As a particularly promising technology, artificial intelligence (AI) is attracting hundreds of billions in US dollars from various global investors. Is this extreme focus on AI starting to impede other important business segments amid the global foreign investment stagnation?

AI Investments in 2024

Businesses across the globe increasingly adopt AI technologies for cost reductions, improved customer experience, automation and revenue growth. In 2023, global investment in artificial intelligence reached approximately over $142 billion, a huge surge from about $92 billion in 2022, largely driven by corporate interest and startup funding.

Machine learning (ML) obtained the highest investment share of 62% out of all AI types and subdivisions. Besides, funding for generative AI surged by nearly eight times compared to 2022, reaching $25.2 billion.

AI-linked stocks have also outperformed both U.S. and global indexes by a dramatic 30% since the beginning of 2023, drawing certain comparisons to the dot-com bubble of the late 1990s. While the U.S. and China continue to lead in the AI investments sector, the EU, UK, Japan, and India are actively increasing their participation.

According to Goldman Sachs Economic Research, global investment in AI technologies will reach $200 billion by 2025. While major global investors are focusing on AI, we cannot help but wonder whether other critical industries and technologies are paid enough attention to? Or are they being ignored at the expense of omnipresent AI? Let’s check upon the overall investment statistics, to understand the full picture.

The State of Global Investing

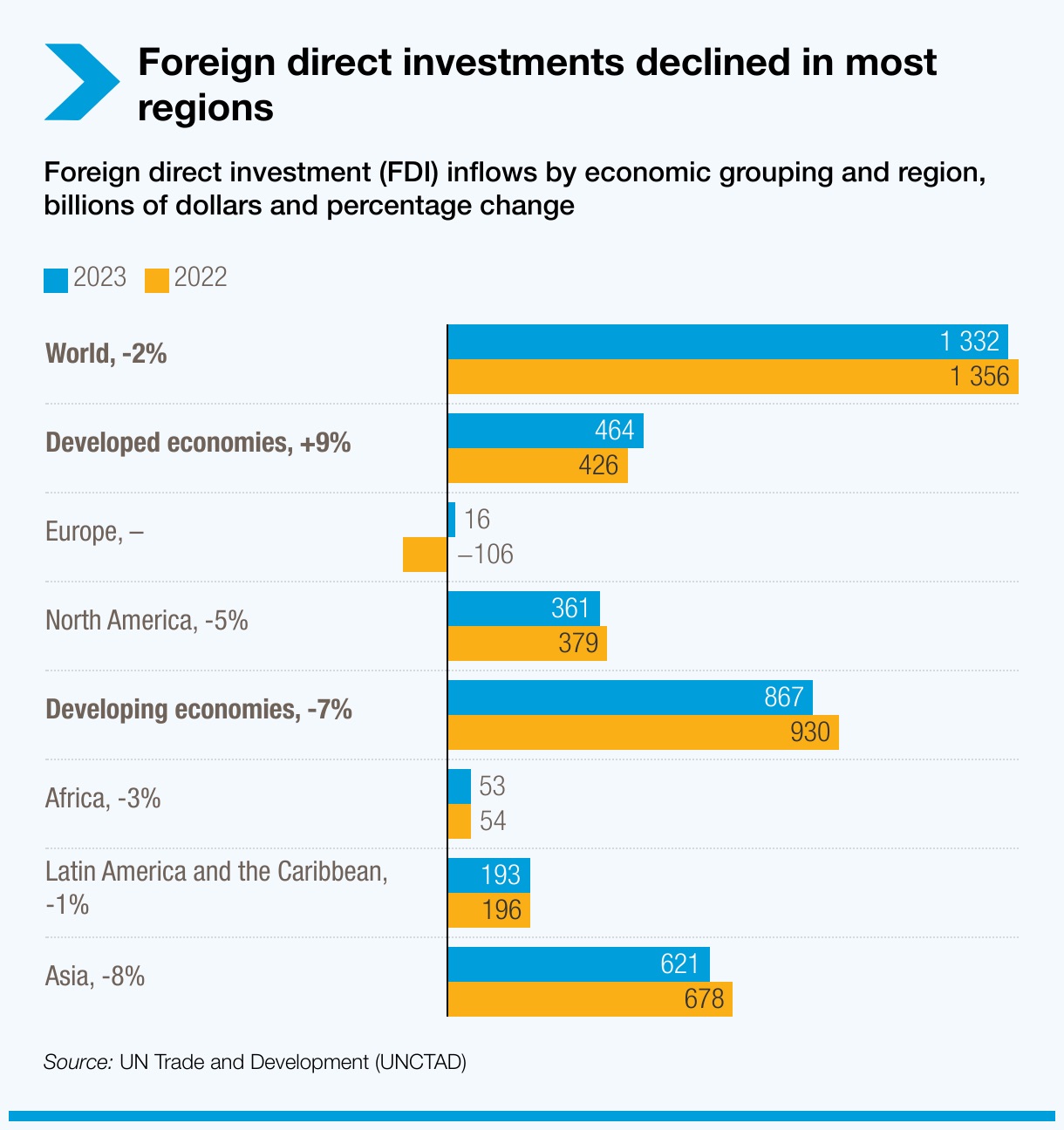

UN World Investment Report 2024 reveals that global foreign direct investment (FDI) fell by 2% to $1.3 trillion in 2023. Moreover, if a few European conduit economies that registered large swings in investment flows are excluded from the analysis, the decline figure exceeds 10%. This slump, driven by overall economic slowdown and rising geopolitical tensions, mainly affected developing countries.

While developed economies saw a 9% investing growth, emerging economies witnessed a 7% decline. Besides, reduced investments led to a 26% fall in international project finance deals, critical for infrastructure investment specifically in the poorest countries. In addition, deficiencies in project finance affected sustainable development, with new funding for Sustainable Development Goals (SDGs) sectors falling over 10%, particularly when it comes to agrifood and water management, which are also critical for emerging economies.

Investments by Sector

On the background of overall decline, let’s see which segments are suffering the most.

Energy

Global energy investment does not reflect the general downward trend and keeps growing steadily. In 2024, it is set to exceed $3 trillion for the first time. The majority of these investments ($2 trillion) are going to clean energy technologies and infrastructure. Nevertheless, that doesn’t mean there are no investment problems in the sector. In fact, there are major imbalances in global energy investment, and Emerging Markets and Developing Economies (EMDE) outside China account for only around 15% of global clean energy spending. To compare, African countries saw mere $22 billion investments in renewable power in 2023, while China alone attracted $359 billion in the same sector.

Healthcare

Healthcare investing underperformed in 2023, giving rise to the neutral outlook for 2024, as the industry continues to face ongoing challenges. While private capital transactions are on the decline in healthcare, private equity (PE) transactions mitigate the effect.

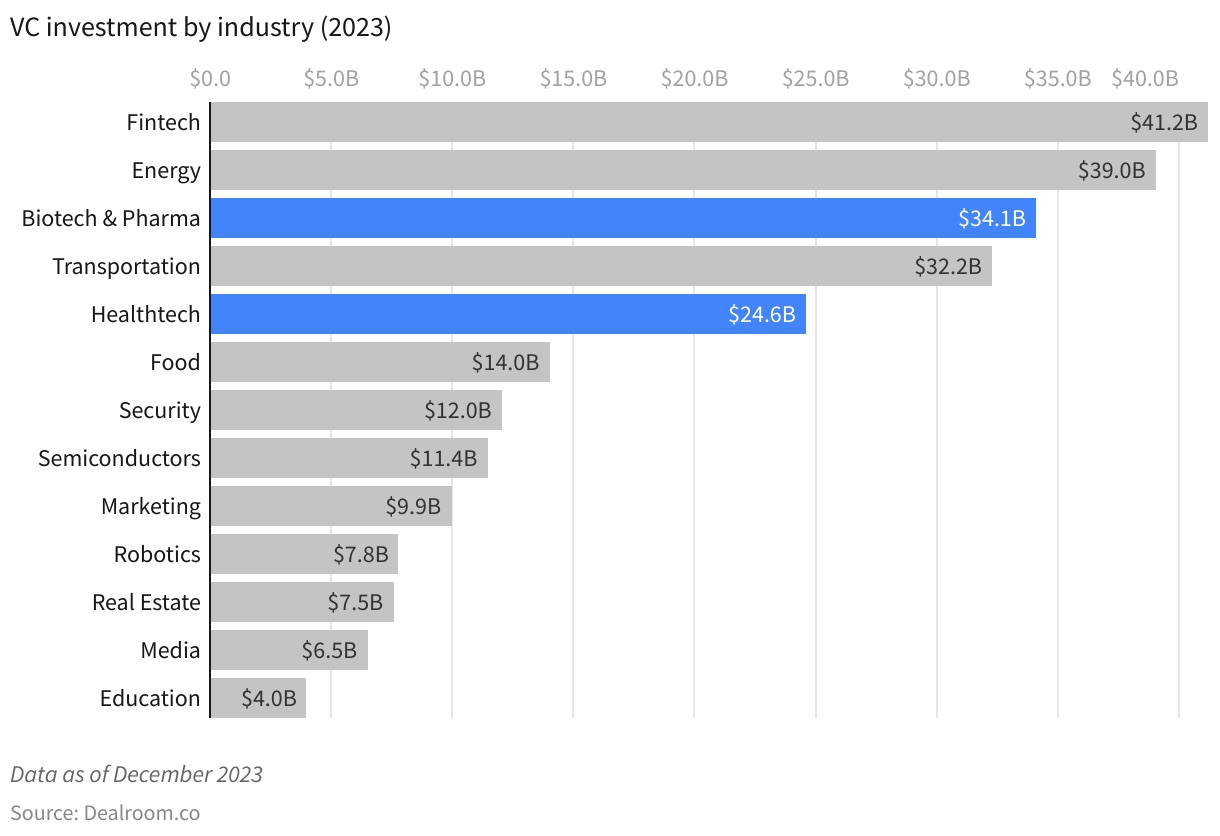

Health technology (healthtech) remains particularly robust. It has seen a surge in investment since the 2020 pandemic. The sector saw $25 billion in venture capital investments in 2023. Healthcare is the fifth biggest VC investment category after fintech, energy, biotech & pharma, and transportation. When combined, healthtech, pharma and biotech, which are all linked to healthcare, are the biggest VC investment category, with $61 billion invested in 2023.

At the same time, since 2021’s peak, healthtech investment has been gradually falling, witnessing a sharp 35% decline last year. Moreover, almost half of wellness and education startups haven’t obtained any more funding since their investment rounds of 2021, as well as 44% of clinical trial enablement, provider operations or alternative care startups.

On the bright side, a recent report by Silicon Valley Bank revealed that venture capital investment in healthtech is on the rise this year, hovering between $4 billion and $4.5 billion per quarter. The total investment amounts are exceeding the pre-pandemic numbers. Although there are very few mega-deal funding rounds worth over $100 million in the sector today, overall deal volume in Q2 reached a record high due to increased investments in early-stage startups, with 42% of health tech rounds being seed rounds.

Education

Education in most countries is largely financed by governments. At the same time, some private capital goes to educational initiatives as well as innovative technologies that facilitate learning. However, lately the sphere has not been investors’ top priority. In fact, investment in edtech is well positioned to hit its lowest total in years.

According to Crunchbase data, startups in the space have raised a little over $1 billion in total funding in 2024 so far. Similar to healthtech, investments in the segment peaked in 2021, with over $22 billion in total funding and have been falling steadily ever since. In 2023, edtech funding has barely reached $3,65 billion, which is much lower than pre-pandemic levels ($8,6 billion in 2019).

Is the Rise of AI Investment the Reason for Other Sectors’ Decline?

While two investing trends are happening at the same time, it does not necessarily mean they are related or one is triggering the other. With AI and more traditional sectors, the situation is not that simple.

On one hand, at some point, investments in AI and investments in other sectors collide. Thus, investors today are increasingly looking beyond funding core AI infrastructure and often focus on practical applications and industry-specific AI solutions.

For example, they may invest in AI-driven diagnostics and drug discovery solutions, which are part of healthcare and biotech ecosystems. Or else, investors may fund edtech startups who spend part of the funding on AI-powered functions which enhance customer experience on their platforms.

At the same time, a clear focus on AI means that startups and established companies which leverage artificial intelligence and machine learning to improve their operations have more chances to be favoured by investors. These are technologies of the future, and you either go with the flow to remain competitive or remain outdated and ultimately fade into oblivion.

Therefore, we see a significant decline in funding for other sectors, particularly traditional tech, fintech and biotech, as well as clean energy in emerging markets. Moreover, various companies are redirecting the majority of their budgets towards integrating AI capabilities. This has led to a slowdown in non-AI technology investments and development, though other technological advancements may be as important as AI in the long-term.

Conclusions

On the background of overall funding decline, a surge in AI investments diverts attention of both businesses and investors from other technological advancements, not to mention non-tech sectors. Though many companies from the critical sectors such as energy, education, or healthcare apply AI in their activities and remain in investors’ spotlight, a whole larger portion of the startups are not related to AI and suffer from the lack of funding. As is evident from the statistics, ESG businesses from the emerging economies as well as large cap healthtech startups are especially affected. Besides, edtech funding is critically low today, though the quality of education directly correlates with the quality of our global future.

Is AI to blame for such insufficiencies? Of course not. AI is just a technology, and a very promising one. It boosts businesses’ productivity and profitability. Thus, investors are simply flocking to the most prospective earnings rather than a vague perspective of doing social good. To do them justice, business owners and managers themselves do acknowledge the power of AI and the benefits it will bring them. So, instead of waiting for investors to turn away from AI prospects, perhaps, it’s wiser to embrace the technology and become part of the winning community. After all, investors now increasingly focus on practical applications and industry-specific AI solutions rather than original AI developers.