The Mastercard Economics Institute (MEI) predicts a global GDP growth of 3.2% in 2025, driven by robust U.S., Indian, and GCC economies, with moderate growth in Europe and Latin America.

According to the annual economic outlook for 2025 released by the Mastercard Economics Institute (MEI), the global economy is to continue its steady recovery in 2025, with GDP growth expected at 3.2%, slightly higher than in 2024. Key growth areas include the U.S., India, and the Gulf Cooperation Council (GCC), while China gradually stabilizes with policy support.

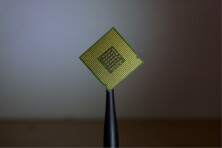

The report notes that inflation and and interest rates continue to ease, and lower prices encourage consumer spending on big items like electronics as well as discrtionary spending e.g. travel and experiences. However, numerous risks linked to global politics and U.S. changing economic plans remain.

MEI predicts global inflation to settle at 3.2% in 2025 after excluding extreme values, with G10 countries averaging a lower inflation rate of 2.4%.

Interest rates are also expected to moderate. In 2024, global central banks already began reducing them to stabilize the economy. MEI predicts these shifts will continue in 2025, and the regulators worldwide will be aiming for “neutral” rates that balance inflation and growth without overstimulating. Rate cuts are predicted to lower borrowing costs, affecting consumer spending patterns, especially on high-ticket and durable goods. The U.S. shows the greatest sensitivity to these changes, with some effects also felt in Canada and the U.K., though to a lesser extent.

Regional differences and trends, like migration impacts and trade policies, will shape the year ahead, highlighting both opportunities and challenges for economies worldwide.

India is expected to become the fastest-growing major economy next year, with a forecast GDP growth of 6.6% and consumer spending growth of 6.2%. The uplifting scenario will be driven by a rising middle class and investment which is less exposed to global demand.

Mainland China’s economy is expected to stabilize with 4.5% growth in 2025. The boost is facilitated by increased government stimulus and pro-growth measures that protect businesses from economic headwinds such as weakened consumer confidence and a slowdown in the housing market.

The U.S. economy is poised for moderate 2.3% GDP growth in 2025 on the background of 2.7% inflation. However, external factors like policy changes could influence the growth momentum. Lower interest rates are expected to boost spending in sectors reliant on financing. At the same time, while higher-income groups are expected to drive gains in discretionary spending, others will still face cost pressures. Moreover, internal risks like policy uncertainty and job market slowdowns may impact U.S. economic outcomes.