Although India is traditionally a cash-based economy, government initiatives increase consumer confidence in digital payments

Card payments in India keep on rising – research. Source: shutterstock.com

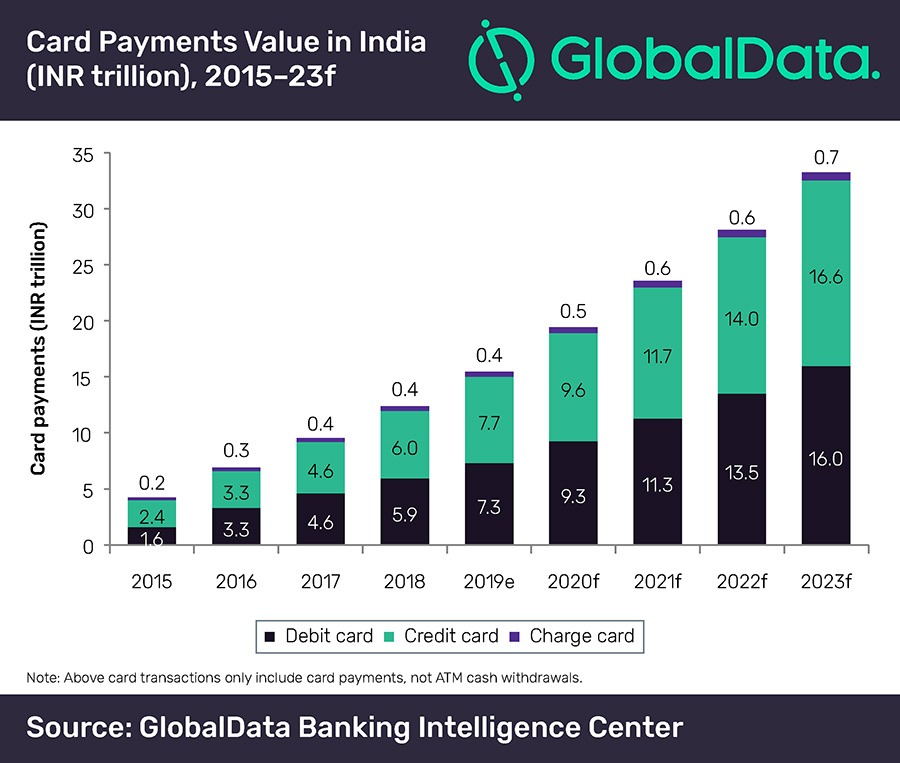

According to GlobalData, the total number of card payments in India increased from 2 billion in 2015 to 7.8 billion in 2019.

The report reveals that the introduction of the Pradhan Mantri Jan Dhan Yojana (PMJDY) program facilitated the growth of the card payments over the last four years. It offers low-cost banking services, the appointment of banking correspondents, the launch of payment banks to offer banking services and the reduction of merchant fees.

The rise of credit cards’ use is connected to value-added services such as reward points and discounts offered by banks. Payment facilities and loans installment on credit cards is also supporting growth.

The value of credit card payments is expected to increase from $110.6 billion in 2019 to $237.9 billion in 2023. The value of debit cards’ use is set to rise from $105.1 billion in 2019 to $229.3 billion in 2023.

Along with that, the government is taking steps to encourage the acceptance and usage of debit card payments. For instance, the merchant discount rate was capped at 0.4% for debit card transactions below $28.7 for merchants with an annual turnover of less than $28,733.6 since January 2018. For merchants having a higher annual turnover, the rate is capped at 0.9%.

SEE ALSO: