Jack Jia has been in the tech avant garde for over a decade. With rationality always in mind (based on a very sensible and rich resume), Jia’s qualities and insights make him the perfect person to ask about crypto and its future. His near-immediate decision to get into crypto after discovering Bitcoin was a perfectly practical decision for Jia, who is now the head of a next generation fiat on & offramp — GateFi.

I asked Jack Jia about getting into the industry, what’s happening with global crypto regulations, and why some people still hesitate to look into DeFi.

Something personal

ALICE TIERMES: You went ‘full-time crypto’ in 2013, halting a promising wind turbine project before launch because you “discovered Bitcoin and changed career paths”. What was that first acquaintance with Bitcoin and how soon after were you certain of your decision to pivot?

JACK JIA: I learned about Bitcoin for the first time during a dinner party in October 2013. A Hong Kong hedge fund manager took an interest in me as a young entrepreneur and started telling me about this new financial technology. His words carried weight, so in subsequent weeks, I started looking into Bitcoin. Since I studied Political Economics during college, Bitcoin made sense to me, not from a technical perspective, but from an economic perspective as a neutral state-less internet-native money. Two months later I joined Snapcard (which later rebranded in Wyre).

AT: Was the Operations Manager position at Snapcard your first ‘real job’ in the crypto industry? How did you get it?

JJ: Yes, this was my first full-time job in crypto when I joined as the first employee of Snapcard in December 2013. At the time it was only two co-founders running things out of Boost.vc, which is a Silicon Valley incubator run by Adam Draper (Tim Draper’s son). Because I wanted to jump into crypto and yet was a bit burned out as a founder of my wind turbine startup, I wanted to look for a role where I was not the founder. Initially, I looked at regular job posts such as Angelist but there were no crypto roles open. So, I went on Craigslist and found a post by Snapcard. I drove down to San Mateo for an interview and vibed really well with the CEO Michael Dunworth and was brought on the following Monday. The first few months at Snapcard working out of Boost.vc were magical, sleeping on beanbags, grinding during the day time, and hanging out with other startup founders in the evening.

AT: Most people I’ve spoken to had their start in the industry by learning independently (and continuously) and being really excited to participate in DeFi. Can you recommend some sources for beginners looking to understand cryptocurrency, Bitcoin, and blockchain technologies?

JJ: There are many good publications nowadays ranging from deep technical research to casual light reading. There are also educational channels on Youtube such as WhiteBoardCrypto, and even mobile apps for crypto learning such as EasyA. My general approach is to read at least 15 minutes a day, consistently. More specifically, I take 5 minutes to browse sites such as Coindesk, Cointelegraph, Decrypt, and The Defiant, just to get the headlines of the day. Then I browse Crypto Twitter for 10 minutes where I’ve curated a specific list of people who only post threads of substance such as Faina. And then when I have time to sit down and really read for 45 minutes or longer, I would recommend top picks on Mirror.xyz or Messari, the blog posts of any company that you’re interested in, the API docs of those companies, as well as research blogs by top crypto VC firms such as a16z and 1kx and Paradigm.

AT: What do you wish you knew before you got into crypto ‘full-time’?

JJ: I wish I knew more about traditional finance and capital markets. I did not get into crypto for the money but because I believed that crypto can make the world a better place. I genuinely believed that we were in a war to fight for global financial freedom, and my personal contribution as a full-time operator was meaningful. But since I never worked on Wall Street, I did not know the difference between investing, trading, speculating, and gambling. This got me in trouble when playing with my own money, where I had to pay millions in tuition to learn the hard way. I don’t necessarily regret it, as this experience of getting rekt’d has taught me valuable lessons about money and the role of money in my life. While it’s good to have some skin in the game, I think it’s important to do your own research and take a genuine interest in the technology.

AT: How was Consensus? What was the most exciting, boring, and surprising?

JJ: Consensus was awesome. So much of crypto is about the community at the social layer. One can think of the space as a social network of distributed nodes, teams on the ground in different cities building awesome products. Austin is a key node in that regard. Especially in a post-covid work environment with less frequent office visits, it’s important for the community to get together during such conferences and learn from each other.

AT: Are you working on anything new now?

JJ: GateFi by Unlimint, next-generation fiat on-ramp. While I was at Wyre, we built a first-generation fiat on-ramp that went on to support many dapps and wallets in the space, in terms of user onboarding, kyc gating, and payment processing from fiat to crypto. The likes of Wyre and MoonPay operated as money service businesses with state-to-state money transmission licenses that enabled them to gain access to banking networks and payment networks to build out a fiat-to-crypto on-ramp product, but these first-generation on-ramps were not direct principal members of those payment networks. They all operated one layer above, sort of as a relayer to sponsor banks. This caused a lot of product issues in terms of fraud, fees, data, and conversion rates. This is why I decided to come to Unlimint to build a fiat-to-crypto on-ramp on top of a true payment infrastructure provider with direct access to each payment network.

Unlimint and GateFi

AT: You are the head of GateFi at Unlimint, which just acquired the license to provide its payment services in Nigeria. In light of financial turmoil caused by money-printing and CBDC enforcement, Nigerians have largely turned to crypto. Knowing it will be very beneficial, will GateFi’s on and off ramp transaction services be available in Nigeria as well?

JJ: Unlimint is first and foremost a payment company, so our payment institution license in Nigeria allows us to process payments from individuals to merchants. In the context of processing payments for crypto in Nigeria, this needs to be looked at in terms of physical jurisdiction laws and regulations, as well as digital jurisdiction standards and policies. There are different guidelines to follow between a country (Nigeria) and a network (Visa). To be honest, I haven’t looked at our rails in Nigeria just yet, as the crypto division of Unlimint has other priorities this year in the EU, APAC, and LATAM. Even so, Nigeria is an exciting market for us and a big opportunity for growth.

AT: Unlimint announced the launch of GateFi in November 2022. Just before that, a number of collapses rocked the crypto industry, sparking a discussion about necessity for stricter crypto regulations in many parts of the world. So the launch was in the eye of the storm, between collapses and a forthcoming reaction to them. What was the most difficult part of operating in those conditions?

JJ: Just the distraction of the unfolding stories. November 2022 would’ve been my third bear market. While shocking because of the scale, it was not surprising because of history. Dating back to Mt. Gox, Cryptsy, BTC-E, QuadrigaCX, and more, there had been many centralized exchanges before FTX that had collapsed, either due to fraud, mismanagement, security vulnerabilities, or all of the above. The difference this time is a coordinated effort from TradFi and regulators to encroach into the space in a meaningful way, which is newsworthy enough to steal time from building. A part of me enjoys bear markets because builders get to build without the hype and the froth of a bull run, but bear markets are not short on drama, which can be distracting for a builder-operator.

AT: Being a global company, Unlimint operates in many jurisdictions. Right now there are circulating rumors that major crypto companies like Coinbase are considering moving to more regulatory friendly parts of the world. What do you think the regulatory landscape would look like by 2025, and how do you plan to adapt?

JJ: With MiCA in the pipeline, and Hong Kong SFC creating a pretty good regulatory framework for virtual asset service providers, I think Europe and Asia are going to take the shine from the US by 2025. Inversely, I do not think that US regulators will create any meaningful regulatory framework anytime soon. For us, Unlimint is a team of more than 500 employees globally, half of whom are compliance, legal, risk, and operations. We have always operated with the strictest controls, and have always favored getting our own licenses in each jurisdiction where we operate.

Regulation

AT: Crypto regulation is a major topic this year, from SEC crackdowns to European Parliament brawls and Hong Kong courts. In many countries, regulations are being made by people unfamiliar with the subject, or without any regard for a different and better future. What would the world look like with some countries having clear and lenient regulations, while others have strict, anti-crypto laws?

JJ: We’re going into a multi-polar world where some countries will allow permissionless blockchain ecosystems to thrive, while others will roll out CBDCs while coercing the venue of crypto exchange, custody, and settlement into incumbent firms such as Nasdaq, Fidelity, Blackrock, Blackstone, and others. This is a huge fork in the road because we do not want crypto to become the Napster of Web3. On one hand, we have a cambrian explosion of self-custody wallets, used for direct access to Web3 without intermediaries; on the other hand, we have anti-crypto regulation putting up barriers to entry that only a select few can operate within. It’s a big problem.

AT: What countries are on your watchlist for having an industry-friendly regulatory potential? Could some countries on that list serve as examples for others?

JJ: In terms of industry-friendly jurisdictions, I am watching Hong Kong and Cyprus. “Industry-Friendly” doesn’t have to mean “lenient”, it just needs to be reasonable and meaningful. Both Hong Kong and Cyprus have good access to their respective regional markets. There are other countries that have created very lenient regulations, but on the world stage, they are not meaningful for a global operation.

AT: We’re observing a demonstrable lack of regulatory clarity in the US, along with anti-crypto efforts by sitting members of the Senate. Do you think it is subject to change in the future, and if so, what would catalyze this change?

JJ: I do not think the US’s anti-crypto stance will change. Perhaps on a state level such as in Wyoming, Texas, Colorado, Nebraska, and Florida. But definitely not on a federal level, for a variety of reasons. I alluded to this earlier but I just don’t think that Wall Street will sit on the sidelines and allow the likes of Binance/FTX to eat their lunch.

AT: What happens if Ethereum or another major cryptocurrency is determined to be an ‘unregistered security’ or otherwise a subject to scrutiny in the US or other significant jurisdiction? Do you think there’s a risk of that? If that’s the case, then do you think that other jurisdictions might follow suit?

JJ: This is a huge existential threat. For example, Bitcoin is being attacked at the protocol level by regulators because Bitcoin mining is very energy intensive and nominally antithetical to ESG. Similarly, for Ethereum and other proof of stake protocols, Office of Foreign Assets Control (OFAC) and Financial Action Task Force (FATF) enforcement can cause censorship at the protocol level where node operators are legally forced to censor certain “illicit” transactions, which will cause consensus mechanism issues across the Ethereum network. And of course, if any large-cap crypto is deemed an unregistered security, such as in the case of Ripple v. SEC, or the NYDFS Paxos lawsuit for BUSD issuance, this will all set a very bad precedent for the rest of the industry and have bigger structural implications beyond what happened with FTX.

The crypto of future

AT: What’s your vision of the coexistence of fiat currencies and crypto for the next five years? Besides the emergence of CBDCs, which global processes could take place in the rapidly changing financial environment?

JJ: Things will develop asymmetrically across physical jurisdictions and digital jurisdictions. We have seen that many nations and banking institutions are anti-crypto and will censor any off-chain transactions related to crypto. But we have also seen Visa, Mastercard, and other digital jurisdictional players embrace crypto and adopt on-chain infrastructure. I believe that major payment networks along with fintech giants will lead the way in creating new global processes by leveraging stablecoins for cross-border settlements. Right now 90 percent of the stablecoin market is ruled by USDC and USDT. But in the real world, we are moving into a multi-polar world with BRICS currency that challenges the US Dollar. If we had sufficient on-chain liquidity for “HKDT”, “EURC”, and other regional stablecoins, we will start seeing on-chain FX protocols become massively utilized.

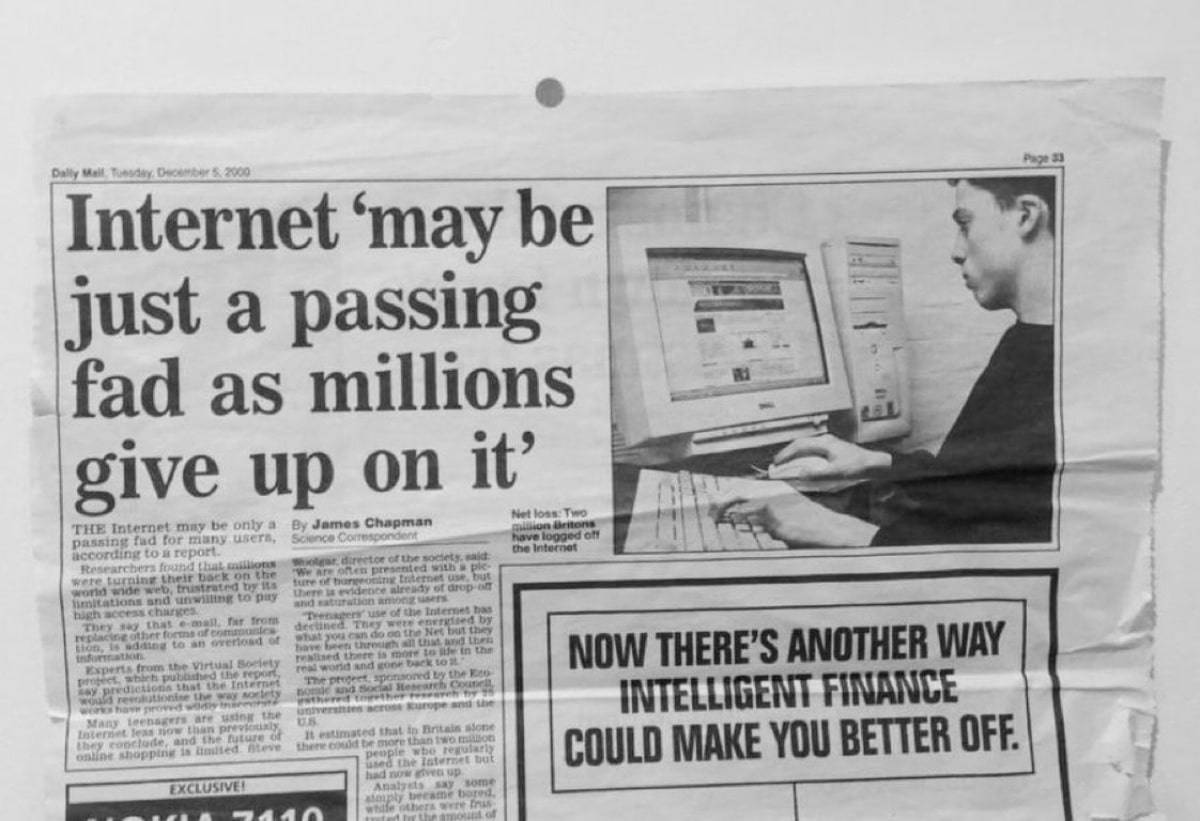

AT: On December 5, 2000, the Daily Mail published an article called “Internet ‘may be just a passing fad as millions give up on it’” — it is now your LinkedIn header. We’ve heard the same sentiment about Bitcoin and the rest of crypto a lot. At this point though, most would agree that at least as a phenomenon, crypto is here to stay. So what is still preventing crypto from becoming globally understood and adopted?

JJ: I think there is a spirit of the times that most people haven’t realized just yet. In the face of AI, deep fakes, and chatbots, how do I prove that I am Me? Well, if I managed my own private keys, from which I broadcasted public tweets, then my crypto wallet becomes not just a place to store financial assets, it becomes my online identity command center where I use my own keys to sign transactions to broadcast my own tweets. This is now cryptographically provable that I am Me. Crypto-native operators have been thinking this way recently, where we don’t like calling a wallet a wallet. Crypto deep tech has now made this possible technically, along with the rise of NFTs making this possible culturally. SocialFi is what I’m referring to, and is the next thing that will impact “most people” by way of disrupting social media. For now, most people haven’t realized just yet that they need a self-custody wallet to manage their online identity, along with a number of other proven use cases such as payments, FX, investing, speculating, and gaming.