Did you know that every third American citizen owns a co-branded credit card from their favourite retailer, warehouse club or airline? Brands eagerly enter partnerships with payment providers to issue their own credit solutions. Today, we wonder if this practice still makes sense amid the abundance of multi-purpose payment products. Do co-branded cards fulfil their purpose of encouraging brand loyalty or is their impact on customers’ retail decisions minimal? Let’s discover the truth together.

What Is a Co-Branded Credit Card?

Co-branded credit cards are popular in many countries of the world. They differ from all other credit cards by combining a reward program from a retailer or service provider and typical credit offering.

Such cards contain the name of the brand involved along with the name of a payment network, e.g. Costco Anywhere Visa Card by Citi. They are produced as a result of the partnership between the financial institution and merchant or other entity.

Some co-branded cards are designed for exclusive use at the merchant stores associated with the card, while others may be used anywhere the card’s payment network is accepted.

Who Uses Co-Branded Credit Cards and Why?

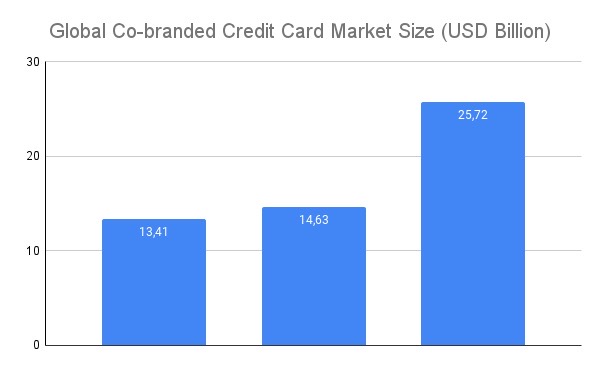

According to the 360iResearch forecast, the global co-branded credit card market size will reach USD 25.72 billion by 2030, growing at a CAGR of 9.74% from USD 13.41 billion in 2023 and expected USD 14.63 billion in 2024.

Co-branded credit cards take a significant 62% share of the U.S. consumer credit market. In India, co-branded credit cards are outpacing traditional ones and are set to dominate the market with 35-40% compounded annual growth from fiscal year 2024 to 2028. The Amazon Pay-ICICI and Flipkart-Axis credit cards have a combined circulation of over 8 million, accounting for one-third of all new credit card issues in India’s current market. At the same time, in Africa co-branded credit cards play a minor role. What sets these regions apart?

Markets where co-branded cards are on the rise display high consumer spending habits, culture of credit reliance and an inclination for loyalty programs. The adoption rates may also be driven by the growth of luxury travel and retail sectors. Meanwhile, in emerging economies like many African countries, the main focus remains on financial inclusion and bringing at least some financial access to the large share of the unbanked population rather than creating reward offerings for brands.

The majority of co-branded cards are used for e-commerce and travel. These industries create the most customer engagement offers, providing tailored rewards and exclusive benefits through strategic partnerships between banks and brands. The survey conducted in India by Redseer Strategy Consultants, in collaboration with Hyperface, showed that 47% of respondents identify cashback offers as a key customer attraction while 41% focus on loyalty points programmes. These two methods have emerged as the most effective strategies for boosting customer retention via co-branded cards.

Customers who are already loyal to a particular brand find co-branded cards appealing as they allow them to maximise rewards and benefits while sticking to their regular shopping decisions. “The Role of Strategic Partnerships in Consumer Credit Cards,” a study by PYMNTS Intelligence and Elan showed that 34% of consumers value loyalty schemes and rewards as the top reason they use store cards, while 38% said the same about their co-branded credit cards.

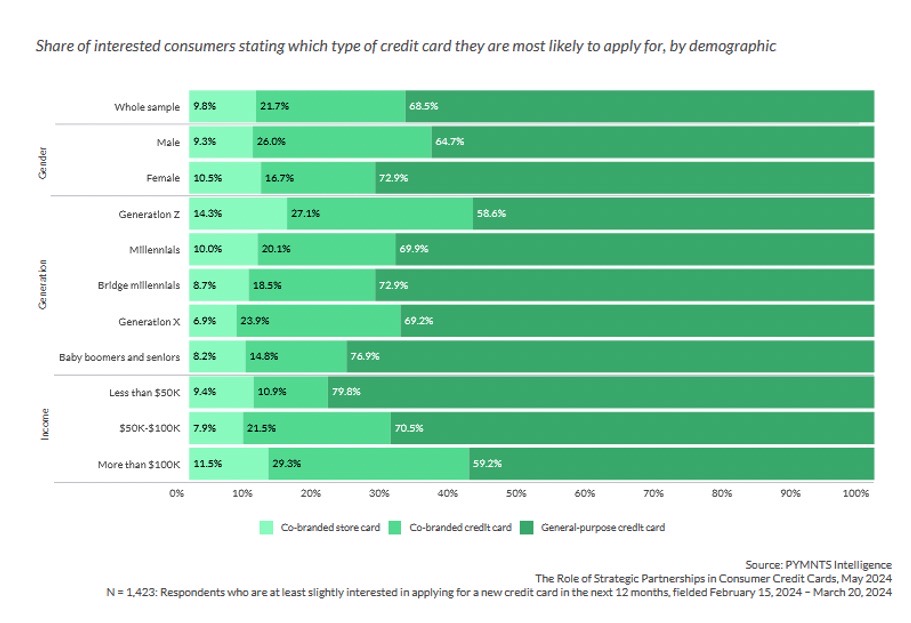

Generation Z is most interested in co-branded store- and credit cards. These financial tools are also the most popular among the people with income over $100K.

Frequent users of the brand may also enjoy higher status or recognition, such as elite status with airlines or hotels, which can come with additional perks, such as free checked bags, priority boarding, hotel upgrades, or special discounts, which are not available to non-cardholders. Besides, some co-branded cards offer special financing options, such as interest-free periods for large purchases made at the partner brand.

Benefits of Co-Branded Credit Cards For Merchants and Banks

While consumers are lured to co-branded credit cards with generous rewards and exclusive benefits, you may wonder what’s in it for the other side of the deal – businesses and financial institutions.

The main perceived benefits of co-branding for institutions include:

- Increased customer loyalty through association with a popular brand. Working with reputable brands can help banks gain credibility and prestige, and merchants enhance brand loyalty and visibility.

- Additional sources of income through fees and interest payments.

- Increasing transaction volume.

- Expanding the customer base through association with new brand partners.

- Enhanced flexibility of available payment solutions.

- Increased digitalisation and personalisation of the checkout experience.

- Integrating innovative technologies such as artificial intelligence and blockchain into loyalty schemes.

- Increase in sales as cardholders are incentivised to spend more to earn rewards.

- Insights into customer spending patterns, preferences, and behaviours, which can be used to tailor marketing strategies and offers.

- Shared marketing and promotional costs between the issuing bank and the merchant.

- Cross-promotions between financial and commercial institutions.

Redseer survey insights revealed that 65% of key decision makers in commerce and banking believe launching a co-branded credit card is a powerful tool for increasing customer loyalty. But is it really so? Do co-branded credit cards influence buyers’ choices and to what extent?

Influence of Co-Branded Credit Cards on Customer Shopping Choices

A 2023 research discovered that consumers are reluctant to use co-branded cards outside of their featured brands, although technically Visa and Mastercard-labelled cards can be used anywhere. The paradox is that consumers tend to use general purpose cards at non-brand locations even when the co-branded card maximises the cashback reward.

One of the possible reasons is that consumers do not fully understand or keep the card’s benefits in mind, focusing solely on brand associations. The average American consumer, for example, has multiple credit cards. When choosing a card to pay with, most users won’t analyse the reward structure or interest rates of each of them in detail, but simply assume the one associated with the brand has the most advantages. It is not always true, though. This logical simplification leads to the fact that consumers are likely to under-use their co-branded card for purchases outside the featured brand.

The survey conducted within the given study revealed interesting results:

- People who have both co-branded and general purpose credit cards use non-brand-specific cards more often (51% vs 31% of monthly spending amount).

- When asked to pay for a haircut, 72% of respondents would use general cards, and only 28% would use a co-branded variant.

- Moreover, people were significantly less likely (61%) to use the reward-maximising card to buy movie tickets when it featured a specific brand than when the reward-maximising card with the same conditions was not branded (84%).

Another issue with the co-branded credit card use is that people treat them more as a way to get rewards than as a borrowing tool. The PYMNTS survey mentioned before showed that 55% of respondents with store cards, and 52% of those with co-branded credit cards pay their full balances off monthly, vs 49% of general-purpose card holders who do the same.

It is partly attributed to the fact that store cards and co-branded cards often have higher interest rates than regular credit cards and may charge retroactive interest if cardholders don’t pay off the balance in time. Another reason is that piling interest eliminates the benefits of the co-branded cards (rewards and cashback). Hence, once the co-branded card carries a balance, it becomes unattractive for future purchases.

At the same time, activation rates of co-branded cards in India, for example, stands at 70% compared with the 50% rate for traditional payment cards. PWC research states that banks witness an increase in the active user base due to co-branded cards. As an illustration, a co-branding programme between a private bank and a popular airline operator activated:

- 16% of customers who never used their cards;

- 10% of dormant customers (shoppers who have engaged with a brand in the past);

- 28% of inactive customers.

These cards also display a 1.2 times higher spending average than general-purpose cards.

What does it mean? People are more eager to get a co-branded card even if they’ll use it on fewer occasions than a general credit card. Besides, once they get it, they tend to spend more, probably to maximise their rewards. These factors do lead to an increasing customer engagement with large brands who issue co-branded cards, found Redseer & Hyperface study.

Final Thoughts

Co-branded credit cards are far from realising their full potential. Their use is limited by brand associations and focuses on rewards rather than credit lines. On the one hand, these financial tools do perform their function of enhancing brand loyalty. They are a tool for merchants and banks to activate dormant customers and expand the client base. Co-branded card owners demonstrate increased engagement and higher spending amounts in an effort to maximise their rewards.

At the same time, most people underestimate the utility of co-branded cards, leveraging them only for brand-associated purchases even when the co-branded card maximises the cashback reward in other purchase categories. This tendency shows an influence of shopping choice on the selection of payment method rather than the opposite. In a scenario, when people are shopping at any other store or public place, they aren’t encouraged to use external co-branded cards. It happens not only due to primary association but also since their benefits outside the brand stores are not prominently advertised. If they were, customers would be more likely to utilise co-branded cards on more occasions.

Finally, co-branded cards remain underutilised due to their often disadvantageous payment terms, e.g. high fees or retroactive interest rates. Since about a half of credit card owners regularly carry a credit balance over to the next billing cycle, co-branded cards are not their payment method of choice. In this case, the influence of co-branding on brand loyalty lessens or eliminates altogether.