Data from a new study suggests that, as of today, China is about five years behind the world leaders in the area of high-end logic chip production and continues to be at a significant distance from the leadership in the semiconductor equipment manufacturing sector.

The corresponding conclusion about Beijing’s position in the advanced segments of the technology sector is contained in a report published last Monday, August 19, by the Information Technology and Innovation Foundation (ITIF). This Washington-based organization is the science and technology policy think tank.

The report on the results of the research conducted by ITIF notes that advanced manufacturers of high-end logic chips, such as Taiwan Semiconductor Manufacturing Company (TSMC) is about five years ahead of Semiconductor Manufacturing International Corporation (SMIC), the largest foundry in mainland China. It should be clarified that in the context of comparing the capabilities of companies, the level of technological development of a particular brand is used as an evaluation parameter.

TSMC, which is currently the world’s largest contract chip manufacturer, 2022 presented its 3-nanometer process technology, which is applied to making some of the world’s most sophisticated chips. At the same time, SMIC tests only its own 5-nanometer technological process. Last year, this company launched the production of chips on a 7-nanometer node for the flagship smartphone series Huawei Technologies Mate 60. It is worth noting that for the Chinese semiconductor industry, this result, despite its clear lag behind the world market leaders, is significant. The relevant thesis is based on the fact that the United States has limited the supply of advanced chips and equipment for the production of microcircuits of the appropriate category to an Asian country. Policymakers in Washington expected that the result of these measures would be a restriction on the use of 14-nanometer technologies by Chinese companies. Obviously, in this case, it was also meant not to give firms from an Asian country access to more advanced solutions. At the same time, SMIC was able to achieve a result that Washington reckoned impossible for any Chinese company.

Stephen Ezell, ITIF’s vice-president of global innovation, who wrote the mentioned report, says that Beijing is currently investing hundreds of billions of dollars in efforts to become the leader in the semiconductor area. The expert noted that impressive successes are being recorded on the corresponding path of China. At the same time, Stephen Ezell underlined that this movement towards leadership is limited. Certain aspects of chip development and production are a kind of deterrent in the relevant context. It is possible that over time, restrictive measures from Washington, which were also joined by its allied capitals, will cease to be a source of any even minimal impact on China’s manufacturing capabilities in the semiconductor industry. The implementation of the corresponding scenario will be possible only if Beijing, in the context of development in the domestic technological environment, can achieve progress of such quality that will mean a sharp leap in the evolution of capabilities relative to the current indicators.

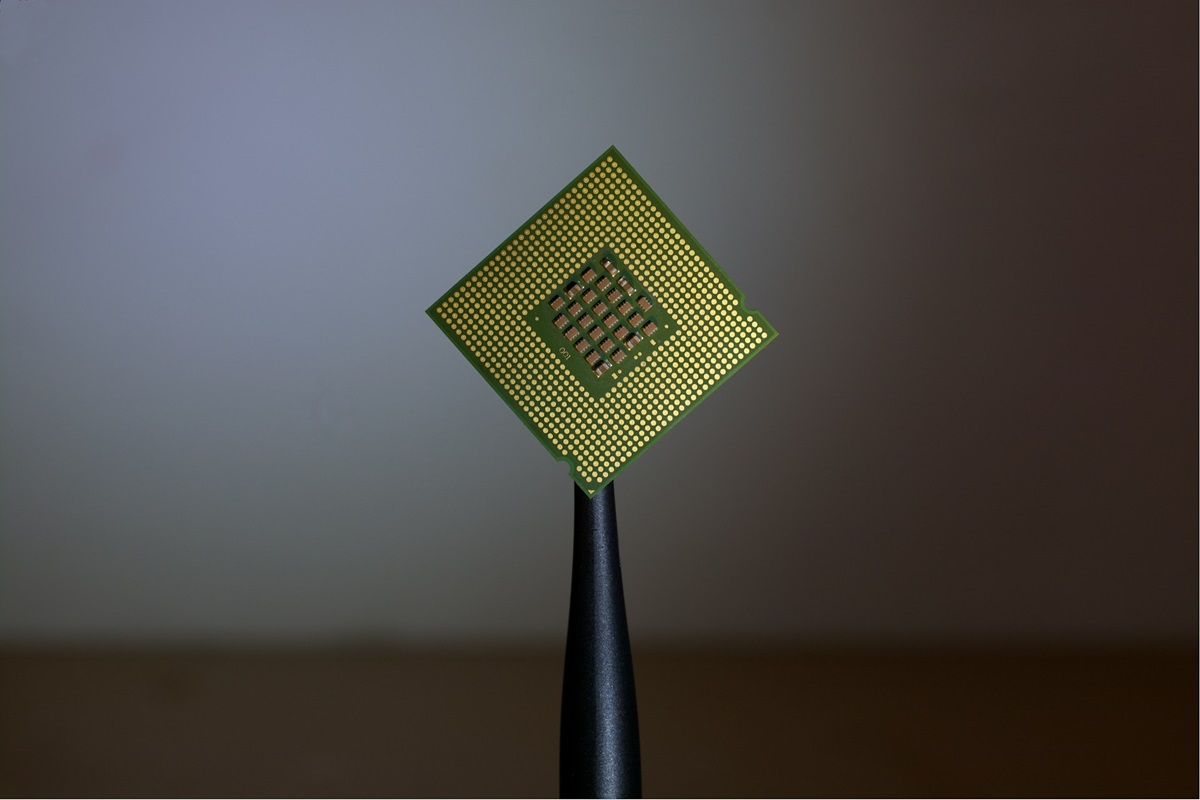

It is worth noting that the chip manufacturing sector is gradually becoming strategically important and of importance that goes far beyond what can be called a highly specialized value paradigm. Currently, microcircuits are a kind of basic component in a wide range of technological products. Chips are included in the equipment of vehicles. These products are also used in smartphones, which have become the main link between the consumer and the virtual reality space. Moreover, chips are necessary for the training and subsequent operation of artificial intelligence systems. In this context, it is worth noting that AI is the most advanced technology of modernity. Artificial intelligence also has significant development prospects. The digital mind existing in the virtual dimension of the matter of the being can become a source of significant transformation of the space of existence of human civilization in all its segments and aspects. AI has the potential to develop a new economy based on virtual thinking systems. Also, the probable exponential evolution of artificial intelligence can become a factor of fundamental political changes and a source of generating transformation processes in the social environment and cultural plane. The basic component of the material platform of the expected rapid development of AI is chips. For this reason, there are currently signs of the formation of a process in the international arena that can be called a struggle or even a war for microcircuits. It is obvious that countries will strive to develop an industry for the manufacturing of such important products. It is worth noting that the United States is currently allocating government funding to bolster the domestic sector of making microcircuits as part of the Chips and Science Act 2022. Similar efforts are also being made in Japan, where the first TSMC plant has already opened, and in Europe, where the mentioned company began building its first production site. China is moving in the same way, but in this case, there are various restrictions and barriers. It is worth noting that the development of the chip manufacturing sector involves significant financial costs. For Beijing, this aspect is not a problem or a task that cannot be solved.

Jimmy Goodrich, senior China and strategic technology adviser to the RAND Corp., says there is no doubt that the United States has crossed the Rubicon in technological rivalry with China.

ITIF notes that in the area of logic microcircuit development, especially in old-generation products, China’s future is more optimistic and promising. In this case, the gap between local companies and world leaders is two years. It is worth noting that China has a high level of domestic demand for logic chips. The corresponding products are used in mobile devices or artificial intelligence apps.

The report also underlined that the positive dynamics of China’s semiconductor industry, especially in the segment of the production of older generation chips, is largely due to massive subsidies, as the head of the People’s Republic of China Xi Jinping supports the aspirations and efforts aimed at achieving the goals of technological autonomy.

ITIF notes that Chinese chip manufacturers have benefited not only from subsidies but also from lower tariffs and taxes. Also, in this case, the sale of land at discounted prices became a factor of favorable impact.

The prevailing view among analysts is that government subsidies are vital to support loss-making Chinese companies. At the same time, the report notes that China’s strategy, implying the autonomy of the country’s actions in the closed internal chip industry, may be extremely difficult.

Moreover, the mentioned subsidies have already caused overcapacity. China’s share in global mature-node production is expected to grow to 39% by 2027. It is worth noting that in 2023, the corresponding figure was fixed at 31%.