The fintech segment has one of the highest rates of startup failures, making it one of the high-growth but high-risk industries. Is it possible to improve the statistics if only a little bit? Here we are to analyse that.

Probably everyone who has ever considered becoming an entrepreneur has heard an alarming narrative that nine out of ten startups fail in their very first years. Of course, that is quite a general statement and we’re going to study the scary stats in more detail, perhaps, even demystifying them.

What Exactly is Startup Failure?

We will not lie. Startups do fail in large numbers. About one-third of them fail within the first three years, 50% don’t live more than five years, and 70% survive to a maximum ten years of operations. At the same time, staying afloat for 5-10 years seems quite a success for a striving entrepreneur, doesn’t it?

Besides, what does failure look like in the business world? It is not always bankruptcy or liquidation. People often use the term to describe the asset sale or operation shut down. However, operations may be restored in time, although it is not the most frequent case.

Sometimes, startups also cease to exist due to an exit which leads to a transformation rather than the end of the company. One type of not-so-bad business exit is Merger or Acquisition (M&A). The company is sold to another business, often at a premium price. The buyer could be a competitor, a larger company, or a private equity firm. In such deals, the business often ceases to exist in the previous form, but its ideas, technology, and even team may continue to function in a different shape.

In addition, we have options of acqui-hire transactions, and assignments for the benefit of creditors (ABCs). They are affordable, quick, and enable the absorption or redeployment of startup assets and talent with minimal damage to reputation.

Furthermore, for a startup founder, failure is not only a lost case but also a valuable experience. In fact, first-time founders demonstrate success only in 18% of the startup launches, while those who venture for their own enterprise for a second time and beyond see greater results.

Failure Rates in Fintech Are Speculative

To begin with, let’s clarify that there are no clear industry-wide statistics for startup failures from reputable research organisations. All the data available online are quite approximate too since most studies explore the financial sector on the whole. For instance, according to LendingTree’s analysis of the U.S. Bureau of Labor Statistics (BLS) data, finance and insurance businesses are moderately resilient. About 22.6% of those startups in the US fail within the first year, and 62.5% do not survive past 10 years.

Specific data on fintech startup failures can fluctuate depending on the region, sub-sector (e.g., payments, lending, insurance tech, cryptocurrencies), and market conditions. It is estimated that roughly 75% of VC-backed fintech startups fail, but for crypto-related businesses this share surges to 95%.

Besides, in certain regions, like India, for example, the general startup failure rate is higher than the global average. However, that doesn’t necessarily mean that startups there are doing business worse than in other countries. After all, it is the third leading hub for unicorn startups globally. On the contrary, India has such a burgeoning startup ecosystem that the space is much more competitive than elsewhere. In other regions, such as the UK, the startup failure rate is lower than the average – approximately 60%. It might be explained by the local startup ecosystem that offers a range of incubators, accelerators, co-working spaces, mentorship, networking opportunities, and access to funding. All these opportunities help reduce early-stage risks.

In the first year, only about 10% – 20% of startups fail altogether. At the same time, around 60% of all tech companies that raise Pre-Series A funding fail to make it to Series A or beyond. Not all of them fail, of course. About the same share gets acquired sometime on the growth path.

Reasons for Failure and Success

Reasons for startup failures vary greatly. Most often, there is no single factor that contributes to the failure but rather a mixture of unfavourable business aspects.

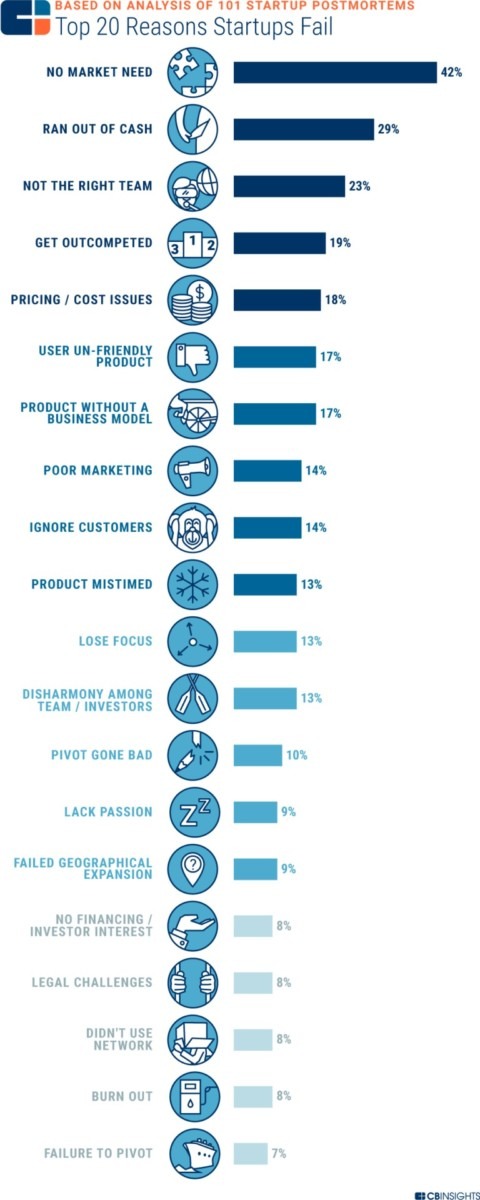

In 2019, CB Insights’ analysts defined 20 main reasons startups failed. They included a vast range of factors from the lack of market need to team burnout. These reasons might be grouped into a few common themes: lack of product-market fit, marketing problems, team and personal issues, poor access to financial resources, legal problems, issues with tech stack and other operational issues.

As for the specific fintech failure cases that we have once analysed, the most common reasons for startup failures in this industry were the inability to find a market niche, misunderstanding of market needs, bad timing, cash flow issues, poorly drafted business plans, weak partnerships, lack of talent or poor team cooperation, unprofitable business models, non-viable products, too fierce competition, as well as rigidness of the business strategy.

How to Avoid Common Pitfalls

Let’s explain some of the key reasons for startup failure:

- Lack of Market Fit: One of the most common reasons is that the product or service does not address a significant problem or satisfy a market need. Without enough demand, the business struggles to gain traction. Besides, the product or service might have bad timing, like when the startup introduces it past the hype or quite ahead of its mass popularity.

- Funding Issues: Startups often rely on limited funding from investors, loans, or personal resources. If the business spends more than it earns or can’t raise additional capital, it runs out of cash. However, in many regions the access to external funding from VC or angel investors is poor. Moreover, around 70% of SMEs in developing economies don’t even have access to formal banking, so their choice of lenders is even more restricted.

- Poor Business Model: Many startups fail because their revenue model is flawed or unsustainable. Some businesses start on vague ideas instead of a solid plan and fail to understand how the business should work. It is estimated that 17% of startups fail because they lack a well-defined business model.

- Competition: Intense competition from other companies, especially more established players, can lead to failure if the startup cannot differentiate itself or compete effectively in the market. It is especially critical for fintech startups as they try to disrupt a well-established industry of finance which has a monopoly of world-famous brands and facilitators in many segments and a long list of legacy players who don’t want to share their vast clientele with emerging startups.

- Operational Challenges: Poor management of day-to-day operations leads to supply chain issues, poor customer service, or inadequate internal processes, ultimately causing failure. Many digitally-focused fintechs replace many functions of bricks-and-mortar banking systems, but fail to offer an alternative to the human touch and trust instilled by face-to-face communication in legacy institutions.

- Leadership and Team Issues: There might be misunderstanding and conflicts between the founders, management team, or other employees who are often few in fresh startups. Startup teams also often have lack of experience in business which can significantly affect the startup’s resilience.

- Failure to Scale and Adapt: Most startups succeed in the early stages (first two years) but struggle to scale or adapt to market changes. Some may try to expand too fast without access to enough funding but fail to become self-sufficient. It was especially evident during rapid changes such as the skyrocketing growth of fintech and e-commerce services during the pandemic. Some startups used the opportunities properly while others misjudged the changing economic situation that made investors less risk-tolerant and rushed to scale too fast.

- Poor Marketing and Sales: Startups often fail to conduct extensive market research before starting their operations or launching a marketing campaign. If one can’t effectively advertise their product or reach their target audience, they will surely not generate enough sales to survive. Thus, poor online marketing is the top reason why e-commerce startups fail (37%).

- Legal Issues: Legal challenges, such as patent disputes, required certificates or licences, changing regulatory restrictions, or any other compliance issues can be daunting even for an established business, so they often become overwhelming for a startup. However, to be frank, regulatory complications typically stop the potential startup founders even before the business launch, and they are almost never the main reason for failure.

- External Economic Factors: Broader economic downturns, changes in market conditions, or geopolitical factors turn the whole markets and economies upside down, force investors to turn to safe profitable options rather than high-risk startups and negatively affect the tech startup growth prospects.

Upon considering what others do wrong, you can easily draw a conclusion on how to avoid these common mistakes. The top three rules are:

Study the Market and Target Audience

Just because you consider some idea or technology amazing, it doesn’t make it attractive to other people. Fintech solutions must address certain pain points characteristic for the region or sector or bring a unique perspective to already existing services. Besides, they must be affordable and comprehensible for the target audience.

Let’s say, you decide to roll out a great savings product. You invest some money in its development and marketing. However, it doesn’t pay off at all. Later, you find out that the target audience is in tight financial conditions at the moment. They would rather prefer a flexible loan solution or a budgeting app since they are struggling to make ends meet and can’t even think of saving some of their salary. Now, that’s a poor market fit, but you realise it too late.

Or else, you advertise your new product or service, which is great in itself, with a culturally insensitive or biassed promotion campaign. The product is doomed by association and the reputation of the startup is hard to restore as well. Perhaps, the ad is fine, but you place it on Facebook while your main audience prefers TikTok.

The lesson here is that startup founders must carefully study the market and their future customers before any public announcements and promotions. Use existing research data or initiate your own survey to find out what your prospective clients want and offer them a curated product to suit their needs. Find out about existing competitors, their offers and customer base. Think whether your service is truly any better and how it can stand out.

Mind Your Financials

Many fintech startups struggle to secure enough capital to sustain their operations or scale effectively. Finding investors and maintaining their interest in your startup is challenging. However, many startup hubs and ecosystems offer networking or accelerator programs where you get not only money but also mentorship. Consider business loans or fundraising platforms as well.

Once you secure the funding, don’t get too excited. Managing cash flow effectively is one of the essential skills for the startup manager. Any miscalculations can mean running out of funds quicker than expected. Of course, you won’t get much profit in a day, but investors will look for signs of long-term viability and scaling potential as soon as you move from the pre-seed or seed funding stage. Choose a suitable business model or combine several viable ones that will enable your startup to eventually become profitable.

Besides, do not forget that we live in an unstable geopolitical environment. Last few years brought the world a lot of global and local crises that negatively affect both the market potential and investors confidence. You must prepare for contingencies to avoid running out of capital and be flexible with your business plan. Do not put all your corporate budget at stake if the circumstances provoke too many risks.

Learn to Run the Business

As you see, poor leadership or inefficient management are also among the top reasons for startup failure. You might be a good tech or finance professional, a true visionary and have a great revolutionary business idea but are you also aware of how to be an entrepreneur? Educate yourself on the relevant business and leadership topics. Learn about the experiences of other entrepreneurs in the field. Their mistakes and success stories will guide you until you get some expertise yourself.

Be brave but also careful. Mind your business partners, they are one of the most valuable assets for any fintech. Partnerships and collaborations help create a robust ecosystem of connected services which doubles the potential of all business stakeholders.