Poland’s banks are high scorers when it comes to adapting to the changing financial landscape, embracing new technology, and developing innovative products and services. As a result, the banking sector of Poland has become one of the most dynamic in Central and Eastern Europe, with a number of major players vying for a market share.

Poland has one of the strongest economies in Eastern Europe and is also one of the fastest-growing within the European Union. For instance, in the first quarter of 2025, Poland’s GDP grew by 3.2% year-on-year, significantly outpacing other Central and Eastern European countries, e.g. Romania (0.2%) or Slovakia (0.9%). Its economic strength is supported by stable macroeconomic conditions, affordable labor, and a strategic location, making the country a prime destination for foreign investment.

Not only the national economy but also Poland’s banking sector has experienced impressive growth over the last decade, outpacing most regional peers. The country’s central bank declared a net profit of PLN 20.86 billion (EUR 4.87B) in the first five months of 2025 for the banking sector of Poland, a 20.41% growth year on year.

In this article, we will take a closer look at the major banks operating in Poland, examining their market share, assets, and recent developments. We will also explore some of the challenges facing the sector, including increasing competition from fintech and payment startups, and the need to comply with new regulations. Despite these challenges, Poland’s banking sector remains on a strong footing and is well-positioned to continue its growth trajectory in the years to come.

PKO Bank Polski

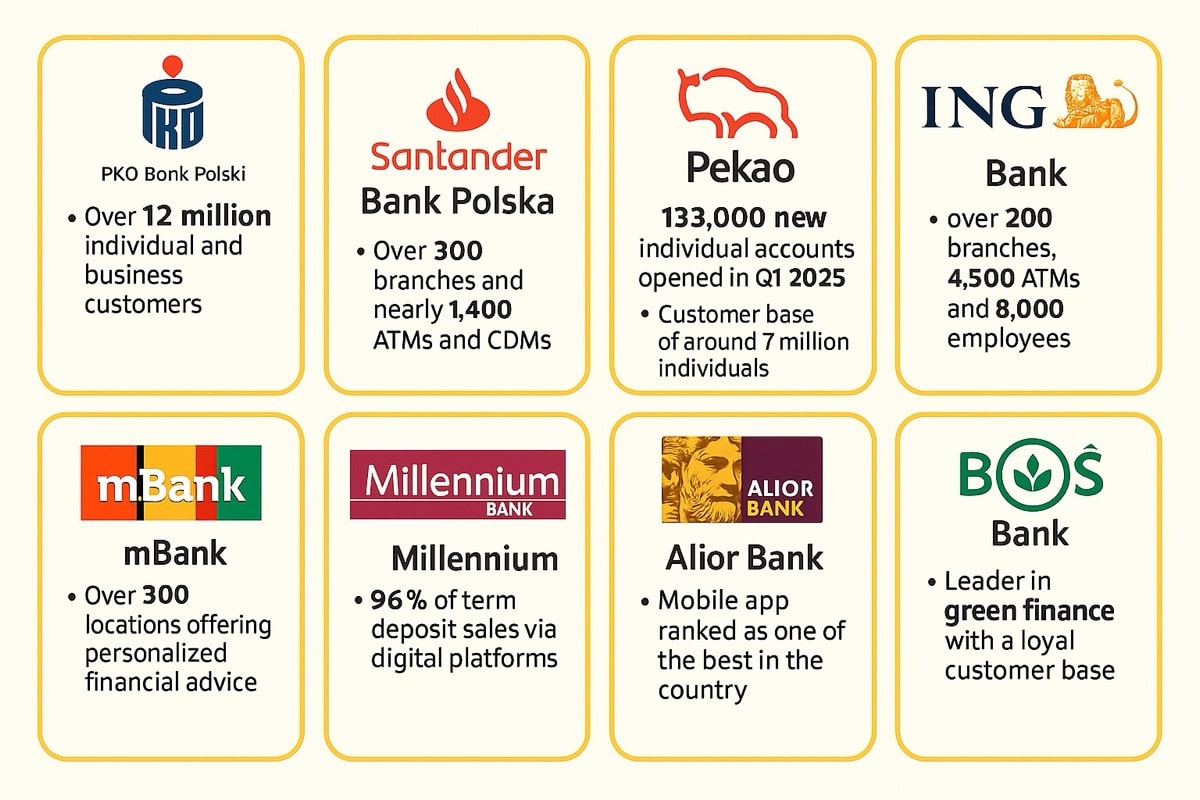

PKO Bank Polski, also known as Powszechna Kasa Oszczednosci Bank Polski, was established in 1919 and has since played a significant role in the development of the Polish financial sector. The largest bank in Poland provides a wide range of financial services, including retail and corporate banking, investment banking, asset management, and insurance services, to over 12 million individual and business customers (one-third of Poland’s residents and one-fifth of local companies) through an extensive network of branches and ATMs throughout the country.

The bank has a strategic focus on central and eastern Europe, but also operates in other parts of Europe. With a highly skilled and motivated workforce of over 25,000 employees, PKO Bank Polski strives to ensure excellent customer service, operational efficiency, strong risk management, and corporate responsibility. Despite its long history, the bank is not a legacy financial institution. It remains dynamic and innovative, actively investing in digital transformation, including AI-driven advisory tools and biometric authentication. Therefore, PKO Bank Polski is well-positioned to remain a leading player in the Polish financial market in the years to come.

Santander Bank Polska

Santander Bank Polska is a leading bank in Poland, maintaining its resilience for over a century, as its roots date back to 1857. The bank is committed to providing its customers with a wide range of high-quality banking products and services, including personal and business accounts, loans, credit cards, insurance, and investment services. Over the years, Santander Bank Polska has built a strong presence in Poland, with a vast network of over 300 branches and nearly 1,400 ATMs, CDMs, and Dual Function Machines, making banking convenient and accessible to all.

In 2018, Santander Group acquired the bank, bringing in a vast international network and expertise. This has allowed Santander Bank Polska to further improve its services and offer its customers more diverse and innovative products, like remote account opening via facial biometric authentication, e-wallet support, mSignature for transaction authorization, mobile insurance, blockchain-powered instant international transfers, and more. The bank is dedicated to responsible and sustainable banking practices, too, as seen from its efforts to support the growth and development of its customers. Santander Bank Polska is more than just a bank; it’s a partner in progress for its customers, providing them with the tools and support they need to achieve their financial goals.

Pekao Bank

Pekao is one of Poland’s largest and oldest financial institutions, with a century-long history of providing financial services to individuals and businesses throughout the country. The bank offers a wide range of banking solutions, including personal and business banking, investment banking, and asset management services.

Pekao has a diverse customer base of around 7 million individuals, small and medium-sized enterprises, and large corporations. About half of them are active mobile banking users, reflecting the bank’s strong commitment to digital transformation, which is a central pillar of its 2025–2027 strategy. Pekao also illustrates high acquisition rates, having opened 133,000 new individual accounts in Q1 2025 alone.

The bank has a strong reputation for providing high-quality financial products and services to its customers and has consistently introduced new products and services to meet their evolving needs. Today, the institution aims to double the number of its AI-powered solutions, enrich its IT infrastructure with more cloud-based systems, and expand interactive capabilities for customer service.

Pekao is committed to responsible and sustainable banking practices and has implemented various initiatives to promote environmental, social, and governance (ESG) factors in its operations. Pekao is a highly respected and trusted financial institution with a reputation for providing excellent financial services to customers in Poland.

ING Bank Śląski

ING Bank Slaski is one of the biggest banks in Poland with over 200 branches, 4,500 ATMs, and 8,000 employees across the country. As a subsidiary of the Dutch multinational banking and financial services corporation, ING Group, the bank has access to global expertise and resources, which allows it to provide high-quality banking services to its clients.

ING Bank Slaski is committed to promoting financial education and literacy in Poland and offers various programs and initiatives aimed at helping its customers make informed financial decisions. The bank has received numerous awards and recognitions for its innovative products, customer service, and corporate social responsibility initiatives.

ING Bank Slaski is a major participant in the Polish banking sector, with a strong emphasis on innovation and digitalization. The bank is constantly working on new solutions to meet its customers’ evolving needs. Since 2017, ING has run the Innovation ING Lab, a dedicated creative space and accelerator program designed to co-create breakthrough banking products directly with customers at every stage.

Its mobile banking app has been commended for its advanced features, including biometric authentication, personalized financial insights, and immediate payments. ING also offers diverse payment options, including a currency account and a payment gateway for businesses. The bank provides excellent services and cutting-edge solutions to its customers while also contributing to the growth of the broader Polish economy.

mBank

mBank is a Polish bank that was founded in 1986 as BRE Bank and later rebranded as mBank in 2013. Over this time, the institution has developed into a universal bank serving retail, business, corporate, and private banking clients. It is a subsidiary of Commerzbank AG and is headquartered in Warsaw.

The bank is known for its innovative approach to banking, with a focus on providing digital solutions that simplify its customers’ lives and help them achieve their financial goals. To this end, mBank has invested heavily in technology and offers a mobile banking app that has received widespread acclaim for its user-friendly interface, speed, and security. The institution also has a junior app to attract young customers. Moreover, mBank strives to provide the best end-to-end digital banking experience for its corporate customers in Poland, targeting 90% of corporate accounts to be opened digitally.

The bank has over 300 locations across Poland that offer personalized financial advice and support, including traditional and corporate branches, light branches in shopping malls, mKiosks, financial centres, and agency service points.

Its product offerings include savings and investment products, loans, mortgages, insurance, and credit cards. In addition to its focus on customer-centricity, mBank is committed to promoting sustainable development and environmental protection. It has implemented various initiatives aimed at reducing its carbon footprint, supporting renewable energy projects, and promoting green financing. As a member of the United Nations Global Compact, the bank adheres to its principles on human rights, labor, environment, and anti-corruption. Overall, mBank is considered one of the most successful banks in Poland, with a strong reputation for excellence in banking and finance.

Bank Handlowy w Warszawie

Bank Handlowy w Warszawie, also known as Citi Handlowy, is a large financial institution in Poland. The bank has been around since 1870, being one of the oldest financial institutions in Europe, and has managed to survive political turmoil and world wars. It became part of Citigroup, a global financial services company, in 2001. However, in May 2025, Citi Handlowy announced an agreement to sell its consumer banking business in Poland to VeloBank S.A. and focus on institutional and corporate banking.

Until the completion of the transfer (expected about mid-2026), the bank provides a range of financial products and services to individuals, companies, and organizations, with an emphasis on tailored solutions. These include traditional banking services such as savings accounts, loans, and mortgages, as well as investment banking, asset management, and treasury and trade solutions.

Bank Handlowy w Warszawie has a strong presence throughout Poland, with a network of branches and ATMs in major cities and towns, as well as operations in several other European countries. Through its affiliation with Citigroup, Bank Handlowy supports clients with operations across Europe and globally, connecting Polish businesses to international markets. Its innovation, customer service, and dedication to providing high-quality financial solutions have earned it a reputation as a reliable and trustworthy bank in Poland.

BNP Paribas Bank Polska

BNP Paribas Bank Polska is a leading bank in Poland, with a long history of financial stability and a strong presence across the country. The bank offers a wide range of financial products and services, including retail banking, corporate banking, investment banking, asset management, and insurance. It is part of the global BNP Paribas Group, which provides the bank with access to world-class expertise and resources.

BNP Paribas Bank Polska is committed to enhancing the customer experience through digital transformation and investing in new technologies. The bank has launched innovative products and services, such as mobile banking, online investment and application platforms, digital customer service model in branches, Axepta – a payment gateway for e-commerce customers, remote identity verification tools, AI-driven integrated CRM system for retail customers, and more, to meet the changing needs of its customers. It is highly respected in Poland’s financial sector and is dedicated to providing high-quality financial services that support the growth and development of the Polish economy.

Bank Millenium

Bank Millennium is a well-established bank in Poland, founded in 1919. It has a wide network of branches and ATMs throughout the country, making it easily accessible to customers. The bank offers savings accounts, loans, credit cards, insurance, and investment options to its over 3.18 million active retail clients. Its online banking platform is highly rated for its convenience and user-friendly interface.

Bank Millennium has a reputation for providing reliable and innovative banking services. The bank’s experienced and knowledgeable staff are dedicated to providing personalized advice and assistance to help customers make informed financial decisions and achieve their goals. In recent years, Bank Millennium has also invested heavily in digital technology to provide cutting-edge banking services that meet the evolving needs of its customers. The bank’s digital channels handle the majority of transactions today, with 96% of term deposit sales and 82% of loan sales occurring via digital platforms. With a focus on innovation and customer service, Bank Millennium is well-positioned to continue its growth and success in the future.

Alior Bank

Alior Bank is one of the leading Polish banks that offers a range of financial services to its clients. Founded in 2008 and headquartered in Warsaw, Alior Bank’s focus is on delivering innovative and customer-centric solutions to its customers. They provide personal and business accounts, loans, mortgages, and insurance products. Alior Bank has a strong digital focus, with its mobile app ranked as one of the best in the country. They have also developed a fully digital account called the “Smart Account,” which offers features such as automatic categorization of transactions and real-time budget tracking.

Alior Bank is dedicated to advancing financial education and providing assistance to local communities through a range of corporate social responsibility programs. The bank has won numerous awards for excellence in banking and customer service, including being named “Best Bank in Poland” by Global Finance Magazine. Though it has faced some profitability challenges recently, Alior Bank maintains a solid capital position and an improving risk profile, while also continuing to attract and retain customers through innovative products and services.

Bank Ochrony Środowiska S.A.

BOS Bank, also known as Bank Ochrony Srodowiska, is a banking institution founded in 1990 in Warsaw, Poland. It was initially established to support environmental projects in Poland, but it has since expanded to offer a range of financial products and services, including personal and business banking, loans, investments, and insurance.

BOS Bank has a strong presence in the Polish market and operates through a network of branches and ATMs throughout the country. The bank is committed to promoting sustainable economic growth in Poland and is a leader in the field of green finance, offering preferential loans to various environmental projects such as renewable energy, waste management, and clean technology. BOS Bank also implements initiatives to reduce its environmental footprint, supports employee volunteerism, and community engagement programs to promote environmental awareness and sustainability. The bank combines a focused physical presence with digital solutions to serve its niche market effectively. Its commitment to responsible banking and sustainable development has helped BOS Bank establish itself as a leader in green finance in Poland with a loyal customer base.

This article was updated on July 6, 2025, to correct minor errors and include up-to-date bank information, logos, and the current economic outlook for Poland.