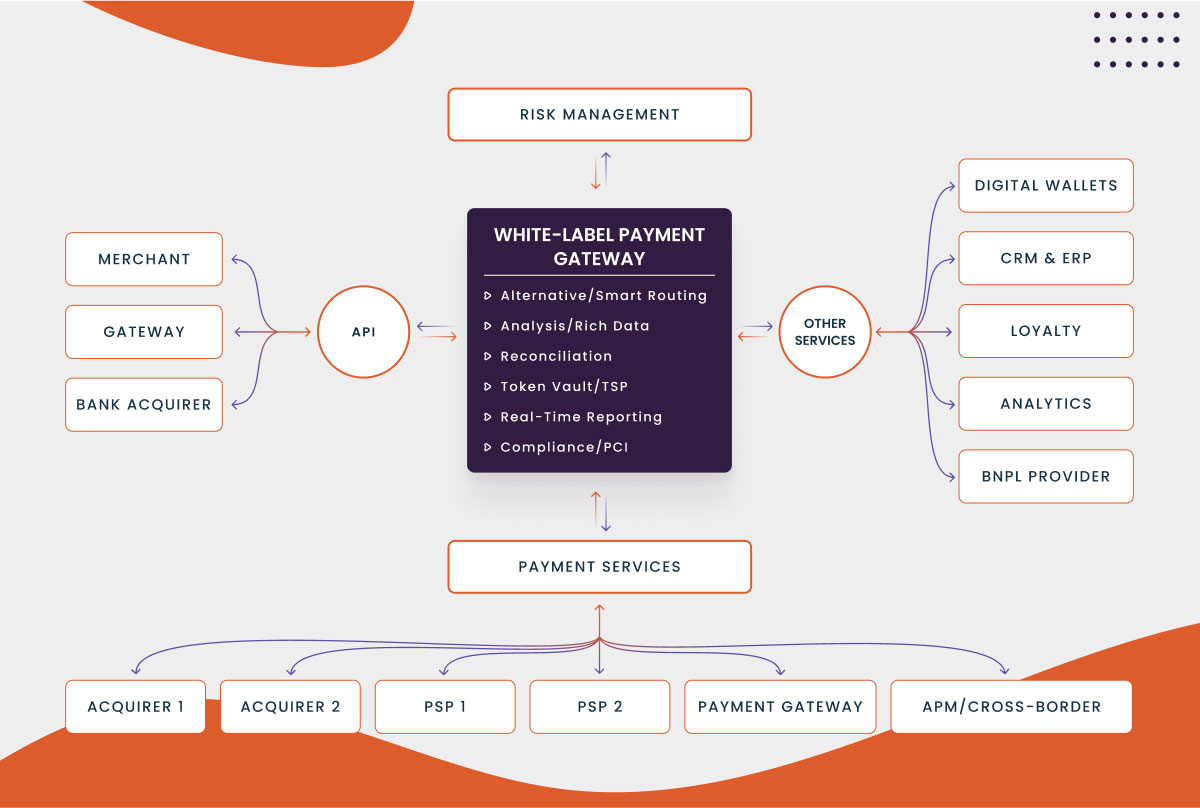

A payment orchestration platform is a set of tools and services that assist in unifying and managing the different aspects of transaction processing from start to finish. Typically, the core elements include connections to various payment service providers (PSP), transaction routing, cascading, fraud protection, automated reconciliation and settlements, vaulting, tokenization, compliance, and comprehensive analytics and reporting. With these tools, payment orchestration optimizes the payment process and simplifies the management of your payment stack.

In this article, we will discuss the benefits of payment orchestration, things to look out for when selecting an orchestration platform for your business, and the most prominent providers of orchestration platforms currently on the market:

What are Payment Orchestration Platforms?

Before proceeding any further, let’s first uncover what is payment orchestration. Payment Orchestration Platform is a technology solution that helps businesses to manage their payments. It is a centralized hub that unites multiple payment methods, providers, and channels under one roof.

Payment orchestration software is equipped with cutting-edge technologies that streamline and automate payment operations. The ultimate goal of payments orchestration is to enhance approval rates, reduce processing costs, improve customer experience, and ensure sensitive data security.

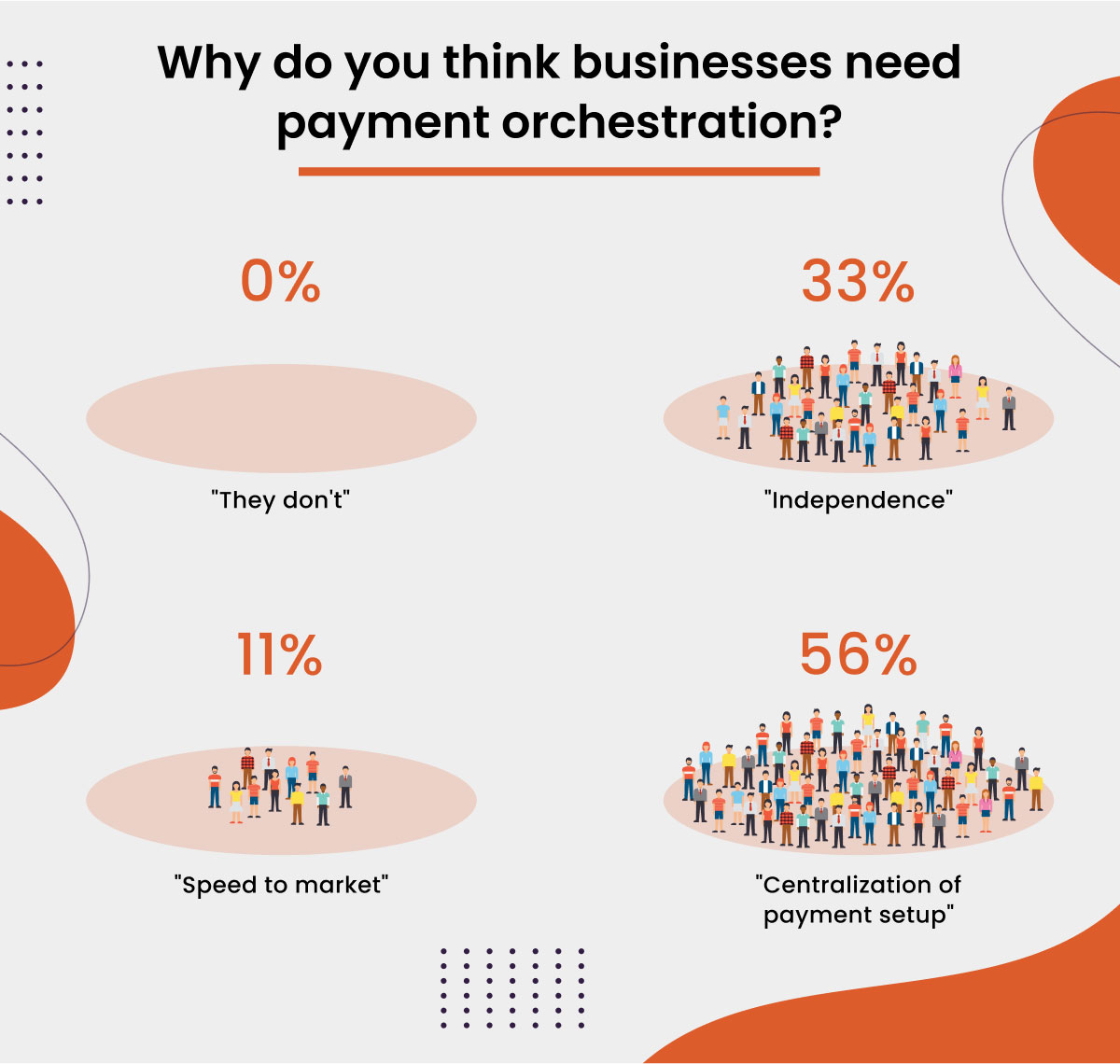

Why use a payment orchestration platform

Payment orchestration is specifically tailored to the needs of merchants, making it an invaluable solution for managing transactions. It offers a vast choice of payment integrations compared to a third-party PSP. Payment orchestration platforms are primarily of value to businesses that operate online and accept transactions through various channels and methods. Payment orchestration is also highly beneficial in terms of system customization. It allows you to tailor the system’s technologies to the industry-specific needs of a merchant’s business.

Benefits of Payment Orchestration

Payment orchestration allows for more flexibility and scalability by handling transaction processing and providing other services. Here are some of the benefits of using an orchestration platform:

Diverse PSP Connections with One API Integration

Payment orchestration platforms facilitate the integration of local and global PSPs by giving merchants access to their pre-established provider connections after a single integration. Connecting to multiple providers will help expand your business to new markets and acquire a broader and more loyal customer base.

Better Acceptance Rates

In a vendor-agnostic orchestrator, connecting to various PSPs and smart routing increases acceptance rates by finding the optimal routes for transactions to be accepted. Automated retries and cascading further minimize transaction declines.

Improved Customer Experience and Conversion Rates

Integrating a variety of local and global PSPs allows merchants to better adapt to customer preferences by providing different payment methods. This leads to an increase in conversion rates by creating a more convenient experience for customers. Smart routing and cascading result in fewer issues with transaction processing and transaction declines, which improves customer experience by eliminating the need to retry purchases or use different payment methods.

Centralized Management

Payment orchestration platforms allow merchants to manage their whole payment stack from one dashboard instead of keeping up with every PSP through its own platform. Merchants receive comprehensive data from all their PSPs in one place with real-time analysis and KPI analytics, which facilitates better decision-making.

Reduced Security and Compliance Responsibilities

Any of the merchant’s security and compliance responsibilities will be taken care of by the payment orchestrator. Payment orchestration platforms are built on PCI compliant vaults, which minimizes compliance scope for the merchants. Payment orchestrators constantly evaluate security regulations and requirements and reduce the burden on merchants to stay up to date on different compliances across different payment services. Tokenization and risk management services also ensure the security of customer sensitive data.

Faster scaling

Connecting to multiple PSPs and payment methods with one integration drastically speeds up the scaling process. Having more payment options broadens your market reach and customer base for your products, and a good checkout experience will lead to loyal customers globally. Payment orchestration makes it easier to accept region-specific payment methods and support cross-border sales, facilitating international expansion.

Minimized fees

With the availability of many PSPs, smart routing, and retries, merchants can minimize costs by directing transactions through channels with the lowest transaction fees. Furthermore, as your business grows, payment orchestration will save you money by reducing setup fees and eliminating additional fees for automated transaction routing.

Ultimately, payment orchestration optimizes the payment process for scaling businesses.

Things to Consider When Choosing a Payment Orchestration Platform

When selecting a payment orchestration platform, there are a few things you should consider in order to find the best fit for your business. The first thing to make sure of is that the platform you are choosing is truly vendor agnostic. Sometimes, if the vendor also offers their own payment gateway, they can tend to direct more transactions their way to increase their profit, but this can negatively impact your acceptance rates and fees. Another crucial factor is whether the platform provides your preferred services and payment methods. There is no benefit in using a platform that doesn’t offer the tools you need for your business goals. Also, make sure that the services are suitable for global businesses and will support your international customers. Figure out how easy-to-use the platform is; is it accessible for business users, or will you need IT to get involved? Think about your resources and what option you prefer. Lastly, establish your ultimate goals of using an orchestration platform – globalizing your payments, diversifying PSPs and payment methods, reducing compliance scope, etc. – and find vendors whose strengths are in those areas.

The Top Payment Orchestration Platforms on the Market

Now that you know what to look for in a payment orchestration platform, we will discuss the best payment orchestration platforms on the market:

1. Akurateco

Akurateco is an Amsterdam-based white-label payment software provider that offers payment solutions to businesses in various industries. With a single integration, merchants can access over 300 payment connectors, consolidated data reporting and management, a payments calendar to keep track of their monthly or yearly fees, and more. Merchants can increase their approval rates by up to 20% with Akurateco’s smart routing and automated retries features and drive conversion rates up by up to 30% with cascading. Their consolidated real-time tracking of payment analytics can help with making better business decisions. With more payment methods, fewer declines, and an easy-to-use refund system, businesses can acquire a broader and more loyal customer base. Akurateco enables full automation of the payment flow, better distribution of traffic, and data-driven decision-making. Akurateco offers a few integration options for your convenience: CMS Plugin, Mobile SDK, API rest/API soap, or Hosted Payment Page (HPP).

Infrastructure Details:

- SLA 99.995%

- Cloud deployment on hardware or Amazon AWS

- PCI DSS 3.2 certification of equipment, solutions, and processes

- 24/7 maintenance of software and hardware

- SMS and DMS payment schemes support

- 3DS 2.0 support

- Dynamic currency conversion

2. Ikajo

Ikajo’s payment orchestration platform connects merchants to over 100 connectors in over 150 currencies with one integration. Their payment methods include cryptocurrencies, credit cards, and alternative payment methods (such as PayPal, Klarna, etc.). Merchants can change priority, turn on or off specific payment methods, and get real-time analytics on their payments all in one user-friendly interface. Ikajo also offers automated reconciliation and a payment calendar that keeps track of all incoming and outgoing payments from each payment method. Their smart routing tool helps businesses increase their conversion rates by up to 30% by choosing the provider with the best terms for each transaction. Meanwhile, the cascading tool will help improve approval ratios by up to 20%. Ikajo offers two types of integration: API rest/API soap and HPP.

Infrastructure Details:

- PCI Level 1 certification

- AML/CTF compliance

- PCI 3DS certification (1.0 and 2.0)

- Cloud development on own hardware or Amazon AWS

- 24/7 maintenance of software and hardware

- SMS and DMS payment schemes support

- Dynamic currency conversion

3. Payoneer

With the Payoneer orchestration platform, merchants can tap into their vast partner network of over 100 payment methods in over 200 countries and more than 150 currencies. Payoneer’s platform provides a global payments automation solution with Enterprise Resource Planning (ERP) integration, fast reconciliation and reporting, flexible approval flows, risk mitigation, increased payment options, improved operational efficiency, and security and compliance. Merchants can simplify payment collection by making mass payouts, eliminating chargebacks, automating reconciliation and settlements, and minimizing fees per transaction. Payoneer also provides flexible online reporting, messaging in multiple formats, and tax services for payees. There are four possible integration models: iFrame, HPP, and a non-integrated option.

Infrastructure Details:

- PCI Level 1 certification

- AML/CTF compliance

- US and EU licenses

- PSD2 compliance

- 24/7 support

- SSL connectivity (DigiCert)

4. IXOPAY

With one integration, the IXOPAY orchestration platform helps merchants manage and outline the transaction lifecycle from start to finish; using IXOPAY software, merchants can connect to any PSPs, acquirers, alternative payment methods, payment processors, and 3rd party payment software. IXOPAY has a network of over 100 PSPs and over 200 payment methods that merchants can use to their advantage. Their platform also provides complementary services such as risk and fraud management modules, automated reconciliation and settlement tools, smart routing, fee management engines, and more. IXOPAY’s risk-based routing, together with cascading and fallback features, results in a 15% increase in acceptance rates. Additionally, automatic card updates maintain payment continuity and reduce declines and decline-related fees. Merchants can manage everything from a central interface with customizable dashboards and critical KPI reporting in real-time. IXOPAY offers the following integration models: Plugins, Mobile SDK, HPP, server-to-server API for PCI compliant environments, Payment.js library with hosted fields for a reduced PCI scope, or virtual terminals.

Infrastructure Details:

- PCI DSS Level 1 compliance

- PCI 3DS certification (1.0 and 2.0)

- GDPR compliance

- 24/7 support

5. Spreedly

The Spreedly payment orchestration platform assists merchants and marketplaces, and platforms with transaction processing from virtually any gateway or service. Spreedly’s POP has a smart routing, which results in a beneficial combination of payment gateways and related services. Due to it, the merchant gets the most ROI from transactions and increased flexibility of infrastructure of payments. The platform also consults on the ready-to-use insights regarding e-commerce, evaluates its performance, and compares it with similar businesses. There also are instruments useful for the technical teams. Using them, they can analyze transactions in-depth to enhance the stack of payments.

Infrastructure Details:

- PCI DSS Level 1

- SCA compliance

- 3DS2, and PSD2 support

- 120+ gateways and PSPs

- 100+ payment services

- Third-Party APIs

Frequently Asked Questions

Let’s look at the most frequently asked questions about payment orchestration platforms.

What is payment orchestration?

Payment orchestration refers to the process of managing and optimizing digital payments. It is particularly beneficial for businesses that accept online payments and manage a variety of payment methods, providers, and channels.

How does payment orchestration work?

A payment orchestration layer coordinates multiple elements involved in transaction processing. Once a customer confirms purchase on a merchant’s website, the payment orchestration platform takes over, using dynamic routing algorithms to determine the most suitable provider for processing the transaction.

Why is payment orchestration important?

Payments orchestration platform simplifies complex payment operations for merchants. It helps to reduce costs, enhance customer experience, and increase approval rates. Ultimately, all these factors contribute to revenue growth.

What is the difference between PSP and payment orchestration?

PSP acts as a facilitator for transactions while Payment Orchestration Platform sits between merchants and multiple PSPs, optimizing payment operations by routing transactions to the most suitable providers.

What is the difference between Payment Orchestration and Payment Gateways?

A Payment Gateway is a technology solution designed for payment data’s secure transmission and processing between merchants and payment processors. At the same time, Payment Orchestration companies provide a solution that also facilitates digital payments but is tailored to businesses’ needs, offering additional features to increase acceptance rates, save on processing costs, and automate manual processes.

Who uses payment orchestration?

Payments orchestration layer is used by a variety of businesses that accept digital payments. They include e-commerce platforms, online marketplaces, subscription services, the travel sector, and many more. Basically, it can be used by any business that wants to accept payments for goods and services online.

Conclusion

A payment orchestration platform will benefit your company in many ways. It helps unify and optimize your payments, automate processes, and broaden your reach to global markets. Make managing payments simpler for yourself and make the payment experience more convenient for your customers. Choose a platform that has the services most fitted for your needs and use it to your advantage!

Vladimir Kuiantsev is the CEO of Akurateco, a cutting-edge SaaS platform with 70+ connectors catering to international businesses. With 10+ years of experience in the payment industry, he’s successfully founded and grown two major payment startups before becoming an executive at Akurateco.

SEE ALSO: