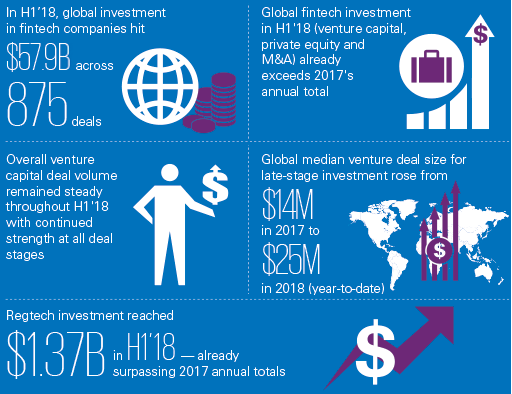

Overall investment in fintech globally at mid-year surpasses 2017 results

How is the global FinTech market developing: research & infographics. Source: shutterstock.com

There are specific indicators which reflect the fact that interest in fintech had significantly increased globally. These factors include the growing number and volume of fintech deals and increased investments the sector attracts worldwide.

We offer you a glimpse of the global FinTech market achievements, listed by KPMG in the biannual Pulse of Fintech 2018 report.

Global

Source: kpmg.com

- Leading market players attracted larger financing rounds, including mobile-only banks Revolut ($250 million) and N26 ($160 million), and P2P-payments firm Circle ($110 million);

- Some companies conducted successful IPOs: EVO payments, GreenSky and Adyen; WorldPay and iZettle achieved M&A exits;

- Interest in AI and robotic process automation continued to gain attention while interest in insurtech and regtech also grew significantly. There has also been an increasing emphasis on B2B fintech solutions — as evidenced by the $250 million raise by Tradeshift:

- So far, 2018 year-to-date funding has already exceeded total annual regtech funding in every year previous except 2016;

- ICOs continued to garner interest globally, despite countries like China banning the practice. In the first quarter Block.one raised $4 billion through an ICO;

- Over the past 6 months, insurtech companies attracted a significant amount of investment, including $100 million+ megarounds to Oscar and Lemonade;

- The global fintech market is expected to remain strong over the remainder of 2018.

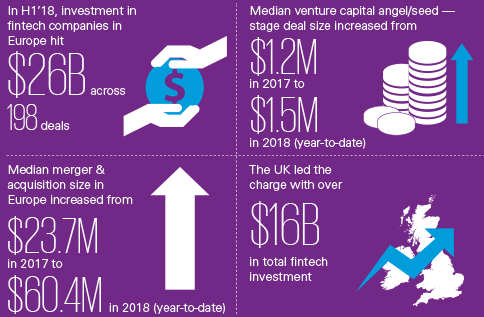

Europe

- On the VC front, fintech investment was more modest in Europe compared to Asia and the Americas but remained relatively strong during both Q1 and Q2’18 compared to previous quarters;

- Challenger banks continued to thrive in Europe, particularly in the UK and Germany, where the regulatory environment has been very supportive of alternative banking models. Traditional banks setting-up their own standalone digital banking offerings in order to complete with challenger banks — such as Pepper, the digital-only bank of Israel’s Bank Leumi.

- Given the implementation of PSD2 and the UK’s synonymous open-banking regulation and GDPR, there has been a surge in regtech activity;

- In April, 22 EU member countries signed a Declaration on the Creation of a European Blockchain Partnership in order to foster collaboration across various blockchain initiatives and to help reduce barriers to potential cross-border blockchain solutions;

- In mature fintech areas like payments and lending, there will likely be a significant amount of consolidation over the next 6 to 12 months as the largest platforms become bigger and others fail to achieve scale.

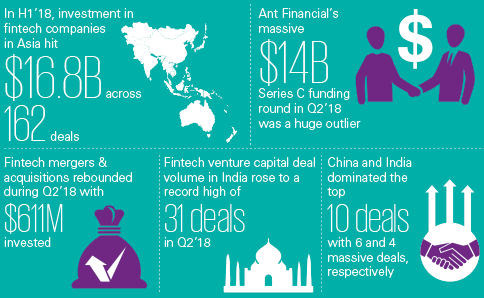

Asia

- Ant Financial’s record-shattering $14 billion Series C funding round in Q2’18 lifted Asia’s mid-year fintech investment to a massive $16.8 billion compared to $5.4 billion in all of 2017. The single deal accounted for over half of the $23 billion in VC fintech funding seen globally during the 6-month period;

- Fintech investment in China strengthened in the first half of 2018 compared to the end of 2017;

- A number of large fintechs — primarily from China — have set their sights on countries within Southeast Asia as the next step in their growth agenda;

- During the first half of 2018, regtech continued to gain slow traction in Asia, particularly in Australia and Singapore where regulators have been strongly supportive of fintech innovation and in India where technologies are required to enable the shift to a primarily cashless society;

- Blockchain and AI will likely continue to be key priorities for fintech investors, in addition to insurtech and regtech.

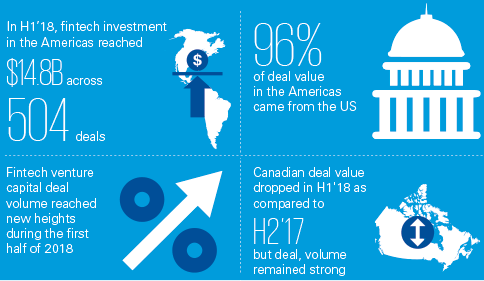

Americas

- The Americas saw a strong start to 2018, with overall fintech investment well on track to exceed 2017’s totals. VC investment was particularly strong, reaching a new quarterly record of almost $3.3 billion during Q2’18. Overall M&A and VC deals volume in the Americas also achieved new peak highs in both Q1’18 (250 deals) and Q2’18 (254 deals);

- AI continued to be one of the dominant focus areas for investors in Canadian fintech. Canada is seen as a global leader in AI innovation — with highly regarded specialists in Toronto, Montreal and Edmonton attracting significant investments to those cities;

- Brazil continued to define itself as a leader in fintech in Latin America during the first half of 2018, with Nubank’s $150 million Series E deal dwarfing many of the other fintech investments in the region;

- While payments and lending will continue to be a key focus for investors in Latin America, from discussions with financial institutions, newer subsectors like regtech, insurtech, AI and blockchain are anticipated to draw a significant amount of attention in Canada and the US.

US

- VC investment in US-based fintech companies remained very strong, with quarterly VC investment reaching a new high of over $3 billion in Q2’18;

- Over the 6-month period, the US saw more than 10 $100 million+ megarounds in fintechs ranging from insurtechs Oscar and Lemonade to blockchain-based Circle Internet Finance;

- The rise in compliance costs has led many traditional banks to investigate and invest in regtech options with the hopes of being able to rein in costs and more efficiently manage regulatory reporting requirements, such as the recently enacted IFRS9;

- During the first half of 2018, a number of traditional US banks pressed down on the accelerator with respect to their digital baking initiatives;

- There likely will be a continued emphasis on partnering, with retailers and aggressive tech leaders globally developing relationships with fintechs in order to steal a piece of the lucrative fintech value chain.

You can download the whole report to get a more detailed review of international markets.

SEE ALSO: The Blockchain Island: Malta Blockchain Summit findings & insights