While FedNow is a rapidly expanding instant payment network in the U.S., we cannot help but wonder how this growth compares to the real-time transactions behemoths like Indian UPI and Brazilian Pix.

This analysis offers a brief overview of FedNow system achievements over its first two years of operation and projections of its potential compared to the world’s biggest instant payment networks, UPI and Pix.

FedNow as the Latest Iteration of U.S. Real-Time Payments

Back in 2023, not so long ago, the U.S. was oddly lagging behind in payment innovations. The country ranked 33rd in the number of monthly real-time transactions. It is no wonder, since instant payments made up only around 1% of overall money transfers in the US, facilitated on a limited scope by the Clearing House’s RTP and Zelle, both owned by a consortium of commercial banks.

The reluctance to embrace real-time payments had a few reasons:

- Lack of trust – consumers worried about fraud, data security, and the lack of reimbursement for scams in instant payment systems.

- Additional fees – many Americans believed instant payments were costly, though fees are often comparable to or lower than traditional methods.

- Last mile connectivity issues – not all US banks and credit unions have joined real-time payment initiatives.

- Legacy infrastructure – banks hesitated to adopt instant payments due to the high cost and complexity of upgrading outdated systems.

- Lack of motivation – unlike emerging markets, the U.S. already had widespread banking access, so consumer demand for instant payments was weaker than in emerging economies with poor banking options.

And then, FedNow came along. This instant payment system, unlike its predecessors, is a federal initiative, not a certain bank or company-owned network. Designed to enhance interoperability, inclusion, and accessibility, FedNow aims to provide a unified, nationwide real-time payment infrastructure that any local financial institution, no matter its size or reach, can join. And yet, at the start, it faced the same sluggish adoption and cautious attitude.

What FedNow Achieved in Two Years?

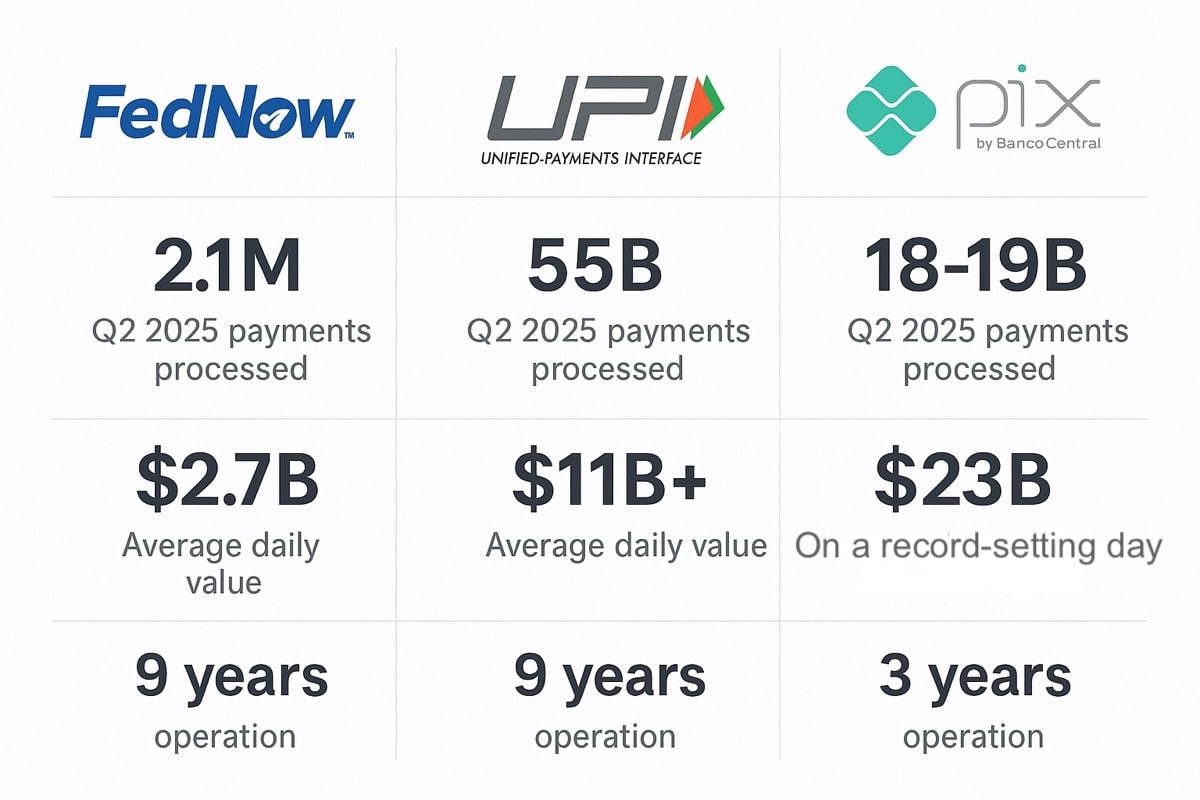

After two years of operations, FedNow issued a brief infographic highlighting its main milestones and achievements over the period. What do these numbers tell us about this real-time payment system?

Fast Participant Growth

By mid-2025, FedNow had onboarded about 1,400 U.S. financial institutions (banks and credit unions). Although it sounds impressive, let’s not forget that based on global comparisons, the USA tops hundreds of other countries in nationwide bank numbers. It has over 4,500 FDIC-insured banking institutions and almost the same number of credit unions. That gives us a small fraction of 12-15% of local financial institutions participating in the scheme.

Strong Volume Build-Up

Quarterly FedNow processing volumes jumped sharply (e.g., a 62% quarterly increase to ~2.1 million payments from Q1 to Q2 2025) while average daily value rose more than 400% to $2.7 billion. How does that compare to longer existing U.S. instant payment solutions?

RTP reportedly processed 107 million payments in Q2 with an average daily value of about $5 billion. However, for Zelle, the numbers are contradictory due to its P2P nature. Although the network typically publishes yearly results, so we don’t have exact 2025 data, based on last year’s performance, Zelle processes about 900 million transactions per quarter, much more than FedNow and RTP, but their worth was about $2.7 billion per day, similar to FedNow achievements since peer transactions are, as a rule, small value.

Evolution of Features and Functionality

The service introduced risk-mitigation tools (account activity thresholds) and raised transaction limits (from $500k to $1M) to better support higher-value use cases.

FedNow also introduced DevRel – a tech portal for FedNow participants and their service providers with docs, sample code, message samples, tools, and specs to help build, test, implement, and maintain FedNow integrations, and added two simple, developer-friendly APIs to make connectivity checks and participant discovery easier for participants and service providers.

How FedNow Stacks Up Against Pix and UPI

To understand the position of FedNow on the global real-time payment scene, we’ll compare the system with two of the world’s biggest instant payment rails – Brazilian Pix and Indian UPI. Both networks are nationwide, public digital payment infrastructures, much closer to the federal nature of FedNow than to private rails like RTP or Zelle.

However, when you analyze their volumes, you must bear in mind that India has a population that is more than 4 times larger than the U.S. and about 6.5 times larger than Brazil. At the same time, the U.S. surpasses Brazil by about 1.6 times in population numbers.

As of Q2 2025, Pix processed about 18–19 billion transactions, and UPI – almost 55 billion. Their daily value was over $11 billion for UPI and $23 billion on a record-setting day for Pix, which doesn’t regularly publish daily figures.

You might say that comparison is not fair, since UPI has been operational for 9 years. However, Pix is a much newer solution, having only 3 years behind it, yet its impressive results are driven by near-universal adoption in Brazil. Besides, even in 2018, when UPI was still fresh and had the same operational standing as FedNow, it boasted about 228 million transactions per quarter, though its average daily value was small – slightly over $2 million as it dealt with P2P retail transfers.

Can FedNow Ever Reach UPI and Pix Ubiquity?

The comparison is clearly not complimentary for FedNow. And the key differentiating factor is ubiquity. India has 2000+ banks in total, with 675 of them already live on UPI (about one-third). In Brazil, the Pix participation share among local financial institutions is even greater – over 45%.

The main questions remain: how did Brazil and India achieve such ubiquity, and can the U.S. leverage their practices to promote FedNow?

UPI and Pix Lessons to Learn for Instant Systems Promotion

Here are the main drivers behind UPI and Pix’s enormous growth:

- Mandatory or strongly incentivized participation: UPI requires major banks to join, while Pix mandates institutions with >500,000 accounts.

- Rapid onboarding of a wide spectrum of institutions, including fintechs, cooperatives, and payment providers.

- Robust public infrastructure and broad merchant ecosystem – QR codes, app payments, and customer-facing online solutions enable widespread adoption by micro, small, and large businesses.

- Nationwide, public infrastructure. Both UPI and Pix are central bank-driven, ensuring interoperability across all participants, standardized messaging, APIs, and compliance rules.

- Early adoption momentum: Even at launch, UPI and Pix benefited from a strong regulatory push and digital payment initiatives targeting retail users.

Challenges FedNow Faces in Gaining Momentum

What Pix and UPI have may be challenging for the U.S. market, though. To begin with, FedNow adoption is voluntary, leaving smaller institutions reluctant to join due to possible infrastructure and cost hurdles. Experts widely agree that a mandate is unlikely in the U.S. financial system, so the network is limited to encouraging actions.

The next hurdle is that more is not always the merrier. Both India and Brazil have fewer financial institutions, so they could more easily and quickly onboard the majority of the significant industry players. Meanwhile, in the U.S. market, reaching out to all the institutions, especially on a voluntary basis, would take much longer.

Finally, there’s no urgency regarding banking services availability, which is often pressing citizens of emerging economies to adopt real-time payments as the only path to financial inclusion, affordable remittances, cash reduction, or merchant access. In the U.S., instant payments don’t solve structural problems; they are just a nice addition to existing “good enough” reliable banking rails.

What Can Be Done

And yet, all these obstacles could be overcome with the right strategy. FedNow might not be able to duplicate the success surge of UPI or Pix, but there’s surely plenty of room for growth. To accelerate the adoption of real-time payments, U.S. players might focus on a few practices India and Brazil used besides mandates.

Developing Public and Merchant-Facing Technologies

Nobody is eager to use financial services that are hard to implement and cause a lot of friction. However, FedNow’s rollout has so far focused more on institutional connectivity than on merchant-facing innovations. FedNow has delivered a powerful backbone for instant payment integration via its Request-for-Payment tool, structured messaging, and automation. Nevertheless, it’s still building its front-end reach. Unlike UPI and Pix, with widespread QR-code merchant adoption and embedded POS systems, FedNow lacks a unified merchant-facing layer, e.g., an interoperable QR payment standard, universal payment links, apps, etc.

Therefore, supporting lightweight merchant interfaces via open APIs or plug-in tools for small businesses could be appreciated by the market participants and encourage quicker adoption. The integration of FedNow into existing POS systems, invoicing software, or e-commerce platforms must become low-barrier and maximally streamlined. If instead of building their own FedNow integration from scratch, merchants were to get ready-made software modules (like QR-code generators, checkout buttons, or payment link APIs), they would be much more willing to onboard.

Boosting Customer and Market Expectations

Even reluctant financial institutions may be forced to adopt novel instant payment rails if they face indirect pressure from customers, vendors, or partners who simply expect instant payment capabilities.

To promote instant payments as standard, FedNow, as a federal service, can encourage employers, insurers, and government agencies to use its system for salaries, refunds, and benefits. That’s how more people would develop a habit of expecting money now rather than later.

Besides, the Fed and participating banks could raise public awareness, highlighting real-world benefits of instant payments (e.g., avoiding overdraft fees, faster settlement for small businesses) as well as better interoperability of the system compared to earlier solutions to build consumer demand.

If FedNow makes it seamless for merchants (especially large retailers, utilities, and service providers) to accept real-time payments, and these methods will become more common, customers will start expecting it at checkout just as they expect card or mobile wallet options.

Finally, if mandates are out of the question, incentives might be helpful. Thus, FedNow adoption might be linked to certain perks, whether we speak of reduced fees, liquidity support, or technical assistance, further pushing institutions to meet growing expectations.

Summary

FedNow has made progress in expanding the U.S. instant payments ecosystem, but its voluntary nature and relatively low adoption still leave it far behind global leaders like India’s UPI and Brazil’s Pix. Unlike those two popular systems, which achieved near-universal coverage through mandates, QR-code infrastructure, and strong merchant integration, FedNow has so far focused on back-end connectivity rather than consumer- and merchant-facing tools. To accelerate adoption, FedNow could emulate international best practices by supporting lightweight merchant interfaces, incentivizing participation, and building public awareness that fosters customer expectations for real-time payments.