A rapid transition to cashless societies in these three countries is enabled by the increased popularity of digital wallets

Norway, Finland and New Zealand are closest to becoming cashless. Source: shutterstock.com

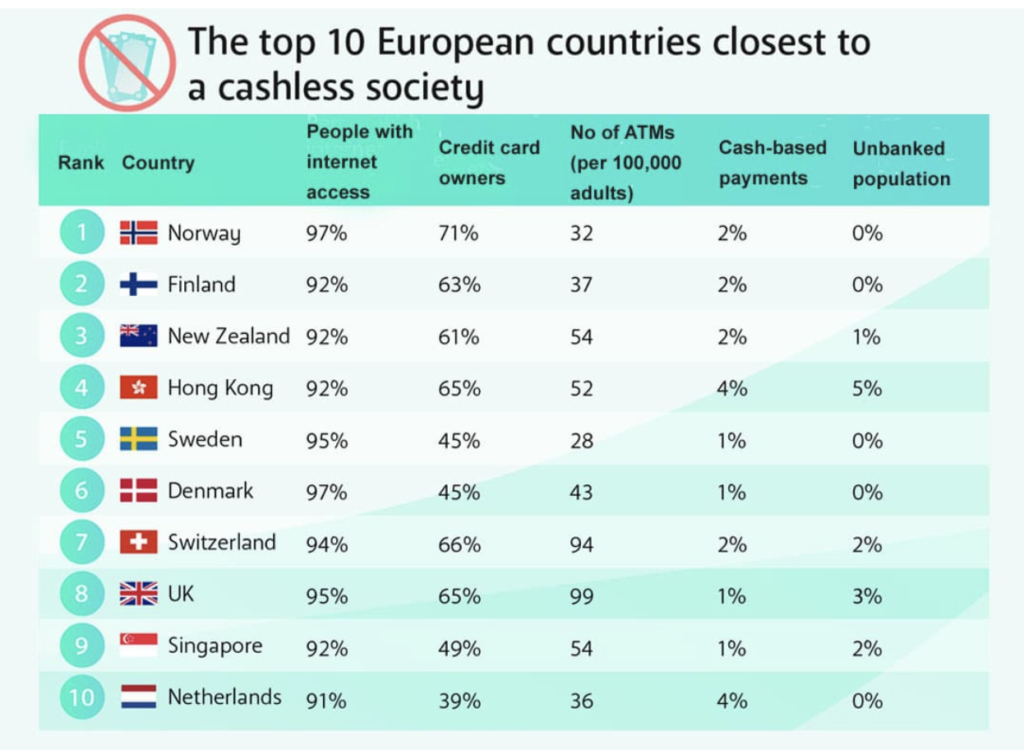

The new research published by Merchant Machine reveals that Norway, Finland and New Zealand are closest to becoming cashless societies. They are followed by Hong Kong, Sweden, Denmark, Switzerland, the UK, Singapore and the Netherlands.

In all 10 listed countries, the proportion of cash-based payments is now less than 5%. In contrast, Morocco sees 74% of all payments remain cash-based, whereas 71% of the population are unbanked. Other cash-reliant countries include Egypt, Kenya, Nigeria, the Philippines, Bulgaria, Peru, Vietnam, Indonesia and Kazakhstan.

Norway, Finland and New Zealand are closest to becoming cashless. Source: Merchant Machine

Bulgaria is the most cash-reliant country in Europe. There, 74% of all payments involve cash. The country also offers 91 ATMs per 100,000 adults, although over 70% of the population have a bank account. In Europe, the countries with the highest cash-reliant index score after Bulgaria are Romania, Greece, Ukraine, Portugal, Czech Republic, Hungary, Slovakia, Poland and Italy.

The research also focuses on the UK. In particular, it shows that card payments make up more than half of all British transactions (51%) followed by those made with a digital wallet (32%). The remainder is made by cash (1%), bank transfer (7%) and “other” including buy now, pay later (BNPL) (9%).

Digital wallets facilitate cashless economy

The study suggests the increased popularity of digital wallets is “likely contributing to reduced cash use”. Besides, it defines the most popular digital wallets globally:

- Alipay, with 1.3 billion users

- WeChat Pay (900 million)

- Apple Pay (507 million)

- Google Pay (421 million)

- PayPal (377 million)

- Paytm (333 million)

- PhonePe (300 million)

- Samsung Pay (140 million)

- Venmo (52 million)

- Cash App (36 million).

SEE MORE:

Over 3/4 of cashless transactions in DACH region are now contactless