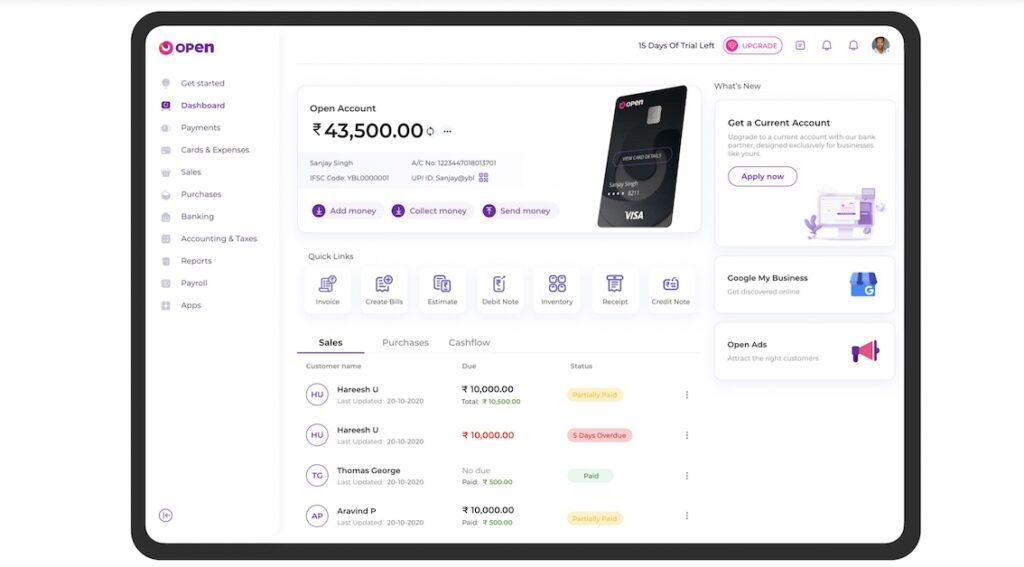

One of the largest private sector banks in India – Axis Bank – partnered with the digital banking enterprise, OPEN, to provide a fully native digital current account for its business customers

Image: OPEN

Axis Bank has partnered with the fintech player, OPEN, to provide a fully native digital current account to its business customers including SMEs, freelancers, homepreneurs, influencers, etc. The product is already live on OPEN’s website.

The collaboration unites the best offerings from the two institutions. Thus, Axis Bank offers a holistic banking experience, while OPEN provides end-to-end financial automation tools for business management. The tools facilitate payments, accounting, payroll, compliance, expense management and several other business-related services.

The new digital current account product will become a time- and effort-saver for customers, as the authentication process will be completely digital. The ID verification takes place remotely, using PAN and Aadhaar, followed by a Video KYC.

Besides, the contactless account opening process requires no document uploads, standing out among other similar market solutions. Account users can avail of over 250 banking services and claim up to 50% cash back through partner deals.

From now on, all existing Axis Bank account holders also get access to OPEN’s all-in-one digital banking platform.

Besides Open Money, OPEN runs an embedded finance platform – Zwitch and an enterprise digital banking platform for banks – BankingStack.

SEE ALSO:

India boosts financial inclusion with 75 digital banking units in rural areas

Samsung launches Axis credit card in India

How to pay in Turkey: facts on the country’s payments market