India’s first dedicated, direct-to-investor mutual fund, Quant Mutual Fund, is being investigated by the Securities and Exchange Board of India (SEBI) over alleged front-running practices.

Economic Times (ET) Monday report revealed that SEBI had conducted a search at Quant’s head office in Mumbai and at the addresses of suspected beneficiaries in Hyderabad, seizing mobile phones, computers, and other digital devices to investigate the alleged front-running.

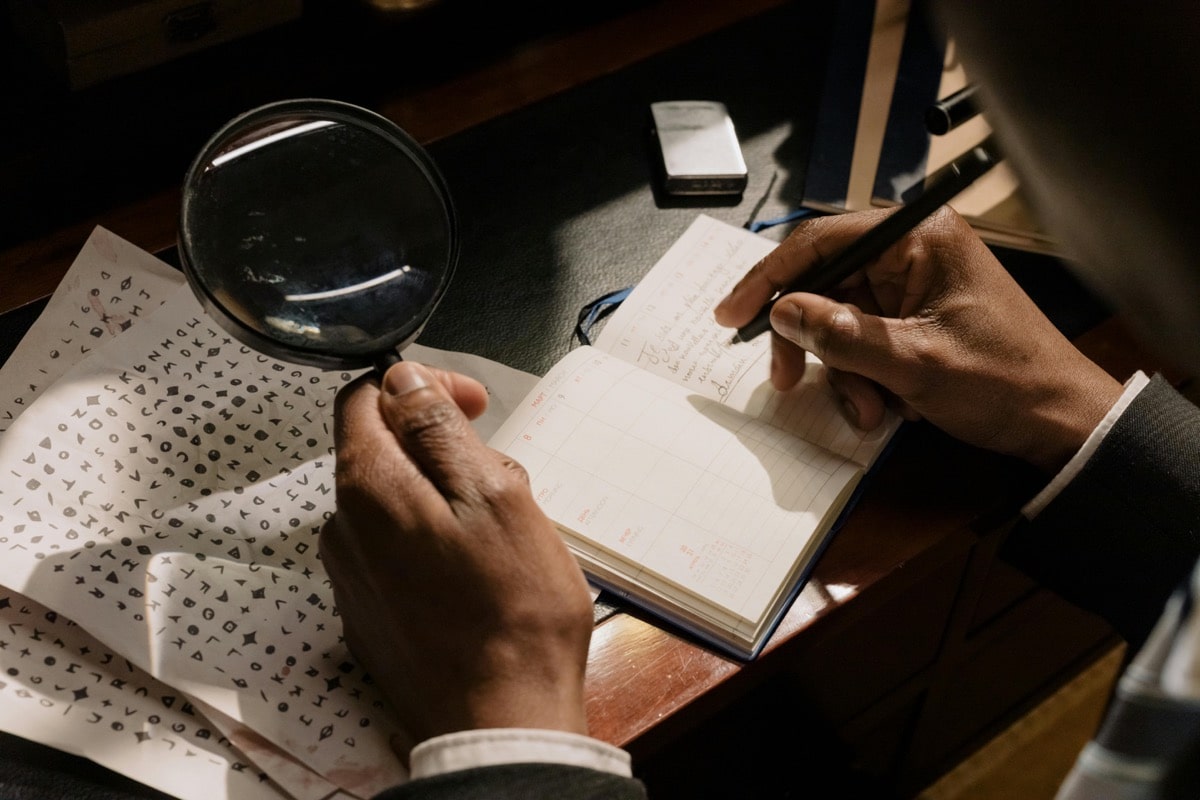

Front-running is trading stocks or other assets in advance based on insider information about future transactions that will affect their price. Typically, insiders make personal securities purchases before executing client orders. They can also leak or sell insider information to third parties so that they conduct profitable early trades with an unfair advantage.

SEBI suspects that a dealer from Quant itself or a broking firm which handles the fund’s orders might have leaked trade information for such illegal purposes.

Quant Mutual Fund is one of India’s oldest mutual funds. As of May 2024, it managed assets of Rs 84,030 crore. The fund offers 27 mutual fund schemes, including 21 equity schemes, 3 hybrid schemes, and 3 debt schemes. In May, the fund house added 27 stocks from seven different sectors to its portfolio. Most of the fund schemes display exceptionally high performance.

SEBI is India’s regulator, overseeing business in stock exchanges and other securities markets. The institution is now examining whether someone was leaking confidential information from the Quant asset management company to make illicit profits.

Reportedly, Sebi’s surveillance system indicated a case of front-running by unnamed beneficiary entities mirroring future transactions of Quant Mutual Fund. Allegations are that Quant executives may have passed on confidential information about the impending trade order size and execution timing to suspected beneficiaries to conduct illegal trade in advance of the large transaction.

If confirmed, the front-running case might impact investors and asset management, depending on the guilty party. Thus, fund performance would be questionable if the fund managers were involved in the scheme. However, if it was done by dealers or other employees who are not engaged in the stock shortlisting, the front-running scheme wouldn’t significantly affect fund performance.

Indian mutual fund industry has already seen a few major front-running cases, including incidents at HDFC Mutual Fund and Axis Mutual Fund.

You might also be interested in differences between ELSS funds and mutual funds in India.