FICO tried to assess the impact of the pandemic and how policy has changed during a few last years

Average transaction value in UK increased by over 90%: research. Source: pexels.com

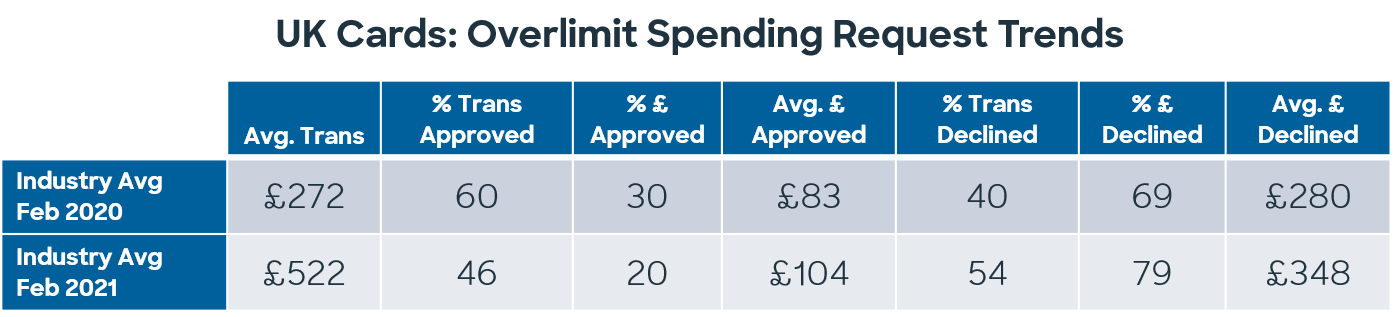

FICO conducted a review of UK credit card spending requests for consumers who missed payments, already exceeded their agreed limit, or would have exceeded their limit if the transaction was approved.

In fact, most card transactions in the UK, roughly 99%, are made by card users spending within their limit and have no missed payments.

Usually, issuers are trying to walk a fine line between customer service. That’s because the embarrassment of being declined in-store or online can damage the relationship. By minimizing losses and being responsible lenders, they try to ensure that any additional costs are available to their customers.

FICO has compared the results of February 2020 and 2021 to see if the requests were affected by the pandemic and how they were dealt with.

According to the research, the number and value of transactions in the industry declined over the years. This may be due to a combination of higher savings for some – therefore, fewer card users trying to exceed the card limit. Also, the reason for that is lower spending and government financial support providing consumers with the funds to support their payments.

Meanwhile, the average transaction cost is up 92% or £250 over last year.

In addition, the industry is seeing a decline in the percentage of approved transactions, 24% lower than a year ago.

The report has also found that the percentage of approved value is lower than last year at 52%. However, the average approved transaction amount increased 35% to £104. On average, declined transactions rose to £348, or 2%.

PaySpace Magazine anticipates that an average transaction cost in 2021 is likely to surpass £350. That’s because after a year of coronavirus restrictions and several lockdowns Brits are expected to dive into traveling and outdoor activities that require special equipment as well.

We’ve reported that 30% of Brits want contactless spending limit to increase.

SEE ALSO: