Statistics say private cryptocurrencies and stablecoins were used for less than 0.2% of global e-commerce transaction value in 2022. At the same time, global cryptocurrency ownership rates have been steadily increasing for the past few years. Besides, the growing number of merchants are adding crypto to acceptable payment methods. Something just doesn’t add up. What is the nature of this paradox? This article aims to discover.

Crypto Checkout Peculiarities

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on blockchains. The latter record transactions across multiple computers and get them verified by network participants in a way that ensures security and transparency. Most cryptocurrencies are decentralised, so that no single entity like a central bank or other governmental administrator controls them.

Cryptocurrencies are used for various purposes, e.g.:

- Peer-to-peer transactions: Direct transfer of value between user accounts/wallets without banks or payment processors involved.

- Investment: Many people buy cryptocurrencies as speculative assets, earning profit if their value increases.

- Smart contracts: Some cryptocurrencies like Ethereum enable developers to create decentralised applications and smart self-executing contracts with the terms of the agreement directly written into code. They automatically execute and enforce the terms of the contract when predetermined conditions are met.

However, it is e-commerce payments, which contribute to one-fifth of the total retail sales globally, where cryptocurrencies are rarely used.

Cryptocurrency transactions can be accepted by a merchant directly, with the digital wallet integrated into the retailer’s payment ecosystem using APIs, or through a third-party aggregator, which helps convert the transaction to U.S. dollars, EUR, GBP or other local currencies.

Many businesses use cryptocurrency payment gateways (e.g. BitPay, Coinbase Commerce, CoinGate) to process payments at checkout. These services work similarly to traditional payment processors like PayPal or Stripe but handle cryptocurrencies instead.

Major e-commerce platforms, such as Shopify, WooCommerce, or Magento, offer plugins or extensions that integrate cryptocurrency payments at checkout. Meanwhile, bricks-and-mortar businesses install crypto-enabled POS systems that can process cryptocurrency payments. Those include physical devices or apps that generate wallet addresses and QR codes for related crypto wallets.

Statistics of Crypto Acceptance in E-Commerce

A recent study “Paying With Cryptocurrency: What Consumers And Merchants Expect From Digital Currencies,” by PYMNTS and BitPay revealed that nearly half (46%) of merchants report having incorporated cryptocurrency into their accepted payment options, though the majority of cryptocurrency transactions they witness are conducted through crypto-friendly digital wallets. Only 23% report accepting payments via crypto-native wallets.

Bigger businesses are more willing to deal with the innovative payment method, with 85% of retailers with more than $1 billion in annual online sales say they accept payments from platforms that facilitate crypto-based transactions, such as PayPal and Venmo.

Notably, most merchants who already deal with crypto payments find it promising. Moreover, 95% of businesses that currently accept crypto plan to enhance or expand their crypto acceptance capabilities with necessary payment platform upgrades that will integrate cryptocurrency more effectively as a payment option.

It is estimated that over 15,000 businesses across the globe accept Bitcoin as one of the most popular crypto payment options. A large share (about 2,300) of them are located in the U.S. where about 15% of the population own crypto.

In 2022, nearly 75% of retailers planned to accept either cryptocurrency or stablecoin payments within the next two years. At the same time, over 50% of respondents preferred to have third-party payment processors convert digital currency into fiat, without actually owning the cryptocurrency initially used for payment.

The leaders in crypto acceptance among industries include gaming and gambling, tourism, retail, food, and banking. About 50% of all Bitcoin transactions take place in online games or at iGaming resources.

As for more traditional industries, some of them are more willing to accept Bitcoin and other cryptocurrencies as a form of payment (e.g. 80% of retail and grocery, and luxury goods sellers are ready to embrace crypto), while others like hospitality, travel, and automotive sectors are not that eager to deal with this innovative payment instrument (25% each).

For some sectors, the willingness to provide the payment offering far exceeds the demand (e.g. financial services and healthcare – 63% vs 0%). Meanwhile, other sectors like travel display another supply-demand mismatch – 64% of consumers would like to see such a payment option, while only 25% of providers are ready to consider the payment method expansion with crypto. Hospitality and automotive industries display similar imbalance.

Issues With Embedding Crypto in E-Commerce Checkouts

Retailers interested in adopting cryptocurrency recognise several challenges in the making. Nearly 90% identified the complexity of adapting their current financial infrastructure to support various digital currencies as the biggest hurdle. The changes can also be too costly.

Security concerns around payment platforms are among the top barriers to adoption too, followed by worries about the evolving regulatory environment and the volatility of the digital currency market. Retailers operating on thin profit margins are particularly hesitant to accept a form of payment that can significantly change its value within short time periods. At the same time, they may leverage stablecoins, that have their value pegged to fiat currencies.

Over 50% of the retailers surveyed by Deloitte agreed that specific regulations need to be established for crypto payments, starting from national guidelines for holding digital assets to clearer tax implications for crypto use, and the ability to store digital currencies in traditional bank accounts.

Do Customers Want to Pay With Crypto?

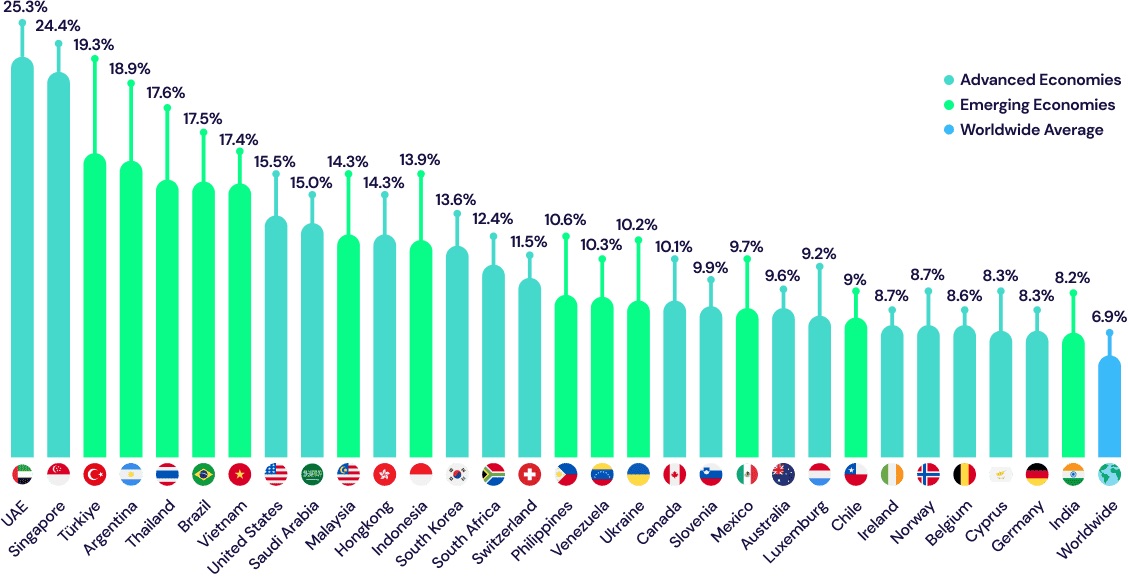

As of 2024, average global cryptocurrency ownership rates have increased to 6.8%, with over 560 million crypto users worldwide. According to a crypto payment company Triple A, the largest share of crypto owners globally can be found in the UAE (25,3%) and Singapore (24,4%). In dozens of countries the cryptocurrency ownership exceeds the average global rate. About 65% of all crypto owners, which is almost 365 million people, want to use their crypto assets for regular payments.

Source: Triple A

At the same time, only 7% of US adults held or used cryptocurrency in 2023, either as an investment tool or for payments, according to data from the Federal Reserve. Moreover, only 2% used crypto for payments, with 1% attributed to P2P transactions and another 1% to paying for purchases or services.

Global data gathered by Statista in 2022 suggested that cryptocurrencies of different types were used only for 0.2% of global e-commerce transaction value in 2022. In Australia, the results are similar. Only 2% of respondents in the 2023 survey used cryptocurrency as a payment method.

Why People Use Crypto for Financial Transactions

The study from the U.S. Federal Reserve showed that the main reasons for paying or making money transfers with crypto were:

- it was the preferred choice by the other party in a transaction (29%);

- transfer speed (18%);

- privacy (16%);

- lower transaction costs (13%);

- safety (7%);

- lack of trust in banks (4%).

Notably, U.S. wealthy adults with income of $100,000 or more were more likely to hold cryptocurrency as an investment, whereas those with income less than $25,000 were more likely to use cryptocurrency for financial transactions.

Interestingly, the majority of Gen Z adults (54%) and Millennials (55%) surveyed by Coinbase agree that cryptocurrency and blockchain are the future, whether or not they own crypto themselves.

Besides, 83% of retailers also expect consumer interest in digital currencies to increase in the very near future. Nearly half of them believe adding crypto to the checkout options will improve customer experience and increase their customer base.

Summing Up the Full Picture

Gathering all those pieces of informational puzzle allows us to see a full picture of cryptocurrency payments in e-commerce. The first striking detail is that both consumers and retailers are enthusiastic about crypto and its future. Both sides see the benefits of crypto payments but they are still far from mainstream use.

In most countries of the world, crypto ownership is less than 10%, which is too little compared to fiat. Even fewer people use crypto for payments, as the majority of crypto owners are interested in keeping their Bitcoins or altcoins as a form of potentially profitable investment. It is not surprising, considering the history of Bitcoin price growth and future forecasts.

All that leaves us with less than 400 million people who are currently willing to use crypto for payments. What is this number compared to approximately 2.64 billion people who shop online worldwide, or 8.2 billion people who live on this planet altogether?

The most non speculative type of crypto are stablecoins. However, they are used by less than 30 million people and have gained some dubious reputation after the Terra (UST stablecoin) collapse in May 2022.

So, the demand for crypto payments in e-commerce is actually quite low, especially in countries with more or less developed crypto regulation. In emerging markets, where crypto adoption is often higher due to economic instability, such transactions are not yet regulated or not allowed altogether.

Considering the complexity and often high cost of integrating crypto in the existing payment infrastructure, retailers don’t rush to do it. We might see some rise in crypto adoption among the high-ticket sectors, like luxury goods, vehicles, or even property since high-net-worth clients are more likely to have crypto in their portfolios. However, grocery stores are not as quick to chase crypto opportunities, though people with lower incomes are statistically more inclined to use crypto for payments.

There is also a certain mismatch between the segments where people would like to pay with crypto and the ones where it is technically possible. Overall, crypto is still a nascent financial technology, which raises more questions from both users and merchants than answers are available. Both sides of e-commerce deals require more education and awareness about crypto as a means of payment, as well as some regulatory clarity on the issue. Knowledge about the benefits of crypto is power and key to further global adoption which is sure to come.