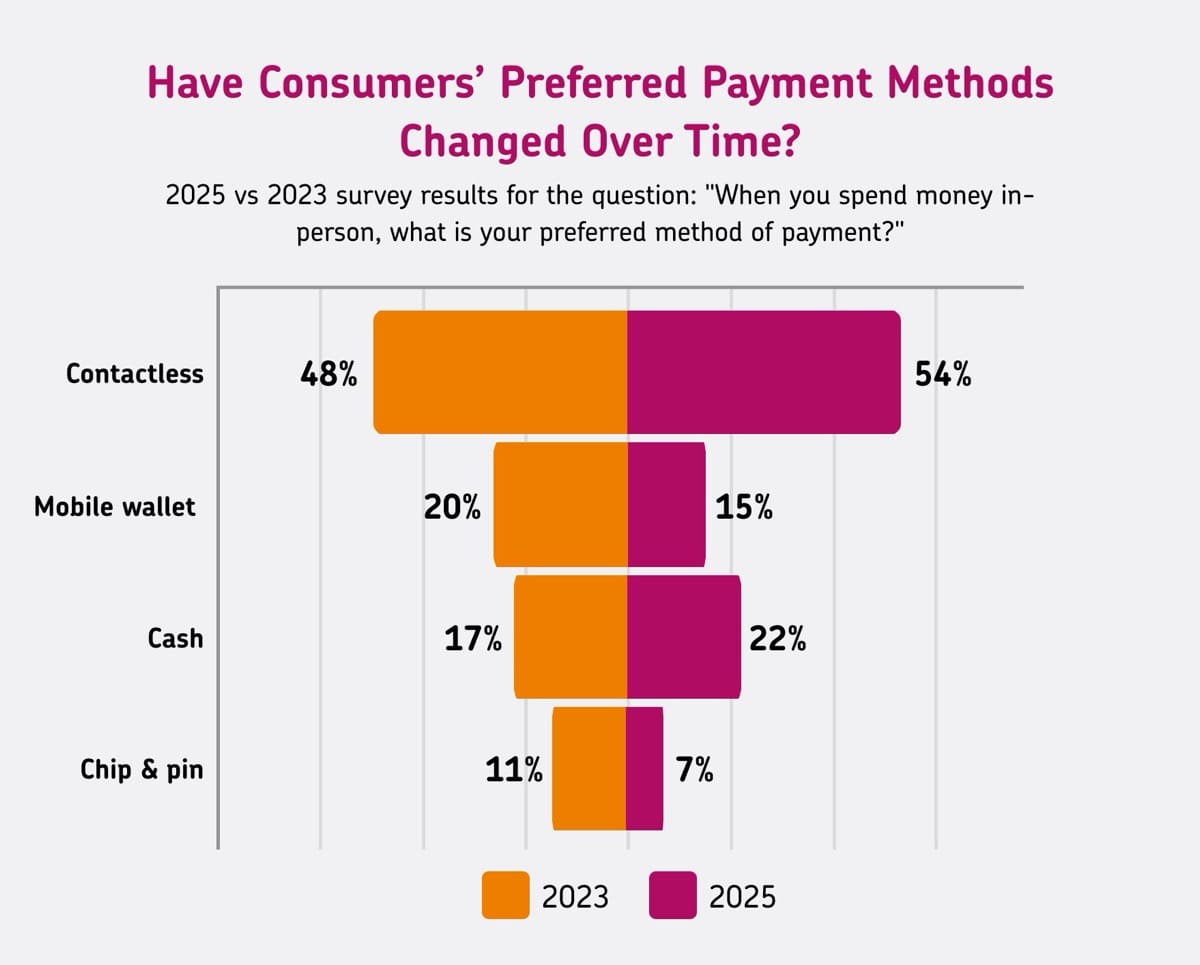

An increasing number of British consumers say contactless is their favourite way to pay in-store, though cash use in stores has also grown by over 20% in two years, reports Takepayments.

Takepayments recent research that surveyed 2000 British consumers, aged 16-86, to discover how shoppers prefer to pay in 2025, revealed that 54% of the shoppers prefer contactless payments in-store, while 56% of the survey participants still carry cash. Moreover, cash use in-store has gone up 26% since 2023.

Contactless payments are becoming increasingly important for British consumers. In fact, 45% of survey participants report having abandoned an in-store purchase because the payment system was down. Among those who abandoned their purchase, 34% said they didn’t have enough cash on hand, 28% found switching from card to cash too inconvenient, and another 28% lost trust in the store’s systems due to a technical issue.

While most shoppers would still purchase items from a business that only accepts cash, more than half (52%) of UK consumers say it would be inconvenient. That’s a noticeable surge by nearly 20% from 2023 (33%).

At the same time, more than half of respondents (56%) still carry cash, and in-store cash use has risen by 26% since 2023, now surpassing mobile wallets to become the second most popular payment method in physical stores. While it is predictable that 66% of UK citizens over-55 always have cash on them, notably, even half of 18–24s say they carry cash at least some of the time (50%).

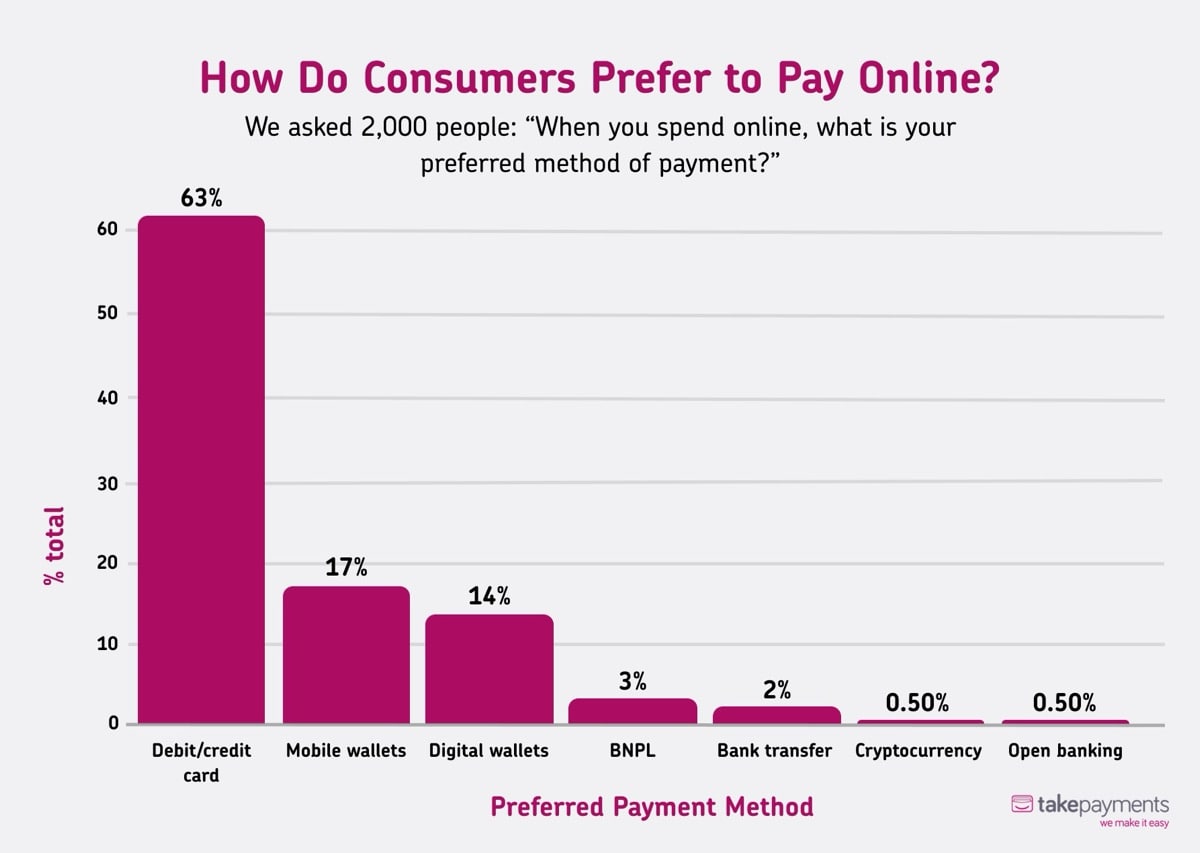

As for online payments, nearly two-thirds of shoppers (62%) continue to favor debit or credit cards for e-commerce purchases, maintaining their lead over alternative payment methods. However, mobile wallets are rapidly gaining ground, especially among younger consumers. Among 18–24-year-olds, mobile wallets have already overtaken cards as the most popular way to pay online, with 42% naming them their preferred method.

Convenience remains the top driver. Thus, 72% of mobile wallet users say they choose them because they’re the easiest option, while 52% appreciate faster transaction times, and 21% consider them the safest way to pay.

Yet, convenience cuts both ways: 30% of shoppers say the most frustrating part of online shopping is having to enter card details manually, and 15% admit they would abandon a purchase if their preferred digital wallet wasn’t available. Despite this shift, trust still plays a key role in choosing a payment method. The vast majority, 72% of online shoppers, look for Verified by Visa or Mastercard SecureCode logos before completing a transaction.