployed Erica, the financial digital assistant, on their mobile app. Wells Fargo used a ready-made Facebook Messenger bot to start with. At the same time, Capital One developed Eno, an SMS-based chatbot.

These were all first steps on the long road to customer service automation. Today, the banks have made great advances using this innovative technology.

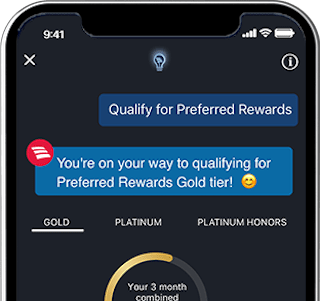

The Erica project has been greatly improved. Along with ordinary skills like checking balances and finding some functions in the app, it performs transactions on your command. More exciting features are already in beta-testing mode. Using the banking data and machine-learning algorithms, this chatbot can provide a whole range of personalized proactive insights on finances. In particular, it sends personalized recommendations, offers, advice, and educational videos on how to save money and make smarter credit decisions.

Erica has been greatly improved. Source: bankofamerica.com

Hang Seng Bank from Hong Kong introduced two chatbots, HARO and DORI, promising human-like conversations fueled by machine-learning technologies. The chatbots can communicate in Chinese and English, and can also understand Cantonese as well as the mixing of English and Chinese. Through interacting with customers, HARO and DORI will continuously improve their ability to address customer inquiries.

HARO handles general inquiries about the bank’s products and services, helps customers identify suitable products, provides application information, assists customers with calculating repayment amounts for designated personal and mortgage loans, makes simple money transfers, pays utility bills, exchanges currencies, and settles credit card debts.

Meanwhile, DORI is in charge of searching for dining and shopping discounts as well as making recommendations based on customer preferences. DORI can also make reservations for customers at selected restaurants.

Amelia, which is more than a chatbot, but a “cognitive assistant”, is able to discern the most complex inquiries and take action on them. She resolves roughly 70% of queries within her scope independently. With a new life-like interactive avatar, she brings a human touch to the digital world, delivering true-to-life communication and superior customer experiences. SEB bank started using this service to give answers to 4 types of questions which make up 15% of total customer service volume.

Commonwealth Bank of Australia introduced Ceba to assist customers with more than 200 daily banking tasks such as activating their card, checking account balances, making payments, updating contact details, or getting cardless cash. Ceba is smart enough to know its possibilities are limited. It will let you know when it’s better that you chat with a human – and give you the right contact info, so you can get in touch with the right team.

Cleo is not a typical banking chatbot. It aims to substitute a money management app instead. Offered by a London-based start-up, this AI-powered chatbot satisfies various queries such as your spending across multiple accounts and credit cards. It classifies transactions based on merchant or category, and provides help with your decision making. For example, Cleo can advise whether you can afford something based on the financial data it has gathered from you. Cleo has a chatty tone of voice, with informal language and lots of emojis, and encourages her users to talk to her in the same way.

Cleo is not a typical banking chatbot. Source: facebook.com

The potential use of chatbots for banks

Juniper Research, an analyst house that focuses on digital technology trends and markets, forecast that chatbots will be responsible for cost savings of over $8 billion per annum by 2022. This forecast was made in 2017 so the actual number may be much greater.

The Juniper team has recently revealed more of their predictions regarding chatbots stating that the global number of successful retail chatbot interactions will reach 22 billion by 2023, up from an estimated 2.6 billion in 2019. Therefore, lots of data show that technology has great growth opportunities.

Meanwhile, researchers believe that the banking sector is most suited and primed to an immediate roll-out of chatbots compared to other industries. Improvements in NLP (Natural Language Processing) will dramatically reduce the failure rate of chatbot interactions, making them more precise and valuable for customers. Juniper Research has found that RPA (Robotic Process Automation that includes robo-advisors and chatbots) revenues in banking will reach $1.2B by 2023. With an estimated revenue above $200 million in 2018; the technology will show growth of over 400% during the forecast period.

Some of the future applications of chatbots in banking include:

- refined financial planning advice

- tracking potential fraudulent activities

- using facial recognition for authorizing small transactions

- staff training

- calculating best savings and investment scenarios

However, a lot of improvements must take place, the biggest challenge being multilingual bots and recognizable jargon.

SEE ALSO: