Loans play a crucial role in helping Canadians achieve their goals, whether it’s buying a home, financing education, or starting a business. This article explores the most common types of loans available in Canada and provides insight into how they work, helping you make informed decisions about your borrowing options.

How Loans Work

Before delving into specific loan types, it’s crucial to understand the key factors that differentiate various lending options in Canada. Consider these important aspects:

- Interest rates: Loans can have fixed or variable rates which can significantly impact your repayment amount over time. Fixed rates offer stability, while variable rates may fluctuate with market conditions.

- Repayment terms: The duration of the loan affects your monthly payments and total interest paid. Shorter terms often mean higher payments but less overall interest.

- Security: Secured lending options require collateral, potentially offering lower interest rates, while unsecured ones rely solely on your creditworthiness.

- Fees: Look beyond interest rates to understand the total cost of borrowing, including origination fees, prepayment penalties, and other charges.

- Flexibility: Some loans offer features like payment holidays, the ability to make extra payments, or options to refinance.

- Eligibility criteria: Lenders assess factors such as credit score, income, and debt-to-income ratio to determine your eligibility and loan terms.

In Canada, loans can be obtained from various financial institutions and lenders. Traditional banks are a common source, offering a wide range of loan products. Credit unions like Innovation in Canada typically provide competitive rates and more personalized service. They may have more flexible lending criteria, especially for members with long-standing relationships.

Online lenders have become increasingly popular, offering convenience and sometimes quicker approval processes. Additionally, government programs provide specific loans, such as student or small business ones. Each source has its own advantages and considerations, so it’s worth exploring multiple options to find the best fit for your needs.

Mortgage Loans

This is arguably the most significant type of loan for many Canadians. Mortgages are used to purchase residential or commercial property and are secured by the property itself.

Types of mortgages:

- Conventional mortgages: Require a down payment of 20% or more.

- High-ratio mortgages: For down payments less than 20%, requiring mortgage insurance.

- Open mortgages: Allow extra payments or full repayment without penalties.

- Closed mortgages: Have restrictions on extra payments but often offer lower interest rates.

How they work:

- Lenders provide a large sum of money to buy a property.

- The borrower repays the loan, plus interest, over a set term (typically 15 to 30 years).

- The property serves as collateral, meaning the lender can foreclose if the borrower defaults.

Key features:

- Down payments are usually required (minimum 5% for homes under $500,000).

- Interest rates can be fixed or variable.

- Mortgage insurance is mandatory for down payments of less than 20%.

Personal Loans

Personal loans are versatile financial products that can be used for various purposes, from debt consolidation to home improvements.

How they work:

- Lenders provide a lump sum that’s repaid in fixed instalments over a set term.

- Interest rates are typically fixed but can sometimes be variable.

- Loan terms usually range from one to seven years.

Key features:

- Can be secured (backed by collateral) or unsecured.

- Interest rates are generally higher than mortgage rates but lower than credit card rates.

- Loan amounts typically range from $1,000 to $50,000.

Student Loans

Student loans help finance post-secondary education and are available through government programs and private lenders.

Types of student loans:

- Government programs:Federal programs with standardized terms across the country.

- Provincial/territorial: Terms vary by province or territory.

- Private student lines of credit: Offered by banks and credit unions.

How they work:

- Funds are provided to cover tuition, books, and living expenses.

- Repayment usually begins after graduation, with a grace period of six months.

- Interest may or may not accrue during the study period, depending on the loan type.

Key features:

- Government programs often offer more favourable terms than private ones.

- Interest paid on student loans can be claimed as a tax credit.

- Repayment assistance plans are available for those facing financial hardship.

Auto Loans

These are specifically designed to finance the purchase of new or used vehicles.

How they work:

- Lenders provide funds to buy a vehicle, which serves as collateral for the loan.

- The loan is repaid in fixed monthly instalments over a set term (typically three to eight years).

- Interest rates can be fixed or variable.

Key features:

- Down payments may be required but are not always necessary.

- Longer loan terms can lower monthly payments but increase the overall interest paid.

- Some dealers offer promotional rates, including 0% financing on new vehicles.

Home Equity Lines of Credit (HELOCs)

HELOCs allow homeowners to borrow against the equity in their homes.

How they work:

- A credit limit is set based on the home’s equity (usually up to 65% of the home’s value).

- Borrowers can draw funds as needed, up to the credit limit.

- Interest is paid only on the amount borrowed.

- Minimum monthly payments are required, typically covering interest only.

Key features:

- Interest rates are typically variable and tied to the prime rate.

- More flexible than traditional loans, allowing for revolving credit.

- Can be used for various purposes, including home renovations or debt consolidation.

Business Loans

These help entrepreneurs start, expand, or maintain their operations.

Types of business loans:

- Term loans: Lump sum repaid over a fixed term.

- Lines of credit: Revolving credit that can be drawn upon as needed.

- Equipment loans: Specifically for purchasing business equipment.

- Microloans: Smaller loans for startups or very small businesses.

How they work:

- Lenders provide funds for business purposes, which are repaid with interest over a set term.

- Loan terms and conditions vary widely depending on the lender and the type of loan.

Key features:

- Can be secured (e.g., by business assets) or unsecured.

- May require a detailed business plan and financial projections.

- Interest rates can be fixed or variable.

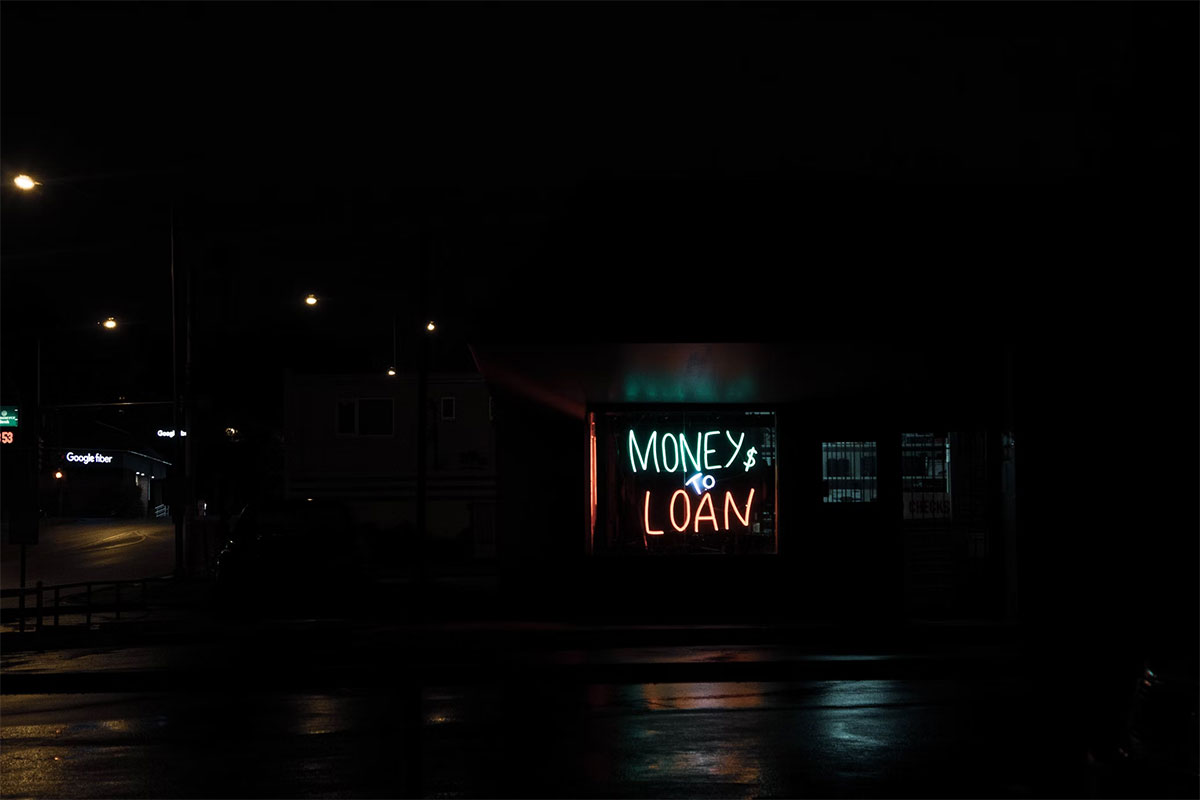

Payday Loans

Payday loans are short-term, high-cost loans typically used for emergency expenses.

How they work:

- Lenders provide a small amount of money (usually up to $1,500) to be repaid by the borrower’s next payday.

- The borrower provides a post-dated cheque or pre-authorized debit for the loan amount plus fees.

Key features:

- Very high interest rates and fees (can exceed 400% APR).

- Short repayment terms (usually 14 days).

- Regulated by provincial governments with varying rules across Canada.

Important note: While payday loans can provide quick access to funds, they are generally considered a last resort due to their high costs and potential to trap borrowers in a cycle of debt.

Credit Card Cash Advances

While not a traditional loan, credit card cash advances are a form of borrowing that’s readily available to credit card holders.

How they work:

- Cardholders can withdraw cash from their credit card up to a certain limit.

- Interest begins accruing immediately, often at a higher rate than regular purchases.

Key features:

- No grace period; interest charges start immediately.

- Often subject to cash advance fees in addition to interest charges.

- Can be convenient but is an expensive form of borrowing.

Conclusion

Loans can be powerful financial tools when used responsibly. Remember that each loan type serves different purposes and comes with its own set of advantages and considerations. Always carefully evaluate your options and, when in doubt, consult with a financial advisor to ensure you make the best choice for your unique situation.