Introduction of instant payments system and rising adoption of contactless technology set to reduce cash dependency in Slovenia, says GlobalData

What drives electronic payments adoption in Slovenia. Source: unsplash.com

The launch of Slovenia’s first instant payments clearing system–RealTime24/7–by Slovenia-based payments company Bankart and Nordic payment processor Nets earlier this year is expected to drive electronic payments adoption and reduce consumers’ dependence on cash over the next five years, observes GlobalData.

The company states that cash remains the preferred method of payment in Slovenia, accounting for 52.9% of the total payment transaction volume in 2018. However, with the introduction of RealTime24/7, coupled with the growing adoption of contactless payments, the share of cash within the overall payment volume will drop to 47.5% in 2022.

RealTime24/7, which went live in February 2019, enables immediate fund transfers between accounts opened with different banks within Slovenia.

In line with other European counterparts, Slovenia is also gradually embracing contactless technology. The number of contactless cards reached 2.4 million in 2018, up from 1.4 million in 2016. In addition to payments at retail outlets, these cards are widely accepted for transport payments.

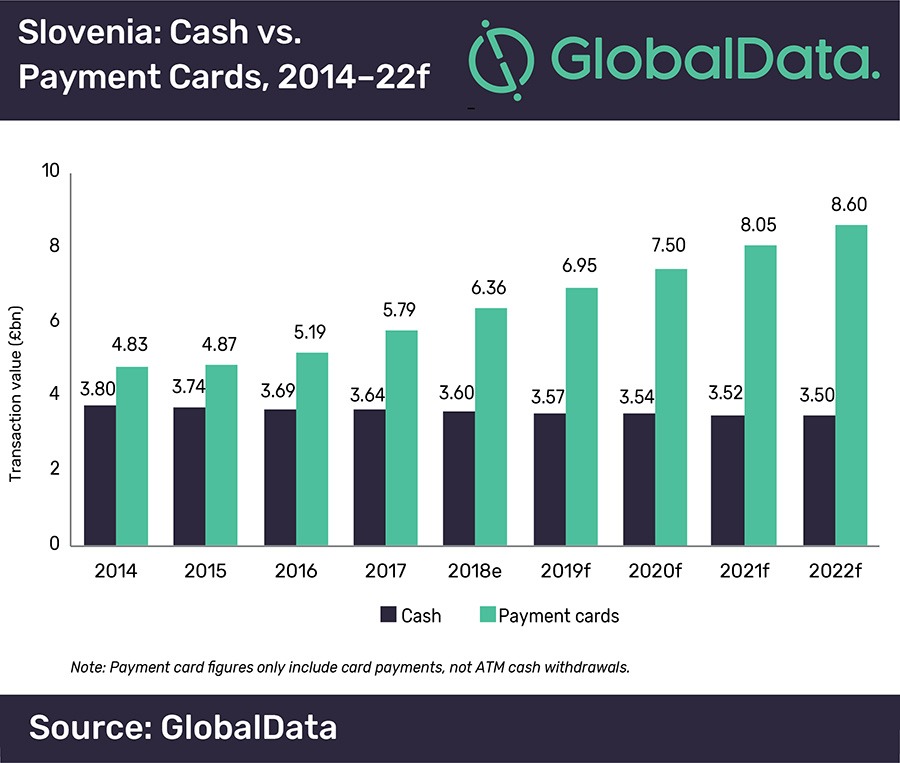

GlobalData forecasts contactless adoption to drive overall card payments in the country. Card payment value recorded a healthy compound annual growth rate of 7.1% during 2014–18, rising from €4.8 billion ($5.5 billion) to €6.4bn ($7.3 billion). This figure is set to reach €8.6 billion ($9.9 billion) in 2022.