Global decline has ultimately undermined the robust UK fintech investment segment: slowdown is impressive

UK fintech investment plunges. Source: pixabay.com

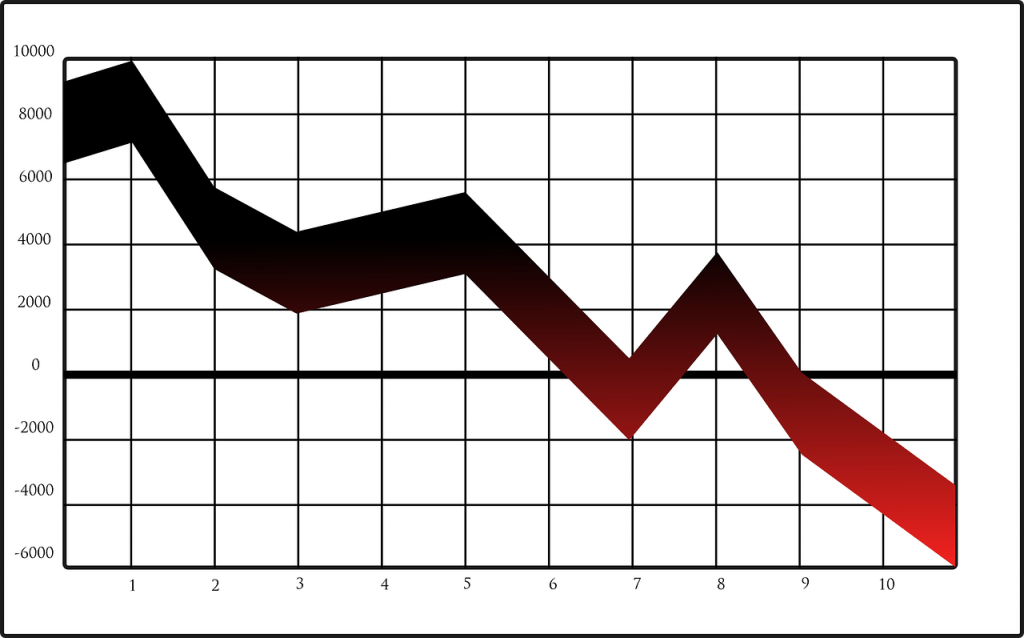

UK fintech investment fell to $9.6 billion in H1 2022, down from $27.8 billion in the same period of 2021, according to a report from KPMG.

Although global financial turmoil has not hindered the British fintech sector from receiving lavish VC inflow for a while, the last few months contributed to a significant H1 2022 slowdown. The UK is now in one boat with the Americas and EMEA region, all observing investors turn to value stocks amid economic uncertainty.

However, the global picture of fintech investment in the first half of the year is not as gloomy as it may seem. Global fintech funding across M&A, PE and VC reached $107.8 billion across 2980 deals in H1 2022. To compare, H1 2021 recorded US$98 billion across 2,456 deals.

Sector-wise, payments continued to attract the most funding, accounting for $43.6 billion in H1 compared to the $60.3 billion received during all of 2021. Regtech also showed strong resilience, attracting $5.6 billion in investment across 157 deals. In addition, crypto investment figures remained well-positioned in H1 2022, contributing $14.2 billion to the total amount.

The most devastating decline was observed in the insurtech sector. It dropped to $3.8 billion of investment globally, clearly unable to match the $14.8 billion in investment seen in 2021.

Nevertheless, all these decreases should not alarm the fintech community. As noted by Anton Ruddenklau, global fintech leader, KPMG International, the investment patterns simply shifted back to levels seen in 2019 and 2020.

SEE MORE:

Canadian fintech investment sinks

Our goal is to continue investing in Ukrainian FinTech — Nykyta Izmailov, CEO of N1 fund

VCs contributed $14.2B to the crypto industry in H1 2022, but investment pace is slowing – KPMG