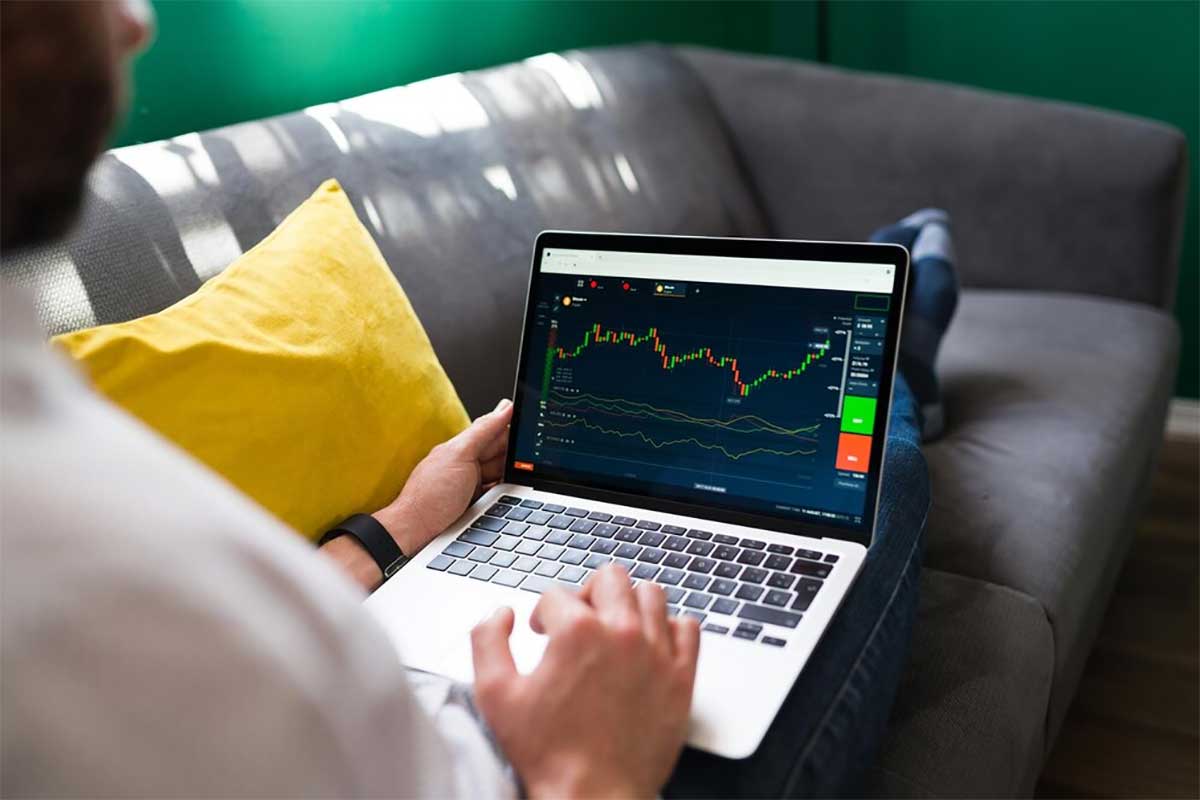

Cryptocurrency trading has become popular as blockchain technology integrates with financial systems. Many brokers now offer platforms that make it easier for traders to buy, sell, and profit from digital currencies.

One such platform is TradingView, which encourages users to “look first, then leap,” meaning traders should research and understand each trade before executing it. The saying hints at the importance of having sound trading strategies and risk management techniques, which are critical to consistently making money when trading any asset class.

The Relative Strength Index and Bollinger Bands Strategy

Technical indicators are popular tools traders use to identify potential entry and exit points in the market. The Relative Strength Index (RSI) and Bollinger Bands are commonly used indicators. When used together, these indicators can provide traders with extra confirmation of emerging trends and possible reversals on TradingView app charts.

The RSI calculates the magnitude and velocity of recent price changes to evaluate oversold or overbought properties in an asset. Readings above 70 indicate overbought levels typically associated with downtrends, while readings below 30 signify oversold levels that may precede uptrends.

Bollinger Bands plot standard deviation channels above and below a simple moving average to gauge volatility and price extremes. The upper band acts as resistance in a downtrend, while the lower band serves as support in uptrends. Price reaching the upper or lower bands can signal pending reversals.

Traders adopting this strategy look for RSI to reach overbought or oversold levels and confirm the emerging reversal with Bands. If the RSI exceeds 70 while the price touches the upper Bollinger band, a short position may be taken. A long position can be considered when the RSI falls below 30, and the price hits the lower band.

Common exits include taking profits halfway between the Bands or when the price reaches the opposite Band. Stopping out above or below nearby support or resistance also works. The RSI crossing 50 can act as another exit trigger to lock in gains from the reversal.

Moving Average Crossovers

Moving averages (MAs) are versatile indicators traders often use to identify new trends and potential reversals. One common technique involves looking for bullish and bearish crossovers.

A moving average smooths out price action by averaging closes over a set timeframe, creating a dynamic support and resistance level. Shorter MAs react more quickly to recent price shifts, while longer MAs focus on the bigger picture.

When a faster MA crosses above a slower MA, it signals prices are now in an uptrend. This bullish crossover suggests that the upside momentum is accelerating. Traders may go long at the crossover point or on a throwback to the MAs.

Conversely, when the faster MA crosses below the slower MA, it indicates a new downtrend as downside momentum picks up. This bearish crossover can trigger short trades, especially if it aligns with previous resistance.

For example, combining a 50-day MA with a 200-day MA is common. If the 50-day MA crosses above the 200-day from below, that golden cross indicates a strengthening uptrend. A prevailing downtrend is confirmed if the 50-day drops below the 200-day death cross.

Breakout Trading

Breakouts are key moments in technical analysis that occur when price penetrates a key support or resistance level, signaling potential continuation of the prevailing trend. Capitalizing on breakouts can be lucrative but requires confirmation filters to avoid false signals.

To trade breakouts effectively, first, identify significant support and resistance levels where the price has historically bounced higher or lower multiple times. Once the price breaks above resistance or below support with strong momentum beyond the boundary, a long or short trade can be taken, assuming the move aligns with the dominant trend.

Rather than entering on the initial breakout, a wise alternative is waiting for throwbacks or pullbacks to the breached level to enter. This confirms that previous resistance or support will now become support/resistance. Traders can enter long on pullbacks to former resistance, stopped below the last swing low.

Ideally, exit breakout trades at logical targets like the next historic price barrier. Trailing stops below rally highs or above pullback lows also maximizes upside. Always use stop losses placed conservatively behind significant swing points to limit downside.

The MACD Strategy

Crypto traders use the Moving Average Convergence Divergence (MACD) indicator to identify momentum and potential trend changes. Its key components are two exponential moving averages (EMAs) and a histogram.

When the faster EMA crosses above the slower EMA, it signals rising momentum. When it crosses below, it indicates falling momentum. The histogram visualizes the difference between the two lines. Above zero shows accelerating prices, and below zero decelerating prices.

Traders use MACD for three strategies: Crossovers entering positions when momentum shifts, Histogram Reversals anticipating impending shifts based on historical trends, and Zero Crosses to trade pullbacks when the EMAs cross the midpoint.

While MACD strategies originated for stock trading, crypto’s high volatility makes them well-suited to digital assets. The indicator can spotlight subtle trend changes in any timeframe. Success depends on skill in interpreting the interplay of its lines.

Fortunately, MACD signals are visually intuitive:

- Buy when the MACD line crosses above its signal line.

- Sell when it crosses below.

- Wait for confirmation if the lines nest tightly together or cross frequently.

Identifying Profitable Trades With Popular Indicators Using TradingView

The leap toward consistent profits requires the best technical analysis tools and strategies. TradingView provides traders with customizable indicators and tools for in-depth market analysis. The moving average crossover, breakout trading, RSI plus Bollinger Bands, and MACD strategies outlined in this guide represent demonstrated techniques to identify high-profitability trades.