Over 100 anti-ESG bills have been introduced across various U.S. states this year, as one of the world’s leading economies is refocusing its priorities from sustainability towards profitability. In times when ESG disclosures are not mandated and many financial institutions are greenhushing their sustainability-linked efforts, should payment providers still bother about the environmental outcomes of their activities?

The fleeting nature of U.S. politics is especially evident in its ESG attitudes. Being one of the richest and most influential countries in the world, the United States has contributed significantly to the foundation of ESG reporting and supporting mechanisms, particularly through generous investments and early standard-setting bodies. However, today, the United States is rolling back its involvement with sustainability-linked initiatives, setting its eyes on financial success rather than planet care. Even though most of the radical anti-ESG bills do not get to be laws, the U.S. legislation in general has notably weakened requirements for ESG disclosure.

Many financial and payment companies decide to greenhush (retreat from publicly sharing) their ESG efforts due to potential political and stakeholder backlash, even if they keep sustainability commitments internally. At the same time, they increasingly face dilemmas of tailoring ESG strategies depending on the target market, as, in most regions, corporates are mandated to disclose climate-related information, aligning with global standards.

Sustainability-Linked Payments Explained

Sustainability-linked payments are part of a wider movement to connect the way we pay with clear, measurable environmental, social, and governance (ESG) goals. In practice, this means the payment terms change based on specific sustainability outcomes, like carbon reduction targets, supply chain transparency, or social impact milestones.

For example, a green fintech solution might reward merchants for using sustainable transaction systems or provide some benefits to individual shoppers who make eco-friendly purchases. A bank could lower processing fees for businesses that meet ESG in payments criteria, while e-commerce marketplaces may integrate carbon-offset contributions into checkout. Payments industry ESG initiatives are also exploring impact-driven payment models where part of the fee is directed toward climate or community projects.

These innovations fit squarely within sustainable finance trends, moving beyond symbolic “green” marketing toward impact-driven payment models that aim to deliver tangible outcomes. By linking payment infrastructure with ESG metrics, the fintech sector isn’t just moving money but promoting corporate and personal responsibility, nudging both merchants and consumers toward choices that benefit people and the planet.

Benefits of Green Payment Processing Solutions

As any eco-friendly initiative, sustainability-linked payments and related financial products first and foremost benefit the planet. However, alongside their ultimate goal, green fintech solutions bring a couple of bonuses to all the sustainable transaction systems participants.

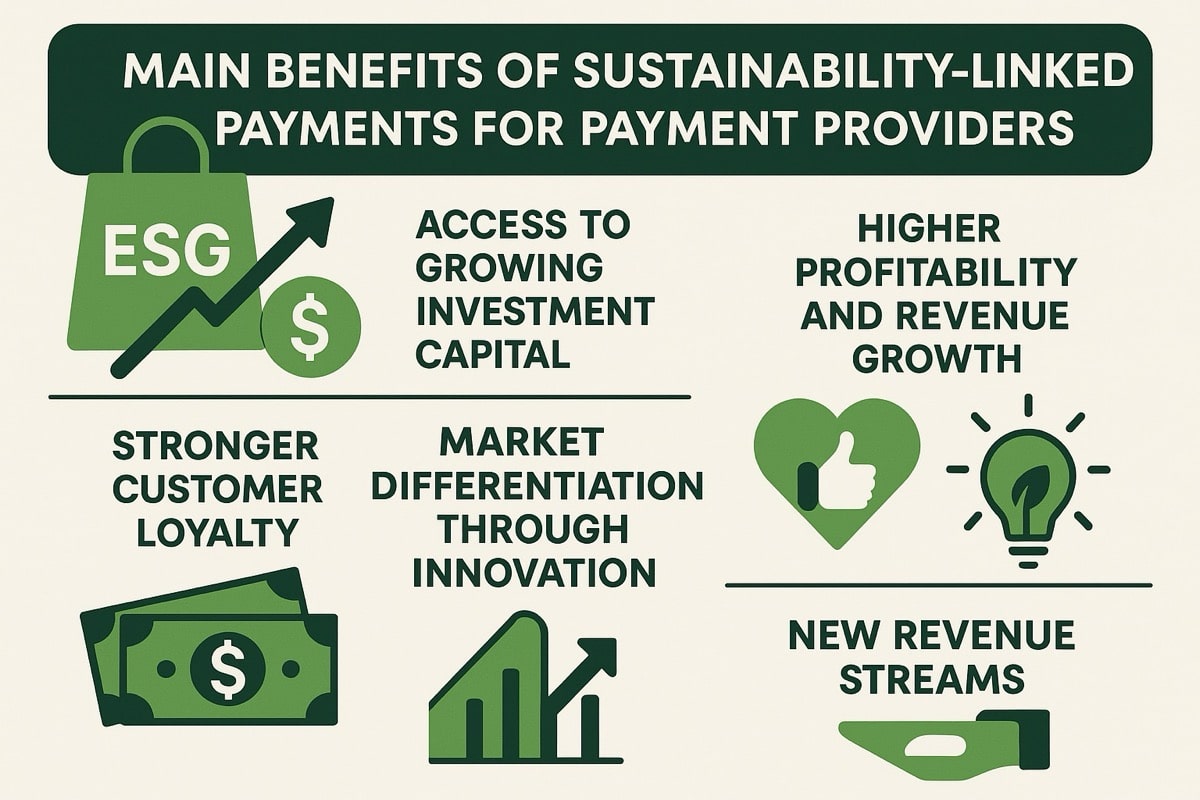

Top 5 Benefits of ESG in Payments for Providers and Fintechs

Focusing on ESG in payments offers payment providers a competitive edge. Whether they result in carbon-tracking transaction tools or sustainability-linked financial products, ESG payment provider strategies help differentiate offerings in a crowded market. Here is how fintechs benefit from ESG focus:

Access to Growing Investment Capital

- Over 80% of institutional investors in the US and Europe plan to increase funding for ESG products.

- Venture capital investment in ESG-focused fintechs doubled from 2019 to 2020 to $1.8B annually, reaching $6B in 2024, with forecasts of $28.8B by 2025.

- Although current slowdown in global fintech funding may impact the growth trajectory of ESG-focused fintech investments, over three-quarters (77%) of asset managers surveyed in 2024 have increased their focus on developing ESG-related investment products in response to public demand.

Higher Profitability and Revenue Growth

- ESG-committed companies report 9.1% higher profit growth and 9.7% higher revenue growth over three years.

Stronger Customer Loyalty

- Younger demographics are especially loyal to providers with clear environmental and social commitments, driving long-term retention.

- Half (52%) of Gen Z consumers are more likely to choose a bank that promotes social justice or environmental causes, while 64% are willing to pay more for products and services from environmentally responsible brands.

Market Differentiation Through Innovation

- ESG payment provider strategies include carbon-tracking tools, sustainability-linked financial products, and green payment processing solutions that run on renewable energy. While many providers offer standard digital payment services, few embed measurable sustainability outcomes into their core offerings. If that happens, the provider creates a unique value proposition and may gain a reputation of an innovative, responsible, and forward-thinking firm.

New Revenue Streams

- Opportunities in sustainable lending, green bonds, and impact-driven payment models create additional sources of income while reinforcing ESG leadership.

There’s a Reason End Customers Prefer ESG Focus in Payments

According to PwC’s 2024 Voice of the Consumer Survey, consumers are willing to spend an average of 9.7% more on sustainably produced or sourced goods and ESG-focused services, even amid inflationary pressures. Here’s why:

- Climate Change Gets Tangible: 85% of consumers report experiencing first-hand the disruptive effects of climate change in their daily lives.

- Impactful Spending: customers can see substantial environmental or social impact of their purchases, for example, a tree is planted per transaction, a share of a payment gets donated to local communities, or carbon offsets are automatically applied, which turns everyday spending into positive action.

- Rewards for Sustainable Behavior: Many ESG payment programs offer incentives such as cashback, loyalty points, or premium benefits for eco-friendly purchases, encouraging greener choices.

- Transparency and Tracking: Customers gain tools to monitor their own carbon footprint or ESG impact or receive feedback on product sustainability, e.g. packaging recyclability, ethical sourcing, or local production, helping them make more informed and responsible consumption decisions.

- Alignment with Values: Choosing providers that integrate ESG principles helps customers support causes they care about, empowers them and brings the sense of meaningfulness, enhancing personal satisfaction and brand trust.

What’s In It For Merchants?

Merchants that accept sustainability-linked payments can appeal to a growing demographic of socially and environmentally aware consumers. As part of each payment goes toward a social or environmental initiative, brand reputation among responsible consumers grows stronger.

Payment data are traceable and they can feed into corporate ESG reports, providing verified metrics on sustainable sales. ESG disclosures are improving transparency and building trust with investors and partners. A majority (71%) of investors agree that companies should incorporate ESG/sustainability directly into their corporate strategy and surely prefer to clearly see if that’s the case with the company they support.

Finally, merchants aligning their activities with sustainable finance trends may get potential financial incentives. Thus, some payment programs provide lower transaction fees, access to sustainability-linked financing, or preferential lending conditions if merchants meet certain ESG targets.

Can Payments Actually Drive Measurable Environmental Outcomes?

Many products and services today are labelled as ‘eco-friendly’ just for the marketing purposes. Financial industry is not an exception. Thus, customers wonder how they can avoid getting on the hook of plain greenwashing and stick to payment services that actually drive measurable environmental outcomes.

Now, many sustainability-linked financial products do empower consumers to lead greener lifestyles. We have cards and wallets that track the carbon footprint of each purchase so that shoppers can adjust their behavior to more environmentally conscious. Fintechs and banks providing precise, user-friendly impact metrics (like how many trees you’ve helped plant or monthly overviews of total emissions linked to your shopping habits) rather than vague claims attract more customer trust.

Carbon-linked payment incentives, like planting trees for every transaction or funding renewable energy projects, demonstrate how impact-driven payment models can directly generate measurable environmental benefits. Although not every fintech provides annual updates, here are just a few numbers to admire:

-

- GreenFi (ex-Aspiration) users have collectively planted 5,820,859 verified trees, with a total of 28,059,454 funded prior to verification. These efforts are estimated to sequester 1,172,300.2 tonnes of CO₂, equivalent to removing 254,848 cars from the road for a year.

- TreeCard, linked with the Ecosia search engine, directs the majority of profits from users’ transactions toward reforestation projects and enables users to contribute to tree planting by counting their steps as they get outside for a walk. As of latest data available, TreeCard community members have funded the planting of over 200,000 trees worldwide, while the wider Ecosia initiative has already surpassed 231 million trees planted.

- Klarna sustainability tools enabled over 7.26 million users to track their carbon footprint, making 4.75 million “conscious purchases” in 2023 alone.

- bunq plants 1 tree per €1000 spent using their cards (or per €100 with their Elite plan), and users can track individual contributions via the app. Since 2019, bunq users have planted over 25 million trees and offset over 4 million tonnes of CO₂ in this way.

These aggregate statistics make sustainability tangible. Fintech app and card users can see that their spending collectively contributes to real-world outcomes: millions of trees planted, major emissions reductions, or millions of dollars invested in planet health.

Merchants also gain from participating in payments industry ESG initiatives, as they can showcase verified contributions to environmental goals in their ESG in banking and corporate disclosures. However, today, such disclosures are not a must in many destinations.

Should Fintech Companies Bear ESG Responsibility When It’s Not a Must?

Although the U.S. is not a trendsetter in respect of sustainability initiatives in 2025, its example is a nice illustration of a controversy reigning over the payment industry today. State legislatures have introduced over 100 bills to limit ESG liabilities for businesses this year. The truth is that wider community is against such radical measures, and only a tiny fraction of these bills turned into laws (11, to be precise, have passed). Nevertheless, the focus on planet health clearly fades in challenging economic and geopolitical circumstances.

Thus, 92% of investors worry that ESG-related initiatives harm their short-term corporate performance, with 66% admitting their institution is likely to decrease its consideration of ESG in decision-making.

While legislators are attacking financial institutions’ ability to consider climate risk and other ESG factors in their activities and pushing institutions to favor financial returns over ESG goals, many payment industry representatives also argue payments providers shouldn’t be expected to solve climate challenges.

At the same time, large and small payment companies work internationally. They may try to avoid disclosing their ESG considerations for one jurisdiction, but what about other markets where consumers and lawmakers alike expect or incentivize the pursuit of ESG-aligned payments and reporting?

Navigating a patchwork of evolving and changing ESG expectations is hard. So, many financial institutions resort to greenhushing – refusal to publicize ESG information. While earlier the main reason for such a strategy was avoiding critics for too little effort, today, the situation is opposite. Many companies quietly advance ESG goals without advertising them to protect the business from political backlash.

Some might say that governments should be the ones to address sustainability issues, but payment companies also hold unique leverage in this respect. Payments data offers real-time transparency, enabling sustainable transaction systems that tie every dollar spent to measurable outcomes. When scaled across millions of transactions, even small per-payment contributions add up to significant climate impact. Surely, legally you may not be obliged to contribute to our planet getting better, but what about moral obligations?

When tied to social impact payment platforms, climate-positive payment services, and well-structured ESG initiatives, fintech payment solutions become powerful tools for both consumer engagement and systemic change. By linking everyday spending to sustainability, the payments industry can transform itself from a passive processor into an active driver of a greener, more responsible economy.

Nevertheless, without a regulatory mandate and proper regulation mechanisms, ESG initiatives may remain patchy, inconsistent, or more “good PR” than measurable impact. If consumers face more greenwashing than action they’ll lose trust in eco-initiatives altogether. The fact is, solid sustainability initiatives need some back-up infrastructure and legal support.

And yet, I believe we need balance rather than pushing the blame from one ecosystem participant to another. In the end, it won’t matter who wasn’t accepting the responsibility first, if life on the planet turns disastrous. So, ESG in payments should be pursued no matter what as a value-creating innovation and a way to make significant positive change, not just a compliance box or PR play.