Brazilian fintech comprises of many amazing startups

10 best players of the Brazilian fintech market. Source: unsplash.com

Latin America has seen an increase in the number of fintech startups over the last decade, whereas Brazil, Mexico, and Colombia host the highest number of promising businesses in this segment. Experts believe Brazilian fintech has a bright future since Brazil’s Central Bank is currently implementing new open banking regulations. At the same time, the Brazilian population is mostly young and enthusiastic to adopt technological changes. Therefore, fintech in this country has great opportunities to break the large banks’ monopoly, and improve access to financial services.

In May 2019, there were 380 Brazilian fintech companies, up from 120 fintechs in 2015. By rough estimations, over 180 new fintechs have launched in 2019-2020. The top market players excel at providing services. They have the highest valuation, a great number of customers, and solid investments attracted. It’s time to find out their names.

Top 10 Brazilian fintech startups

- Nubank

- Creditas

- PagSeguro

- ClearSale

- Guiabolso

- Weel

- Pravaler

- Neon

- ContaAzul

- RecargaPay

Nubank

Nubank is one of the top 10 Brazilian fintech startups. Source: medium.com

This unicorn is one of the largest credit card issuers in Brazil, one of Latin America’s most valuable startups, and by far the largest independent digital bank in the world. Valued at more than $10B, Nubank appeared on the Forbes list of the best world banks in 2019. It serves around 20 million customers in Brazil, Argentina and Mexico. The bank’s most popular product is the digital account NuConta, with a savings function and credit card with an optional debit function. It also has a rewards program and an app with more exciting features.

Creditas

In 2019, Creditas, a provider of secured loans (formerly known as BankFácil), received $231 million of investments from the famous SoftBank. The core of this fintech’s innovation is the notion of a collateralized loan. The Creditas founders believed it could become the most viable solution to lower interest rates for would-be borrowers in Brazil. Now the startup offers various loans for consumers, including car, home, and private loans through their online platform. They’ve received over 4.5 million loan applications claiming to save Brazilian consumers around R$700 million compared to the average personal loan rate.

PagSeguro

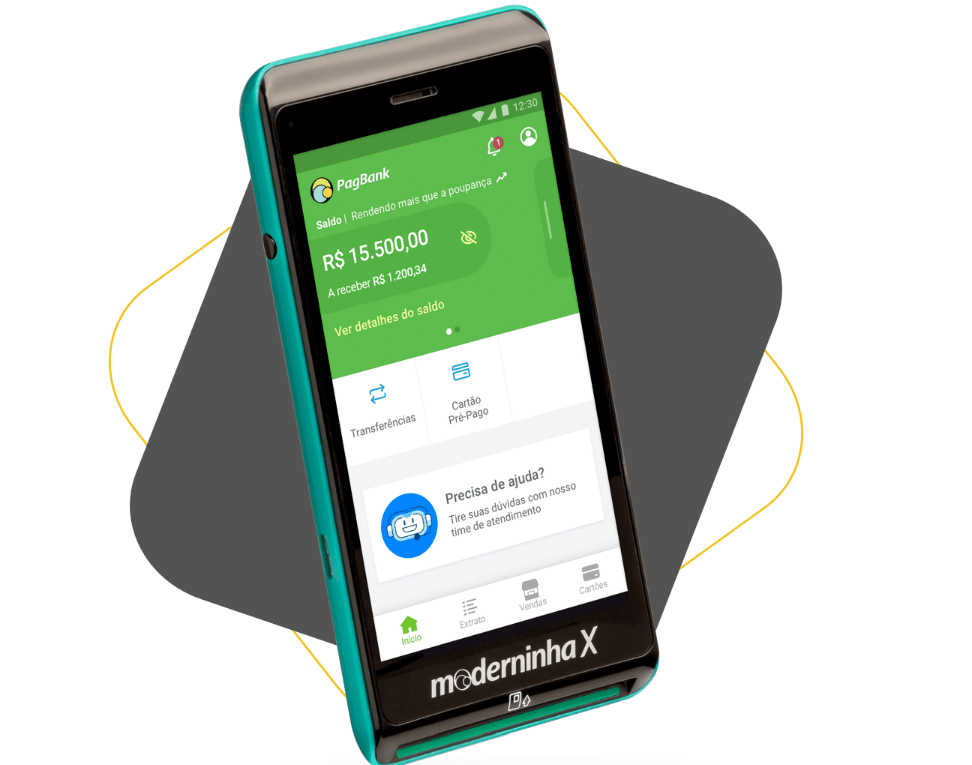

PagSeguro started selling a range of POS and mPOS devices. Source: pagseguro.uol.com.br

Another Brazilian fintech unicorn is a reward-winning e-commerce company. Being part of Brazil’s largest Internet portal, UOL group, it was formed to be the company’s financial services platform. According to ComScore, 107 million unique visitors (approximately 88% of Brazilian internet users) accessed a UOL website in June 2019. The PagSeguro and UOL brands together brought trust to the online merchant-customer relationship by introducing an escrow payment feature. In addition to online payments, PagSeguro started selling a range of POS and mPOS devices, credit card readers, etc. Its free PagBank digital accounts provide 8 cash-out methods for sellers and 37 cash-in methods for customers. In August 2015 the company also released a prepaid card with a focus on microentrepreneurs.

ClearSale

During its 18 years in the market, the fraud management company has matured enough to deliver the highest order approval rates and the lowest false decline rates in the industry. It serves over 3000 business clients in 160 countries monitoring and identifying fraudulent transactions with a multilayer approach. It combines both scans by a proprietary AI technology and consistent expert manual reviews from the team of specialized analysts. The service has truly good reviews and a number of world-famous brands on their client list.

Guiabolso

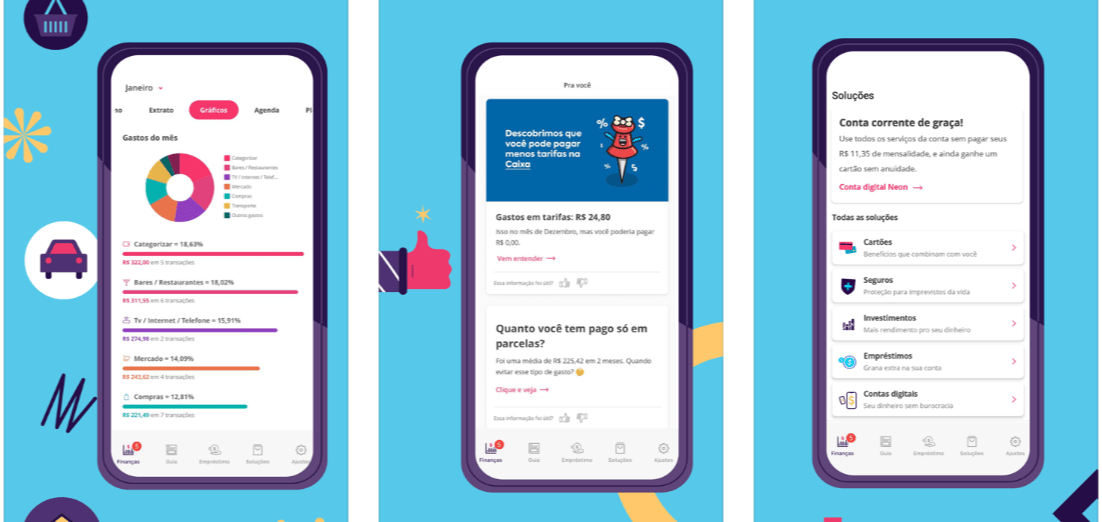

GuiaBolso is a digital hub. Source: apps.apple.com

GuiaBolso is a digital hub that connects Brazilian consumers to financial products via an in-app marketplace with real-time origination. This personal finance platform gives users a complete overview of their finances and provides bank partners with unparalleled data analysis and credit modeling. The company leverages its proprietary bank data aggregation technology to offer customers a range of products from credit reports and financial education tools to credit and investment products. As of December 2019, this Brazilian fintech had more than 6 million clients, up from approximately 4 million in March 2018.

Weel

This fintech finances SMEs by leveraging AI algorithms. Through the digital receivable prepayment WEEL platform, entrepreneurs can send their invoices, establish a credit line, and have financial resources available on the same day, without taking out long and high-interest loans. The company is actually based in Israel but has pioneering operations in Brazil. This year, it raised an investment of R$80 million (about US$18.5 million) through BVx, the innovation arm of the Brazilian bank, BV. Plus, this banking institution will also finance WEEL for up to R$800 million (US$185 million). The startup will use this investment to expand operations throughout all the states of Brazil and potentially reach new parts of Latin America like Mexico and Chile.

Pravaler

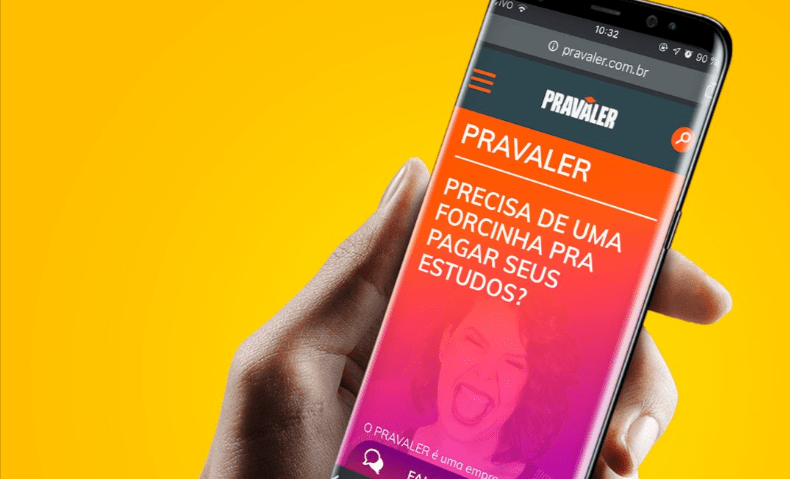

Pravaler has already lent 3 billion reais to 150,000. Source: pravaler.com.br

This leading loan provider specializes in private student loans for Brazilian students. Pravaler has already lent 3 billion reais to 150,000 people studying at undergraduate, graduate, and distance learning courses. The company formed a partnership with more than 500 higher education institutions across the country, which subsidise part or all of the installment interests, forming a true support network for those who have the dream of graduating but need a little help to pay the monthly fees.

Neon

Neon Pagamentos is a neobank for individual consumers. Their products enable users to pay utility bills, receive their salary, make online/offline purchases, transfer funds, invest balances and pay credit card bills with no monthly or annual fees. With a digital account being the main product, Neon has a partnership with Banco Votorantim for account maintenance. Neon credit card/debit cards can also be linked to the mobile wallet. Innovative fintech features also include facial recognition for in-app authorization. The bank currently has nearly 2 million active accounts. In late 2019, the neobank reportedly raised $94 million in funding bringing the general investment amount to over $121 million. The bank is going to use new money inflow to attract new customers and create new products. Neon has revealed it is developing a personal line of credit and going to triple the number of accounts in 2020.

ContaAzul

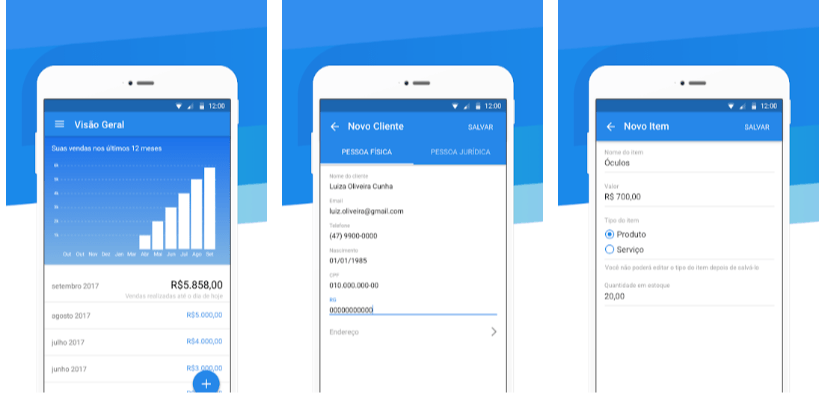

ContaAzul offers multiple subscription plans. Source: play.google.com

The startup provides cloud-based accounting and invoicing solutions for SMBs. ContaAzul offers multiple subscription plans depending on the number of users and features. Their online platform for small businesses helps to centralize all the information and automate flows. ContaAzul also provides an integrative solution along with Pipedrive to help you monitor the sales process, avoiding the retyping of customer and product registrations. ContaAzul was one of the first companies accelerated by 500Startups, a business acceleration program based in Silicon Valley (US). In 2018, it received a new round of equity investment of approximately $30 million led by Tiger Global Management.

RecargaPay

This payment and digital service provider offers the leading mobile payment wallet for personal use and for business in Brazil as well as an outstanding app for mobile top-ups. Its users can also refill their transport cards, pay any bills, transfer money, purchase gift cards, and do a lot more without extra fees and without needing a bank account. Today it’s a full-range payment ecosystem. RecargaPay Prepaid Card is the only one in Brazil that offers 1% of cashback on all transactions, and in its virtual version is free to use. RecargaPay’s mobile wallet doesn’t demand any bank accounts and can be used for contactless payments via the app. The startup is also the largest Brazilian fintech measured in downloads, having surpassed 10 million in Google Play alone.

SEE ALSO: