Let’s get to know more about a white label payment gateway.

The right payment gateway partner is one of the keys to the company or brand’s success and growth. Plenty of business owners are allured by the idea of integrating payments into their software or apps. It makes a great opportunity for payment service providers to enter the game, handling online transactions safely for both parties and expanding the client base on national or international levels.

Along with that, we are going to shed light on the most prominent partners for the white label payment gateway:

We will summarize the key features of each company so you could choose the best option for you.

Let’s get to know more about a white label payment gateway, its peculiarities, and how to pick the best partner.

What is a white label payment gateway?

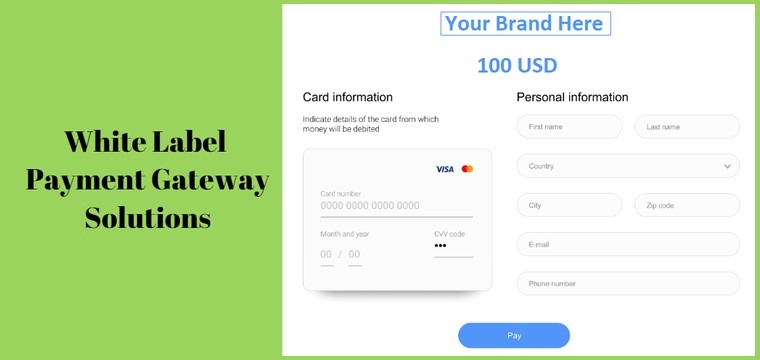

First of all, let’s define the term. White label payment gateway is ready-to-use payment software fully brandable according to business owner requirements. To put it simply, a company puts its logo on the customized solution that is pre-built and provides payment services to clients under its own name.

White label payment gateway allows entrepreneurs to start their operation from day one without developing and maintaining a payment system on their own. As a result, they do not have to spend time and money building a new system from scratch.

White label payment gateways commonly incorporate advanced technologies, such as intelligent routing and cascading, fraud prevention, automated merchant onboarding, and more. The goal is to increase conversion rates and save on processing costs, giving clients a competitive edge in the market.

How does a White Label Payment Gateway work?

A white-label payment gateway works by providing a customer with access to a ready-made system set up according to a customer’s demand.

The software vendor guides the customer through the system and determines how it can be adapted to their business needs. Next, the system is branded with the customer’s logo, colors, and style.

The customer must also choose which banks and payment providers they want to integrate from the available ones or ask for new integrations. As the white-label payment solution is highly customizable, they can configure anti-fraud filters, routing rules, and other parameters as needed.

After the system is set up, the customer’s team receives training on how to manage the system efficiently, and that is it. The last and longest-awaited step is going into live mode.

Benefits of a White Label Payment Provider

A white label payment provider offers numerous advantages that set it apart from other options. Among them are:

Zero development and maintenance costs

In contrast to developing a payment system from scratch, white label payment solution does not incur development or maintenance expenses, saving customers hundreds of thousands of dollars. In addition to cost savings, you also experience peace of mind because the responsibility for keeping the system up and running lies with the provider.

Fast time-to-market

Another significant advantage is that you can start your operation much faster. White label payment gateway time-to-market typically takes a few weeks to a month, allowing you to begin generating revenue from the first month of operation.

Branding and customization

White label payment platform is not only fully brandable but also customizable to your business processes. This includes configuring payment flows, adding payment methods, setting up pricing structures, and implementing features that align with your industry.

Multiple payment integrations

White label payment gateways provide multiple traditional and alternative payment methods already integrated into their system via an open Application Programming Interface (API), available to customers via one integration with the software vendor.

Scalability

You have the flexibility to scale up or down, add new features, and accommodate increased transaction volumes of your company. A white-label payment gateway adapts to changing business needs.

Security

All white label payment gateway providers must comply with Payment Card Industry Data Security Standards (PCI DSS) and other industry-specific regulations. That is why opting for it guarantees your software is secure and can handle your customers’ sensitive card data.

Global reach

Some white label providers have a global presence. They provide a solution capable of processing transactions in multiple currencies and regions, allowing your business to easily expand internationally. Plus, you can expand your services to international white label credit card processing as well.

What are the disadvantages of using a white-label payment gateway?

Aside from the undoubted advantages, there are several disadvantages of white label payment gateway as well, including:

Limited control over the system

Although white label systems have many customization options, it is not fully customizable. That is why businesses have limited control over the underlying infrastructure and technology of the white-label payment gateway. It can become an issue if you require highly specialized features.

Lack of uniqueness

Since white label payment processing is on the rise, software providers provide services to many clients. Due to this, your system will not be unique among competitors, making distinguishing yourself from competitors a demanding task.

Provider dependency

When you use a white-label payment gateway, you depend on the provider for ongoing maintenance, updates, and support. If the provider falls short somehow, it affects your business directly. That is why choosing a reliable and reputable payment partner is crucial.

Who needs a white payment gateway and how to get it?

It is safe to say that both established payment service providers and startup entrepreneurs may be in need of such technology if they are looking for a cost-effective way to run a payment processing business with a cutting-edge pre-built system. Such an opportunity brings plenty of advantages and ways to grow one’s business without spending more resources developing the payment gateway from scratch.

After opting for white label payment platform, entrepreneurs can offer their services to business that needs to accept payments, such as online stores, e-commerce software, gaming platforms, and system providers often use such services. Every company that wants to accept online payments swiftly and securely can become your potential client.

With a white-label payment gateway, it’s very easy to get started. You can look through the list of white-label payment gateway providers and pick the most suitable and reputable partner to your liking. They will show you the demo of their system and guide you through the process.

Things to consider when choosing a white label payment gateway provider

Before choosing a white-label payment gateway provider, it’s better to consider a few things. They are:

- Cost of the system. A crucial factor in choosing a software provider is the price-to-service ratio. Comparing the services and technologies provided by all potential providers will enable you to determine which is best suited to your needs. Make sure the vendor’s setup fee, monthly fee, and additional development costs fit within your budget..

- Time-to-market. Although the software isn’t built from scratch, it still takes some time to set up the system for you. Generally, preparation takes a couple of weeks to a month or more. That is why discussing the terms with the provider beforehand is best to avoid surprises. Keep in mind that the time for system preparation can vary according to the complexity of your business requirements.

- PCI Compliance. As the payment gateway has complete access to customers’ personal information, it must adhere to industry regulations, including PCI DSS standards. Prior to choosing a software provider, make sure they are PCI DSS Level 1 compliant.

The best options on the market: pros and cons

When choosing a partner for the best white label payment gateway, a business owner must realize that not all of them are created equally well. Let’s look at a few examples by reviewing the most popular companies that offer the best-quality services.

Akurateco

Akurateco is a global white label payment solutions provider created by industry experts with over 15 years’ experience in fintech. It is suitable both for startup Payment Service Providers (PSPs) looking for software to run their system on and established PSPs seeking to enrich their merchants’ offerings with additional functionality.

The system enables PSPs to incorporate the latest payment technologies, including:

- Intelligent payment routing

- Cascading

- Automated merchant onboarding

- Fraud prevention

- Tokenization

- Built-in payment analytics

- Smart billing

At the moment, Akurateco’s white label payment gateway has over 300 integrated acquirers and payment providers available to merchants via a single integration to the platform. Furthermore, the company has a proven track of swift development of new connectors upon request.

As a modern payment software provider, Akurateco takes an individual approach to tailoring its system to every client’s needs. Plus, customers can leverage the system on a Software-as-a-Service, On-premise, and Cloud-Agnostic basis. Additionally, the company also offers Payment Team as a Service, providing comprehensive support and guidance every step of the way.

Ikajo

The company offers various integration options and over 100 payment methods

The company offers various integration options and over 100 payment methods

Ikajo is processing main card payment types as well as various alternative options and supports more than 150 currencies.

If you’re concerned about security – don’t be. Each transaction gets a real-time check by over 100 parameters. One-time and recurring payments get different verification scenarios for customers’ convenience.

Clients of this provider will get built-in fraud and chargeback prevention software. The pricing starts at 1.2% and varies based on the industry and other factors. One of the advantages of choosing this company is the possibility to use HPP integration, if your business is small or medium, or an API integration if you’ve got high transaction volumes.

Besides, merchants can use different transaction types depending on the business’s needs. For instance, Ikajo offers payment transaction & cancellation, payouts (which is great for the gambling industry), recurring payments & subscriptions. The latter manages all transactions automatically once the customers set time intervals and agree to the fee structure.

PayPipes

PayPipes offers a technical solution to adapt the payment gateway to the company’s brand and color so that customers can easily navigate regardless of their payment channel or country. In this way, financial professionals can use the payment gateway system to serve customers who open Bank accounts and business accounts to process business transactions.

PayPipes significantly reduces compliance. This way, you can provide customers with a great transaction experience and avoid costly data security assessments on the website.

BlueSnap

BlueSnap is a technology company that provides white label merchant services. The company creates payment software, cloud-based white label payment processor systems, transaction management tools and provides anti-money laundering compliance verification services for PSPs, acquiring banks, and other types of payment businesses.

From simple payment acceptance software developers to market professionals whose products and services are used all over the world. Payment companies, from startups to large companies, use the software, tools, and services provided by BlueSnap to process and manage their online merchants’ transactions, as well as to protect their businesses.

The experienced team at BlueSnap develops and maintains a payment platform for businesses, provides technical support, and advises employees and clients on any issues related to the use of the platform. BlueSnap’s updated documentation and API libraries provide everything businesses need to quickly and easily integrate their customers’ online stores or mobile apps with their white label payment platform.

PaySpace

The company provides a strong anti-fraud system integrated into its payment gateway. That makes its clients’ businesses fully protected from scammers and fraudsters.

Alongside the fraud and chargeback protection, PaySpace offers a chargeback management tool so if ever the “friendly” chargeback happens, it will be closed in client’s favor.

Its direct operator billing solution is available across 80 countries and can be used for both subscriptions and one-time purchases.

Conclusion

There is no doubt that white label payment gateways bring plenty of features to all sorts of businesses. It helps companies stand out from the rest and bring advanced technologies and multiple payment methods to their customers. Offering such services is another opportunity to promote a brand, increase its recognition, and have better control over the customer’s experience.

SEE ALSO: