Did you know which payment method outpaces cash and cards in brick-and-mortar purchases and is 165% more likely to be used than any other online shopping means? Does Apple Pay or Google Wallet ring a bell? Digital wallet adoption statistics 2025 have a lot to say about the global state of digital payments and the direction they’re heading into this year.

Digital wallets are ubiquitous today. Since the 2000s, they’ve gone down a long road from niche payment solutions treated with caution to the most popular online payment method worldwide and a core payment infrastructure for payment providers worldwide. Furthermore, current e-wallet trends have expanded wallet functionality from mobile payments to storing cards, IDs, loyalty passes, and more.

Therefore, the online and mobile wallet market size has grown enormously, nearing $3 trillion and expanding at a CAGR of about 27–32%. In 2024, the market crossed another major threshold driven by smartphone penetration, fintech innovation, and the ongoing shift toward contactless commerce and digital banking: over half the world now uses a digital wallet supporting contactless NFC and in-app payments.

Whether in online or offline settings, mobile and e-wallets make checkout faster, safer, and more integrated with other digital services. P2P payments also benefit from e-wallet functionality: sharing a cost of dinner with a friend is only a few taps away.

This article unpacks the key digital wallet adoption statistics 2025, regional differences in fintech adoption trends, peculiarities of digital payment demographics, key e-wallet platform trends (Apple Pay, Google Wallet, Samsung Pay, and more), NFC/contactless payment growth, and what it means for merchants, fintechs, and consumers.

Global Digital Wallet Adoption: Users and Trends Behind the Numbers

2024 marked an important milestone in digital wallet adoption statistics. The number of global digital wallet users exceeded half of the total worldwide population, enticing merchants, banks, and fintechs alike to pay more attention to digital wallet acceptance, embedding, and enhancement.

Multiple trackers show that between 4.3 and 5 billion people (out of 8.2 billion living on Earth) used a digital wallet last year, with forecasts predicting this share will grow to nearly 70% by 2030. In fact, only about 15% of consumers remain sceptical about mobile and digital wallet use today.

All these users are not sitting idly with their mobile wallet accounts. The amount of mobile payments facilitated by wallet infrastructure is insane. In fact, 2025 transaction volumes are projected to reach up to 10 trillion dollars worldwide.

Global consumers used wallets across in-store and online channels. Digital wallets accounted for 53% of online purchases in 2024, while debit and credit cards together made up only 32%.

In physical stores globally, digital wallets held about 31% market share in 2024, topping other options like credit cards (27%), debit cards (22%), and cash (16%). By 2027, mobile and e-wallets are expected to make up 46% of all POS transactions. It is no wonder that 82% of merchants are planning to further expand their digital wallet acceptance options this year.

Regional Digital Wallet Data & Demographics

Digital wallet adoption statistics are uneven across the world.

Asia-Pacific Region Leads in Mobile Wallet Usage

The countries of the Asia-Pacific region boast some of the highest digital wallet adoption levels and transaction values globally. Contactless payment growth in these countries has been rapid for years, creating mature super-apps and mobile-first digital wallet ecosystems (Alipay, WeChat Pay, GrabPay, and equivalents). As a result, over 60% of global digital wallet users reside in the region.

As of 2025, the vast majority of consumers in Southeast Asia (SEA) use mobile wallets as their payment method of choice for cross-border purchases. Namely, 83% of Indonesian shoppers and 80% of Malaysians use wallets (Touch ’n Go eWallet, Apple Pay, Google Pay, etc.) to buy from abroad.

Both Alipay and WeChatPay have over 1 billion active users and jointly account for over 90% of mobile payment transactions in China, where nearly 90% of urban adults regularly use digital wallets. In India, almost 91% of consumers use digital wallets for P2P and business payments as well, as they are seamlessly integrated with the national real-time A2A payment system UPI. PhonePe and Google Pay wallet hold a combined market share of 86% UPI payments in India by transaction volume.

LatAm, Africa & Middle East Show Promising Fintech Adoption Trends

In the emerging markets of Africa, the Middle East, and Latin America, digital wallets drive financial inclusion in areas where traditional banks couldn’t properly serve. Mobile wallet adoption rates in these regions are projected to grow between 147% and 166% this year.

In Africa and the Middle East, the growth in adoption is driven by the rising use of mobile money platforms like M-Pesa, which are enhancing access to e-commerce opportunities. For example, M-Pesa, a dominant mobile money service throughout Africa, supports more than 65 million users. Its network also encompasses over 950,000 merchants and 5 million businesses.

Additionally, various other mobile money platforms are widely used across emerging African markets. In 2024, over half of the 2.1 billion registered mobile money accounts worldwide were held by people in Sub-Saharan Africa.

Meanwhile, in Latin America, digital wallets already account for roughly one-third of both online and in-store retail transactions.

Europe and North America Catch Up With Digital Wallet Adoption Statistics

Europe shows steady growth in digital wallet usage, with about 45% of adults leveraging the power of innovative e-wallet trends, and Northern European countries are illustrating adoption rates as high as 80%. In the U.S., around 56% of smartphone users engage with mobile wallets.

As for digital payment demographics, primarily younger generations like Millennials and Gen Z prefer this mobile payment type. Together, they account for 75% of digital wallet users in these regions.

While adoption in North America and parts of Western Europe, like the UK and Canada, is slower compared to global trends, digital wallets remain mainstream, used by roughly half the population in respective countries. Moreover, recent research has shown that over half (57%) of UK adults today use mobile wallets, up from 42% in 2023. With such a growth tempo, UK digital wallet adoption can soon reach the prevailing majority levels (about two-thirds of the population).

Unlike in Asia, where QR-code payments drive mobile wallet growth, Europe and North America see less QR usage, so credit cards and cash continue to be the preferred payment methods for many local consumers.

Fintech Insights on Popular Digital Wallet Use

Like in many other contactless payment segments, the digital wallet market is highly competitive, encompassing offers from big tech players, fintech startups, and digital banking incumbents. Let’s dive into each of these categories in detail:

Digital Wallet Solutions From Big Tech

Many Big Tech players have contributed to contactless payment growth, boasting enormous numbers of global digital wallet users and transactions processed on a daily basis.

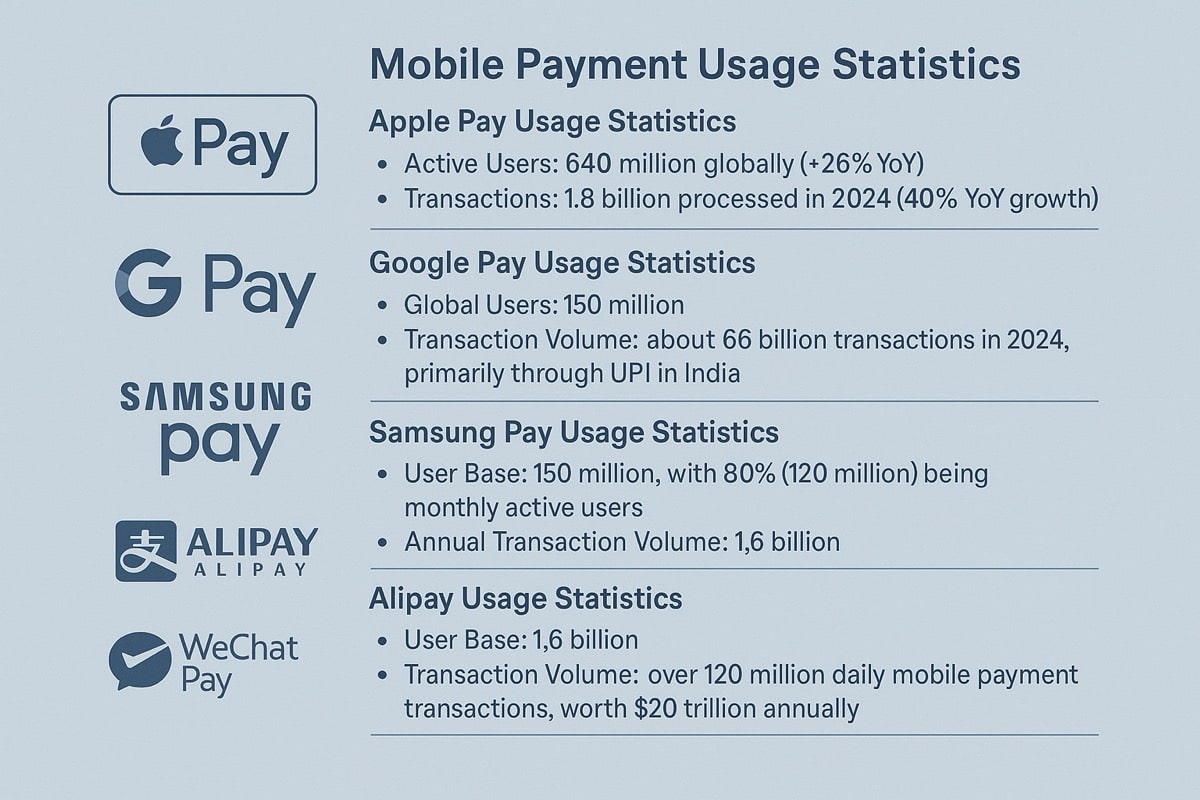

Apple Pay Usage Statistics

- Active Users: 640 million globally (+26% YoY)

- Transactions: 1.8 billion processed in 2024 (40% YoY growth)

Google Pay Usage Statistics

- Global Users: 150 million

- Transaction Volume: about 66 billion transactions in 2024, primarily through UPI in India

Samsung Pay Usage Statistics

- User Base: 150 million, with 80% (120 million) being monthly active users

- Annual Transaction Volume: 1,6 billion

Alipay Usage Statistics

- User Base: 1.6 billion

- Transaction Volume: over 120 million daily mobile payment transactions, worth $20 trillion annually

WeChat Pay Usage Statistics

- Active Users: 1.3 billion

- Transaction Volume: About 1 billion transactions daily

Major Digital Wallet Fintech Developers

Both large and small fintech startups and established businesses in the sphere endeavour to embed mobile wallets and e-wallets into their payment ecosystems.

PayPal

- Active Accounts: 434 million (+2.1% YoY)

- Total Payment Volume: $1.68 trillion in FY 2024 (10% YoY)

Cash App

- Monthly Active Users: 57 million

- Annual Inflows: $283 billion in 2024

Revolut

- Customers: 52.5 million

- Transaction Volume: £1 trillion in 2024 (52% YoY growth)

MetaMask

- Monthly Active Users: 30 million

- Swap Revenue: $325 million cumulative from MetaMask Swaps

Paytm

- Active Users: over 350 million

- Transactions: more than 4 billion transactions monthly, covering payments, recharges, and financial services; the Paytm wallet processed ₹4.4 trillion (about $53 billion) in transactions during Q2 2025 alone

Several smartwatch providers like Garmin and Timex also offer digital payment solutions integrated into smartwatches, but they are rather NFC payment features than standalone digital wallet platforms like Google Pay, Samsung Pay, or Apple Pay.

Both Digital and Traditional Banks Integrate E-Wallet Solutions Rather Than Develop Them

Many banks are supporting digital wallet offerings. However, few are developing their own proprietary solutions. Thus, JPMorgan Chase has experimented with a wallet offering Chase Pay, but discontinued it in early 2020 due to low customer adoption.

Neobanking providers like N26 or Chime process millions of monthly transactions across their various digital payment offerings, including wallet linkage services. However, they have no separate wallet offerings, offering their customers to connect bank cards to Apple Pay, Samsung Pay, Google Pay, and other wallet solutions.

There is also a digital wallet service Paze, developed by Early Warning Services, the company behind Zelle, and supported by major U.S. banks, including Bank of America, Capital One, Chase, Elan, PNC, Truist, U.S. Bank, and Wells Fargo. It is integrated directly into the mobile or online banking apps of participating financial institutions to use for P2P payments and digital banking purposes.

Digital Wallet Adoption: Main Highlights

- In 2024, digital wallet adoption statistics show that more than half of the world’s population, between 4.3 and 5 billion people, are global digital wallet users, with projections reaching nearly 70% by 2030.

- The mobile wallet market size has surged toward $3 trillion, fueled by smartphone penetration, contactless payment growth, and evolving e-wallet trends that go beyond payments to include IDs, loyalty cards, and more.

- Transaction volumes are set to hit $10 trillion by 2025, with digital wallets already accounting for 53% of online purchases and 31% of in-store transactions worldwide.

- Regional digital wallet data highlights the dominance of Asia-Pacific, where super-app ecosystems like Alipay and WeChat Pay process billions of transactions daily, while emerging markets in Africa, the Middle East, and Latin America show rapid fintech adoption trends driving financial inclusion. In contrast, Europe and North America are catching up, with adoption highest among Millennials and Gen Z, though credit cards and cash still hold a strong presence.

- The digital wallet sector is highly competitive, with big tech players commanding a dominant position. Apple Pay usage statistics reveal 640 million global active users and 1.8 billion transactions in 2024, while Google Pay’s 150 million users process 66 billion transactions, mostly in India via UPI.

- Samsung Pay, Alipay, and WeChat Pay collectively handle billions of transactions daily, reinforcing their role as core digital payment infrastructure. Fintech insights show major players like PayPal, Cash App, Revolut, and Paytm capturing massive volumes, alongside niche platforms like MetaMask for crypto.

- Traditional banks, rather than developing standalone wallets, often integrate with these ecosystems, though some, like the U.S. bank-backed Paze, are experimenting with proprietary solutions. This dominance of established tech and fintech brands sets high barriers for new entrants, cementing their influence over global mobile payments, P2P payments, and the future of digital banking.

*This article was updated on Sept. 12, 2025, with new statistics on mobile wallet usage in SEA and illustrations.

* This article was updated on Oct. 2, 2025, with new statistics on mobile wallet usage in the UK.