Online payments are in the spotlight again. Businesses and their clients are looking for safe and fast transactions with the help of secure third-party platforms or gateways

iDEAL: ins & outs of Dutch favorite online payment option. Source: shutterstock.com

Technology has driven change in the payment space, bringing customers into a new era dominated by cryptocurrencies, e-wallets, and one-click online payments. Even traditional bank transfers are undergoing great modifications.

The hassle-free payments are increasingly important for the growing consumer sector formed by Generation Z. These “view now, buy now” consumers like immediacy but at the same time care for data security. They also prefer mobile payments and m-shopping including buying on social media.

In the UK and the US, a high percentage of digital buyers save payment card details for faster checkout in future purchases. Other European countries support this tendency and strive for less data filling.

Despite the openness of buyers in countries such as Germany and the Netherlands to shop from international websites, local payment methods dominate. Moreover, they consider traditional banks more reliable than their digital competitors. Naturally, they choose a payment method which they consider most secure. However, it doesn’t mean it can’t be convenient and innovative. None of the payment methods is perfect, for sure, but one of them claims to be iDEAL, and it is headquartered in the Netherlands.

Source: ideal.nl

A brief history of iDEAL

This e-commerce payment solution emerged in 2005. It was introduced by the Dutch bank association Currence. The group includes 8 major national banks. It aims to coordinate payment methods and facilitate cooperation between PSPs by providing high-quality standards and transparency to the payment systems in the Netherlands.

iDEAL is one of the best Currence payment products. The organisation sets clear rules and regulations relating to product use and the product environment as well as supervises participants. The popularity and trustworthiness of the payment system have grown tremendously over the past decade.

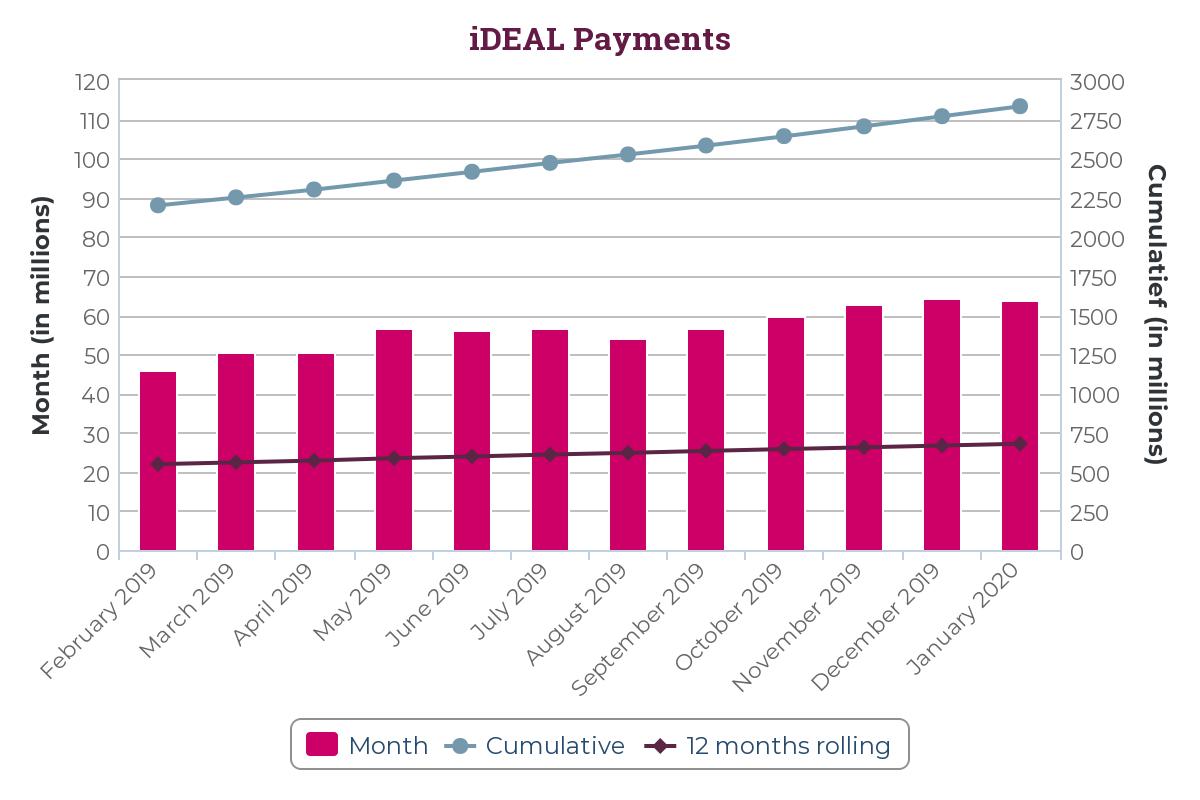

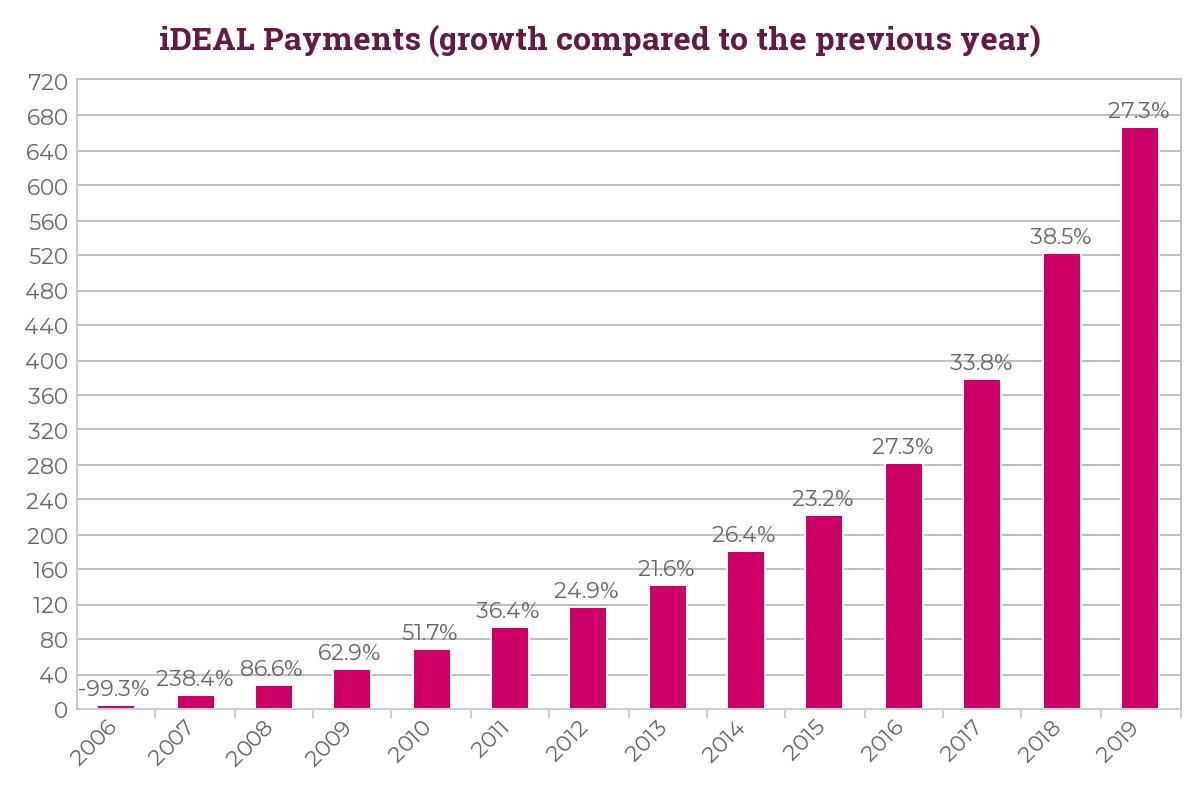

While in 2006 the number of processed transactions was merely 4,5M, in 2018 it skyrocketed to 513M.

On average around 1.5 million iDEAL payments are processed daily. iDEAL has registered more than 2 billion total online payments as of early November 2018. The first billion iDEAL payments took nearly 11 years to complete. The second billion required less than 3 years.

Source: ideal.nl

How does iDEAL work

Payments are done using the mobile banking app or the online banking environment of your own bank. Many businesses in the Netherlands support this payment option. Therefore, you can see an iDEAL button at the checkout stage.

As long as you have access to the internet- or mobile banking of one of the participating Issuers, you can instantly pay with iDEAL. You do not need to register separately.

The Issuer allows its customers to pay with iDEAL via their own mobile banking app or their internet banking environment. The Issuer transfers the successful iDEAL payments to the Acquirer, CPSP or to the C2C provider. The Acquirers, CPSPs and C2C providers ensure that the beneficiary receives the iDEAL funds. The money is transferred via a SEPA Credit Transfer.

You can also use the iDEAL app for purchases and payments. Source: shutterstock.com

You can also use the iDEAL app for purchases and payments. With the iDEAL app, consumers can pay by scanning QR codes. They can also use the app to generate QR codes and to present them as a payment request to other consumers. Hence, it covers both ordinary e-commerce purchases and P2P transactions.

An iDEAL QR code differs from the usual ones by the iDEAL logo in the middle of the code. You can find iDEAL QR codes on screens, printed matter, letters, bills and invoices, for example in restaurants and on collecting boxes. Customers simply approve the payment by using their mobile access code, a fingerprint or facial recognition.

After scanning a QR code, you can check the payment details. In some cases, you can change the amount, for example, if you wish to give a tip. When you press the pay button, you are being forwarded to the mobile banking app of your bank, where you make the iDEAL payment just as you are used to.

After that, you return to the confirmation page of the payment receiver.

To generate iDEAL QR codes, you simply have to register in the iDEAL app by using your email address. Your email address will be used to send you the confirmations of the received payments. After your registration, you can directly generate iDEAL QR codes. These iDEAL QR codes can be scanned and payed by other consumers using the iDEAL app or the mobile banking apps of Rabobank or Knab. The payment will be processed by Online Betaalplatform.

The handling costs of a payment request using the iDEAL app are 30 euro cents per transaction.

Payment methods

Payment variants enable Dutch consumers to pay practically everywhere with iDEAL. Originally iDEAL was designed for webshop payments, but nowadays e-commerce is only one part of the picture. It is increasingly used to pay energy bills, make donations to charities, buy mobile credits, pay local taxes, traffic fines, etc.

The partnering businesses can use iDEAL as an online payment gateway in their e-store. Then the relevant payment button will link clients to their banking app or online interface.

They can also provide the iDEAL Payment link in emails, messengers or text messages for prepayment or offer their customers the option to pay later. The payment link is often used for invoice payments or a (monthly) subscription fee.

The Payment link takes a customer directly to the sender’s website (landing page) where the iDEAL payment request is ready for approval. The Payment link may never redirect directly to the internet banking or mobile app of the bank. The validity of the landing page expires after the expiration date of the order (the offer) or when the customer has paid. The link does not contain personal or transaction-related information. The landing page must be secured with SSL or comparable means of security.

iDEAL QR codes can be displayed offline. Source: shutterstock.com

The iDEAL QR codes can be displayed offline (on a paper invoice, a restaurant bill, on a shop window) or online (in a webshop, on a TV screen or an order column).

Availability

iDEAL is supported by several consumer banks (Issuers). Namely, they are ABN AMRO, ASN Bank, bunq, ING, Knab, Moneyou, Rabobank, RegioBank, SNS, Svenska Handelsbanken, Triodos Bank, Van Lanschot. Consumers that have access to the internet or mobile banking of one of these issuers are able to pay with iDEAL.

Sometimes, one of the consumer banks is (partly) unavailable due to disruptions or planned maintenance. Businesses and customers can track this information online or via automated push messages if they wish to be prepared for using alternative payment methods. However, with iDEAL paying later is also possible in a trusted environment. In this case, the payment link can be sent.

The iDEAL app is available in the Google Play Store and Apple App Store on your mobile phone.

SEE ALSO: