When considering financial solutions in Finland, understanding the nuances of loans is essential. Whether you’re a resident or an expatriate, navigating the Finnish loan market can be complex. This article provides a detailed overview of loans in Finland, covering various online loan services, their pros and cons, and an interesting comparison between a dice probability calculator and a loan interest calculator.

Online Loan Services in Finland

Ferratum offers quick and easy online loans with minimal paperwork. Their loans are ideal for short-term financial needs.

Pros:

- Fast approval process

- No collateral required

Cons:

- High-interest rates for short-term loans

- Limited loan amounts

Ferratum also provides a user-friendly loan interest calculator that helps you understand the total cost of the loan. Much like a dice probability calculator used in gaming, this tool helps you predict and plan for future financial obligations, making the loan application process more transparent.

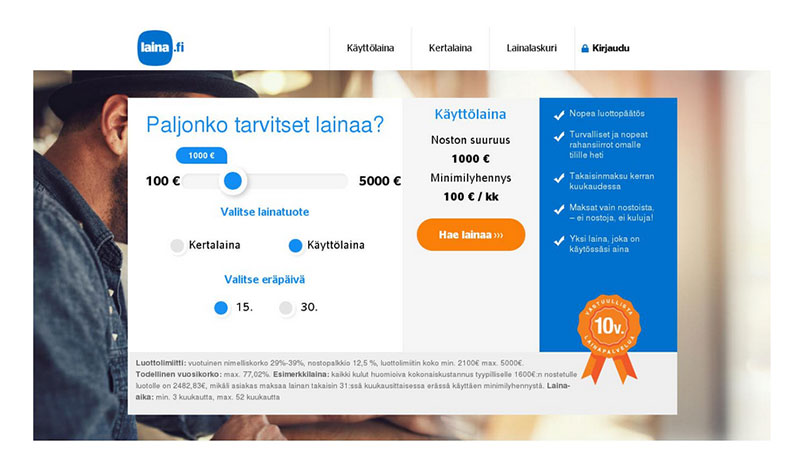

Laina.fi

Laina.fi provides a range of loan options, from personal loans to business loans. They are known for their competitive interest rates and flexible terms.

Pros:

- Competitive interest rates

- Flexible loan terms

Cons:

- Requires good credit history

- Longer approval process compared to some competitors

Laina.fi’s loan calculator helps you compare different loan offers, ensuring you choose the best option for your financial situation. This is similar to how a dice probability calculator aids in gaming strategy, providing clarity and better decision-making.

Nordea

Nordea is one of the largest banks in Finland, offering a variety of loan products, including mortgages, personal loans, and student loans.

Pros:

- Wide range of loan options

- Low-interest rates for mortgages and student loans

Cons:

- Strict eligibility criteria

- Longer approval process

Nordea’s comprehensive financial services include advanced loan calculators that detail your potential repayments. Like using a dice probability calculator in a game, these tools help you understand your financial commitments, making it easier to manage your budget.

OP Financial Group

OP Financial Group offers comprehensive loan services, including personal loans, business loans, and home loans. They also provide financial advice to help you choose the right loan.

Pros:

- Comprehensive loan options

- Access to financial advisors

Cons:

- May require collateral for certain loans

- Lengthy application process

OP Financial Group’s loan interest calculator is a vital tool for prospective borrowers. It allows you to simulate different loan scenarios, similar to how a dice probability calculator helps gamers anticipate outcomes, enhancing your ability to make informed financial decisions.

Fellow Finance

Fellow Finance is a peer-to-peer lending platform that connects borrowers with individual lenders. This service can offer more flexible loan terms and rates.

Pros:

- Flexible loan terms

- Potential for lower interest rates

Cons:

- Variable interest rates

- Requires good credit history

Fellow Finance’s platform includes detailed loan calculators that function like a dice probability calculator, offering transparency and helping you understand the risks and benefits of different loan offers.

Types of Loans Available in Finland

Personal loans are one of the most common types of loans in Finland. They can be used for various purposes, such as home renovations, buying a car, or covering unexpected expenses.

Pros:

- Flexible usage

- Fixed interest rates

- No collateral required

Cons:

- Higher interest rates compared to secured loans

- Stringent eligibility criteria

Home Loans

Home loans, or mortgages, are designed for purchasing property. These loans typically have lower interest rates since they are secured by the property itself.

Pros:

- Lower interest rates

- Long repayment terms

Cons:

- Requires collateral

- Long approval process

Student Loans

Student loans are specifically for covering educational expenses. These loans often come with favorable terms, such as low-interest rates and flexible repayment options.

Pros:

- Low-interest rates

- Flexible repayment plans

Cons:

- Limited to educational expenses

- May require a guarantor

Business Loans

Business loans are tailored for entrepreneurs looking to start or expand their businesses. These loans can be used for purchasing equipment, hiring staff, or other business-related expenses.

Pros:

- Can help grow your business

- Various loan options available (e.g., equipment loans, working capital loans)

Cons:

- Requires a solid business plan

- Potential for high-interest rates

Payday Loans

Payday loans are short-term loans designed to cover immediate expenses until your next paycheck. They are known for their quick approval process.

Pros:

- Quick approval

- Easy access

Cons:

- Extremely high-interest rates

- Short repayment period

Conclusion

Navigating the loan landscape in Finland requires a good understanding of the various options available, their pros and cons, and the tools at your disposal. Whether you’re considering a personal loan, a mortgage, or a student loan, knowing the benefits and drawbacks can help you make an informed decision. Additionally, leveraging calculators, whether for loan interest or dice probabilities, can provide valuable insights and aid in making well-informed choices.

By understanding the intricacies of loans in Finland and utilizing the right tools, you can better manage your financial future and make decisions that align with your goals and needs.