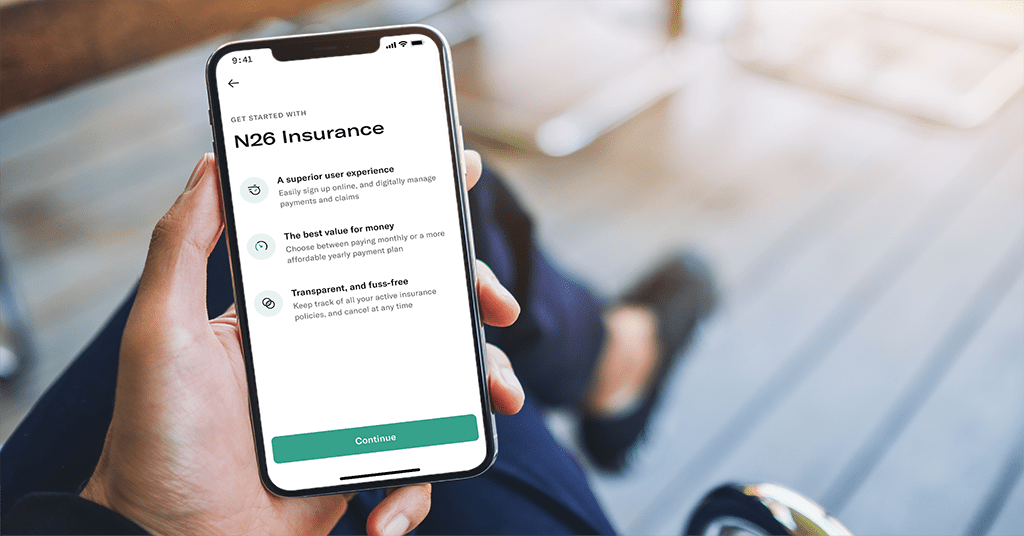

N26 aims to simplify this part of customers’ financial lives

Popular digital bank to offer insurance products. Source: n26.com

N26 has announced the launch of N26 Insurance which will offer the bank’s customers the option to purchase coverage.

Besides, they will be able to manage plans and initiate claims for a range of insurance plans from different providers for every life need via the N26 app.

For this, N26 has teamed up with Simplesurance, the European insurtech company.

Prices start at €6 a month, based on the original value of their smartphone.

The launch of the on-demand smartphone insurance is the first of a series of planned product launches rolling out to N26 customers in Europe. It will include home, life, travel, private liability, bike, electronics, and pet insurance over the coming months, giving N26 customers a way to select, manage, and pay for insurance products through the N26 app.

According to the report, n a market with an annual volume of €1.31 trillion, Europeans spend over €2,000 a person a year on insurance cover on average.

We’ve reported that Hong-Kong-based insurtech YAS has announced the launch of ‘NFTY’, the NFT microinsurance.

SEE ALSO: