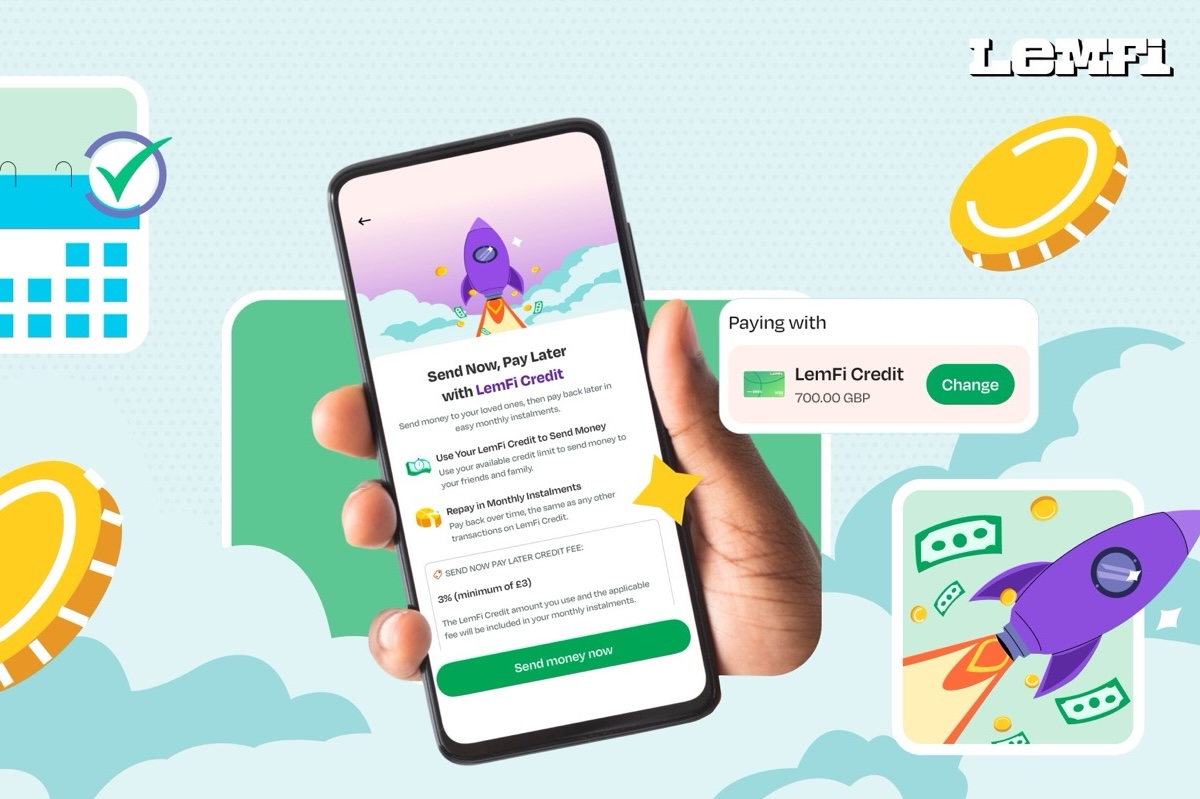

A new “Send Now, Pay Later” service introduced by LemFi combines the flexibility of installment payments with the remittance infrastructure.

Image: LemFi

International payments platform LemFi has launched Send Now, Pay Later (SNPL), a new AI-powered remittance product that lets immigrants in the UK send money home instantly and repay later.

The feature is designed to ease one of the biggest challenges for newcomers — supporting family abroad while managing irregular cash flow and limited local credit history.

LemFi serves more than 2 million customers worldwide, helping people send money to over 30 countries. The new service uses LemFi’s AI-based credit system to offer short-term credit lines ranging from £300 to £1,000, depending on the user’s profile. Customers can send funds through LemFi’s app to any supported country, while repayment is scheduled later according to their credit agreement.

Traditional remittance services typically require full upfront payment, which can be difficult for immigrants dealing with income gaps or emergencies. According to UK government data, migrants send nearly £10 billion home each year, and delays in these transfers can directly affect household welfare in emerging economies where remittances often make up a significant share of family income.

The new LemFi model applies the increasingly popular “buy now, pay later” (BNPL) concept to cross-border money transfers — an area where such credit flexibility was previously unavailable. The company’s Ensemble AI model analyzes a mix of data sources, including open banking data, credit bureau information, remittance patterns, and international credit histories, to determine fair credit limits. This approach helps reduce “credit invisibility” for new arrivals who are typically excluded from mainstream UK lending systems.

Ridwan Olalere, LemFi’s co-founder and CEO, said the launch aims to make remittances more responsive to users’ financial realities:

“The rise of Buy Now, Pay Later means people across the world can buy products and stagger the payments depending on their cash flow. But this has never been possible before with remittance, despite it being such a core part of the immigrant financial experience. With Send Now, Pay Later, we’re integrating credit directly into the remittance experience, ensuring financial support is never delayed by cash flow timing. It’s also a testament to our commitment to building a full-stack, AI-enabled financial ecosystem that understands and serves the unique challenges faced by global citizens.”

The company notes that about five million people in the UK remain “credit invisible,” with immigrants disproportionately affected. Research cited by LemFi shows that nine in ten migrants report growing difficulty in accessing credit, while 13% remain unbanked, compared with just 3% of the general population.

LemFi’s AI-driven risk model continuously adapts to each user’s financial situation, learning from transaction data to improve affordability predictions. The system aims to make credit access faster, fairer, and less biased against users with limited or unconventional financial footprints.

By merging credit and remittance in a single product, LemFi is positioning itself at the intersection of two fast-growing segments — cross-border payments and flexible credit solutions, both of which play an increasingly vital role in financial inclusion and economic stability for migrant households.

After its UK rollout, LemFi plans to expand the Send Now, Pay Later feature to its existing markets in the United States, Canada, and Europe.

Earlier this year, the company raised $53 million in Series B funding, bringing total investment to $86 million from backers including Highland Europe, LeftLane Capital, Endeavor Capital, and Y Combinator.