Starling Banking Services partner with CyberSmart and Digital Risks

UK mobile bank expands its business marketplace. Source: starlingbank.com

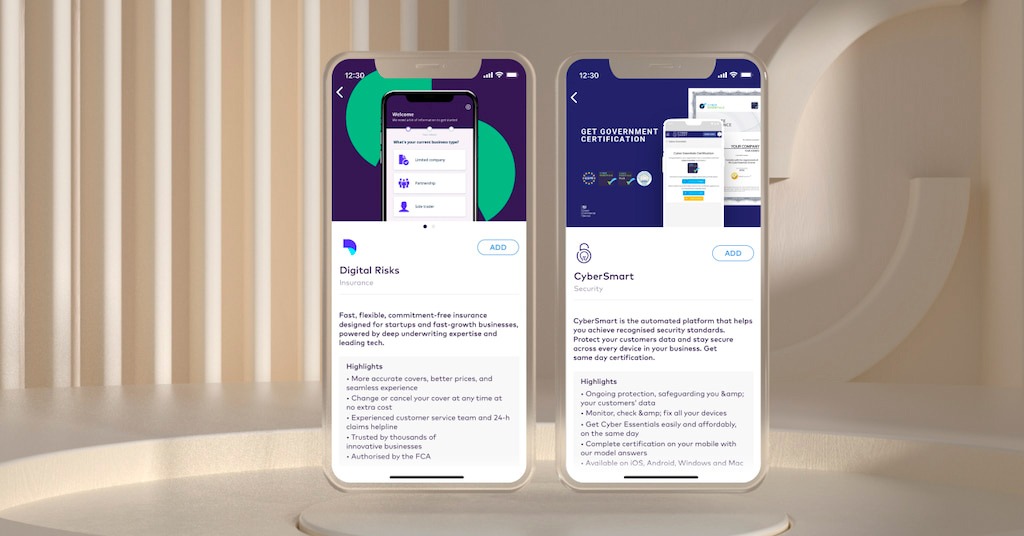

UK’s mobile-based Starling Bank has today added SME insurtech Digital Risks and cybersecurity platform CyberSmart to its business marketplace. The two new partners are part of Starling’s strategy to expand its Marketplace in order to provide business customers with the tools they need to set up and grow their operations. Accessible from within the Starling app, the two complementary products will allow customers to manage more of their business admin from one place.

Digital Risks is the first insurance provider to offer insurance targeted to meet the needs of small and medium-sized digital businesses and the new and emerging threats they face. They offer wide-ranging cover including commercial legal protection, cybersecurity, management liability, employers liability, public liability and professional indemnity.

CyberSmart uses technology to identify digital weaknesses of businesses in less than 60 seconds, recommends fixes and helps companies manage these through a simple online dashboard. CyberSmart will make it quick and easy for Starling customers to achieve their Cyber Essentials Certification, the government-backed accreditation that helps guard against the most common cyber threats and reduce company risk by at least 80%. The platform also allows businesses to ensure that they are fully GDPR compliant.

Digital Risks and CyberSmart are the latest partners to join Starling’s in-app Marketplace which uses Open Banking to give customers direct access to financial services and products securely on their phone. The Bank has committed to launch 48 new partners on its business Marketplace by the end of 2023. Existing partnerships include flexible working capital provider Growth Street and accountancy software Xero and FreeAgent.