Millennials are somewhat safe from most defrauding techniques compared to their younger and elder counterparts

Most vulnerable to low-tech fraud generation named. Source: shutterstock.com

GlobalData says that as long as cash is slowly becoming less relevant, hacking someone’s bank account will become more of a daily deal. Although more people use devices to manage their finances doesn’t mean that physical money or ATM machines will stop existing.

The research reveals that fraud will naturally go to the point of least resistance as long as encryption and security techniques are remaining complex.

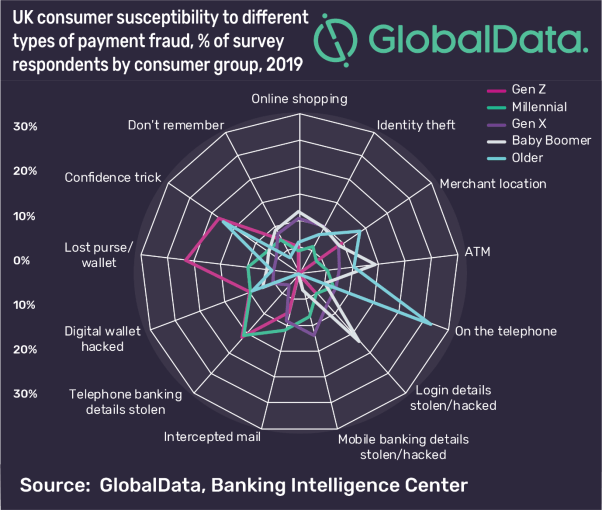

The chart presents various consumer groups’ vulnerability to different kinds of online banking fraud, with Generation Z most susceptible to losing their purse or wallet.

Millennials consider having their telephone banking details stolen as the biggest vulnerability, sharing the proportion with Gen Z.

SEE ALSO: