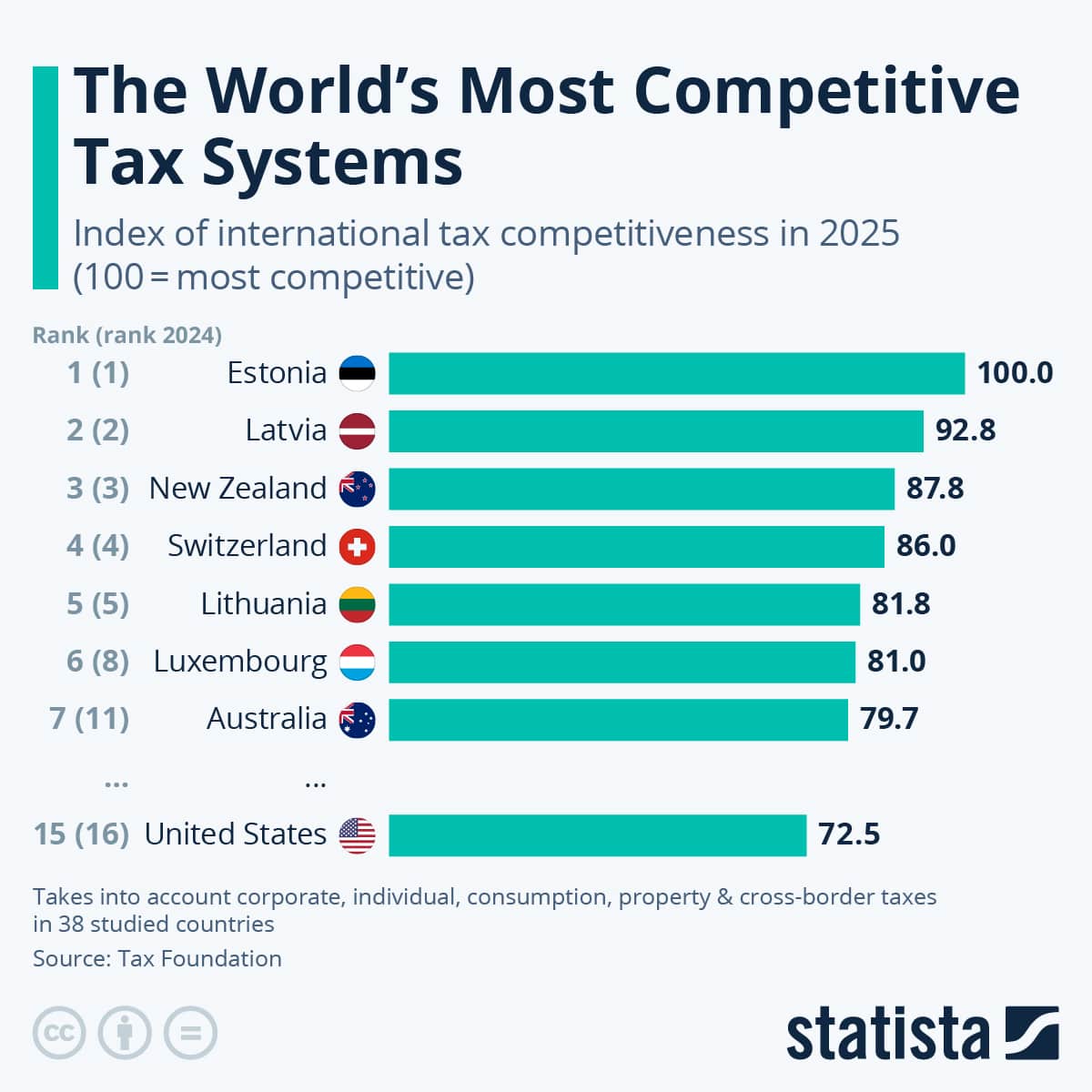

Estonia continues to lead the world in tax competitiveness, ranking first for the 11th year in a row, thanks to its simple, transparent, and investment-friendly tax system.

The Tax Foundation has published its latest International Tax Competitiveness Index, ranking countries based on how effectively their tax systems promote economic growth and investment. For the 11th consecutive year, Estonia led the index, recognized for its straightforward and efficient tax structure, including a 20% corporate tax applied only to distributed profits, a 20% personal income tax that excludes dividend income, a land-only property tax, and a full exemption on foreign profits earned by domestic firms.

At the other end of the scale, France, Italy, and Colombia ranked as the least competitive among the 38 OECD countries. France and Colombia performed poorly on corporate tax measures, while Italy received low marks for consumption and property taxes. All three also maintain wealth taxes, which further reduced their overall competitiveness.

The United States saw a modest improvement this year, moving up to 15th place with a score of 72.5 out of 100, thanks in part to better expensing rules for corporate investments in equipment and facilities. However, it continued to score poorly on property and cross-border taxation. The U.S. remains one of the few nations that still taxes companies on their global income, though global corporate minimum tax reforms are beginning to reduce this disparity.

Image: Statista

The report highlights that well-designed corporate tax systems are key drivers of economic development, investment, and productivity. Economies with lower, simpler, and more neutral tax structures tend to attract more business activity and achieve stronger performance. The Index evaluates countries across five main areas: corporate, individual, consumption, property, and cross-border taxes, emphasizing both competitiveness and neutrality as the foundations of a sound tax policy.

Based on materials provided by Statista.