In a fintech industry ripe with innovation, embedded payments technology holds a special place. Customers love it, merchants benefit from the added value and convenience they bring, and the whole payment journey is redefined end-to-end.

In this article, we’ll discover what it means to embed payments in apps and platforms, how embedded finance is changing the fintech landscape, and finally, what’s hot in the embedded payments sector in 2025.

What Are Embedded Payments?

Imagine integrating payments into your core payment infrastructure, but without the technical, operational and regulatory complexity typically associated with this process. Unlike traditional payment stack, embedded payments integrate with existing software platforms so seamlessly that end users don’t have to experience any transaction friction you expect while juggling multiple payment vendors that redirect customers to third-party payment pages.

Embedded payments let any type of business (like ride-hailing app, healthcare facility, entertainment resource, or a gym) accept payments right inside their own systems. Not only can merchants use the same portal for billing, scheduling appointments, managing customer relations, and more, but also the user never has to leave the app or get redirected to pay for chosen products or services.

Unlike integrated payments, which tie in an external payment provider (often with separate portals or branding), embedded payments weave transaction tools into the core product itself, removing extra friction and making everything feel seamless. From a tech standpoint, this seamlessness is provided via embedded payment API, SDKs, and white-label payment infrastructure that allow platforms to process transactions directly under their own brand.

Embedded Payments Are Vital Part of Broader Embedded Finance

Not payments alone can be seamlessly integrated into a non-financial app or platform. Innovative fintech companies have also come up with the way to supercharge any service with embedded financial options besides payments, like insurance, investing or loans.

The opportunities of the embedded payments and broader embedded finance markets are huge. Just take a look at these impressive stats:

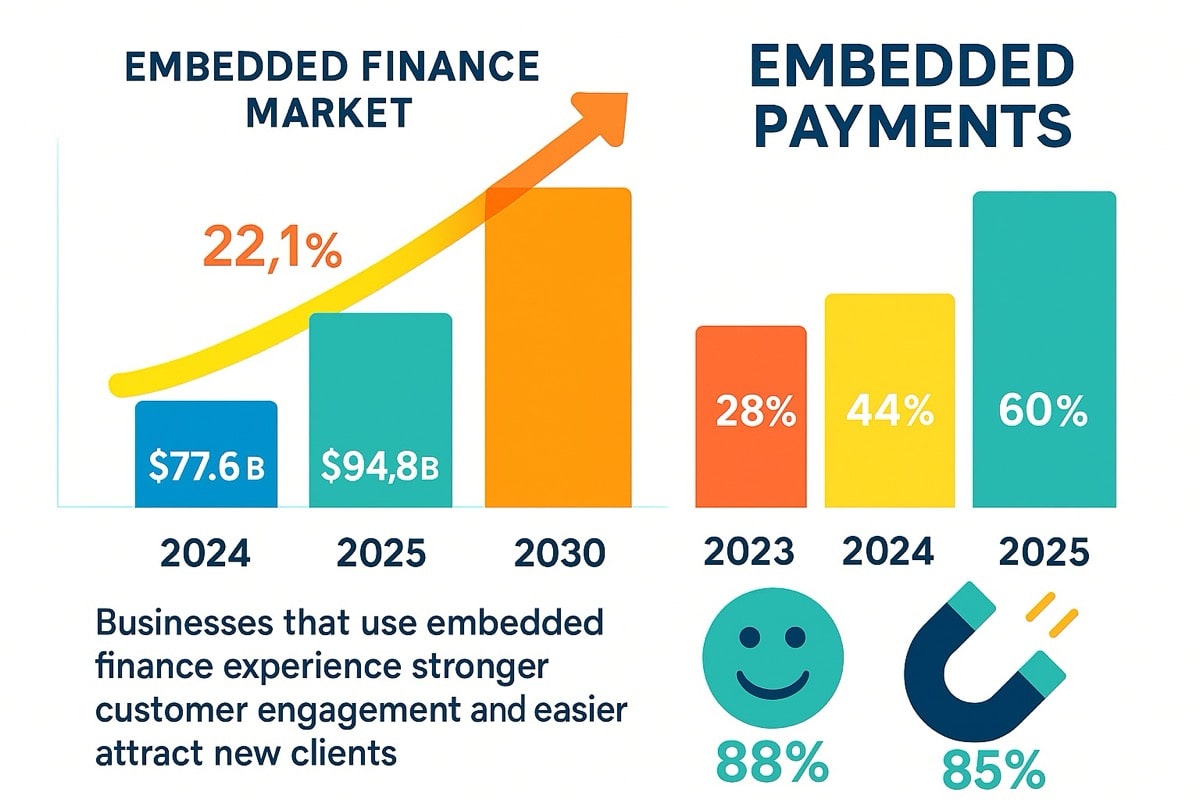

- The embedded finance market is projected to grow at a CAGR of 22.1% this year, up from $77.6 billion in 2024 to $94.8 billion in 2025. By the end of the decade, the growth rate is expected to range between 29% and 33%, which leads us to over $320 billion or even up to $400 billion in estimated revenues for the embedded finance players by 2030.

- Most companies that roll out embedded finance see tangible benefits: about 88% report stronger customer engagement, and 85% say it helps them attract new clients.

- In the broader embedded finance space, payments account for the largest portion of projected value, expected to contribute more than 60% of the sector’s overall worth. As of 2024, the embedded payments share within the embedded finance sector was about 44%, while in 2023, this share was only about 28%. With such rapid growth rates, we might see the forecasted 60% share already this year.

Embedded Payments ≠ Integrated Payments

Embedded payments are not the same as integrated payment solutions, though many people could confuse the two terms. Let’s see how they differ.

Integrated payments connect an outside payment processor to a business’s software through payment gateway integration, letting transactions flow through the system but often sending customers to a third-party portal. Think of a gym that uses management software but redirects members to PayPal when it’s time to settle their monthly fees.

Embedded payments, on the other hand, keep everything inside the platform itself, so that the whole process from sign-up to payment processing and fraud checks happens without any redirections. This way, the payment feels seamless. For example, a ride-hailing app like Uber charges you directly within the app without ever showing another payment provider’s page. Often, embedded payments become so seamless that they turn the customer checkout experience from one-click to zero-click: completely invisible and lightning fast.

Benefits of Embedded Payments

Embedded payments are transforming the way businesses, software providers, and customers interact, offering a seamless and efficient approach to financial transactions. Here’s how each party benefits:

For Software Providers

- Revenue Generation: By integrating payment solutions directly into their platforms, software providers can turn what was once an expense unit into a new revenue stream. This approach allows them to capture transaction fees and other monetization opportunities that would otherwise go to third-party payment processors.

- Enhanced User Retention: Offering embedded payments, including real-time payments embedded within the platform, means users can complete transactions without leaving the platform, reducing friction and improving satisfaction. This seamless experience can lead to higher customer retention and increased lifetime value. Research shows that companies offering embedded financial solutions retain 30% more customers on average compared to their peers.

- Ease of Integration: With the availability of APIs and SDKs from embedded payment providers, integrating payment solutions becomes more straightforward. This operational agility reduces the development time and resources required, allowing software providers to focus on their core offerings.

- Future-Proofing: As the market trends toward software-driven payments, embedding payment capabilities ensures that platforms remain adaptable and scalable, meeting evolving user demands, staying aligned with embedded payments compliance and regulation, and maintaining competitive edge in the fintech landscape.

For Businesses

- Improved Operational Efficiency: Embedded payments streamline the payment process, reducing the need for manual interventions and minimizing errors. This drives process optimization and better resource allocation, whether for traditional B2C or embedded payments for marketplaces.

- Access to Advanced Features: Many embedded payment solutions offer value-added services like fraud detection, analytics, and reporting tools, enabling businesses to make informed, data-driven decisions and enhance their financial strategies.

- Customization and Scalability: Embedded payment systems can be tailored to fit the specific needs of a business, whether it’s handling multiple currencies, managing subscriptions, or integrating with other financial services, ensuring growth readiness and adaptability.

For Customers

- Seamless Payment Experience: Customers can complete transactions within the platform without being redirected to external sites, saving time and reducing the likelihood of cart abandonment. This creates a frictionless journey that strengthens customer satisfaction.

- Enhanced Security: Embedded payments often come with robust security measures, such as encryption and tokenization, ensuring that customer data is protected during transactions.

- Convenience and Accessibility: With features like one-click payments and support for various payment methods, customers can enjoy a more convenient and accessible, user-centric shopping experience, leading to increased satisfaction and loyalty.

Across all categories of the payment process stakeholders, embedded payments offer a win-win scenario. Software providers can generate new revenue streams and enhance user experiences, businesses can streamline operations and access advanced financial tools, and customers benefit from more seamless, secure, and convenient payments while shopping or dealing with service providers.

Key Embedded Payments Trends and Statistics 2025

Within the embedded payments sector, certain trends define the direction of this technology development. Here’s where the embedded payments are heading as we’re nearing the last quarter of 2025.

Real-Time Payments Gain Ground

Instant or real-time payments are becoming more and more mainstream in all jurisdictions. In 2025, 73% of businesses in the U.S. reported using real-time payment rails like RTP or FedNow. In Europe, systems like TIPS settle most transactions within five seconds, reinforcing how instant settlement is becoming the baseline for embedded payment flows. Meanwhile, in India, the growing use of UPI “payment gateways” – merchant acquiring solutions for online/offline merchants, indicates that businesses are actively embedding UPI, the world’s leading real-time payment system, flows into digital checkouts, apps, and other services.

B2B Embedded Payments Are on the Rise

Embedded payments are no longer just for consumers. B2B is catching up fast. Projections estimate that by 2030, embedded B2B payments will handle $16 trillion in transaction volume. Moreover, embedded B2B revenues are expected to grow from ~$1.9 billion in 2021 to ~$6.7 billion by 2026. By 2027, 35% of embedded payments’ revenue will come from the B2B segment. One of the big shifts is that complex B2B workflows with approvals, reconciliation, invoice matching, and other functions are being absorbed into platforms via embedded payments, cutting what used to take days down to minutes.

SaaS & ISV Channels as Payment Distribution Powerhouses

In the U.S., it’s estimated that 40–65% of new SMB merchants will get their payment acceptance and/or acquisition via ISVs or SaaS platforms. This means payments are becoming a bundled feature of business software. In Europe, this channel is still a bit behind but accelerating quickly as software providers look to embed payments as a source of added value. For SaaS companies, embedding payments isn’t just convenience, but a go-to distribution model, powering extra revenue streams and flexible subscriptions.

Embedded Payments Transaction Value & Market Scale Accelerate Growth

Embedded payments are scaling fast. One forecast sees their global transaction value reaching $2.5 trillion by 2028. While the whole embedded finance sector is also quickly developing, embedded payments are expected to continuously capture a major slice of that growth. Additionally, the nature of payments is evolving: in 2025, embedded payments are more than money movement. They also carry valuable attached data that can be used for service personalization, loyalty programs, etc. Thus, each transaction is now enriched with business intelligence, especially in B2B settings.

Embedded Payments at a Glance: Summary

Embedded payments are rapidly becoming the backbone of the embedded finance ecosystem, now projected to account for over 60% of the sector’s value. Their share has surged from 28% in 2023 to 44% in 2024, and is on track to dominate in 2025. Global transaction volumes are forecasted to reach $2.5 trillion by 2028, underlining their scale.

Key trends include:

- Real-time payments: With 73% of U.S. businesses already using rails like RTP or FedNow, and India’s UPI leading global adoption, instant settlement is quickly becoming the norm.

- B2B expansion: By 2030, $16 trillion in B2B transaction flows will move through embedded channels, with 35% of revenues by 2027 coming from B2B use cases.

- SaaS & ISVs as distribution hubs: In the U.S., 40–65% of SMBs will get payment acceptance via software platforms, making payments a built-in feature of business tools.

For the fintech community, this shift is transformative: embedded payments no longer just move money but also generate data-driven insights, customer retention, and new revenue models, positioning payments as both a growth engine and a competitive differentiator.