The country’s payment card market has been booming over the past few years but saw a slowdown amid the pandemic

Card payments in Australia to grow by 8.3% in 2021: report. Source: pixabay.com

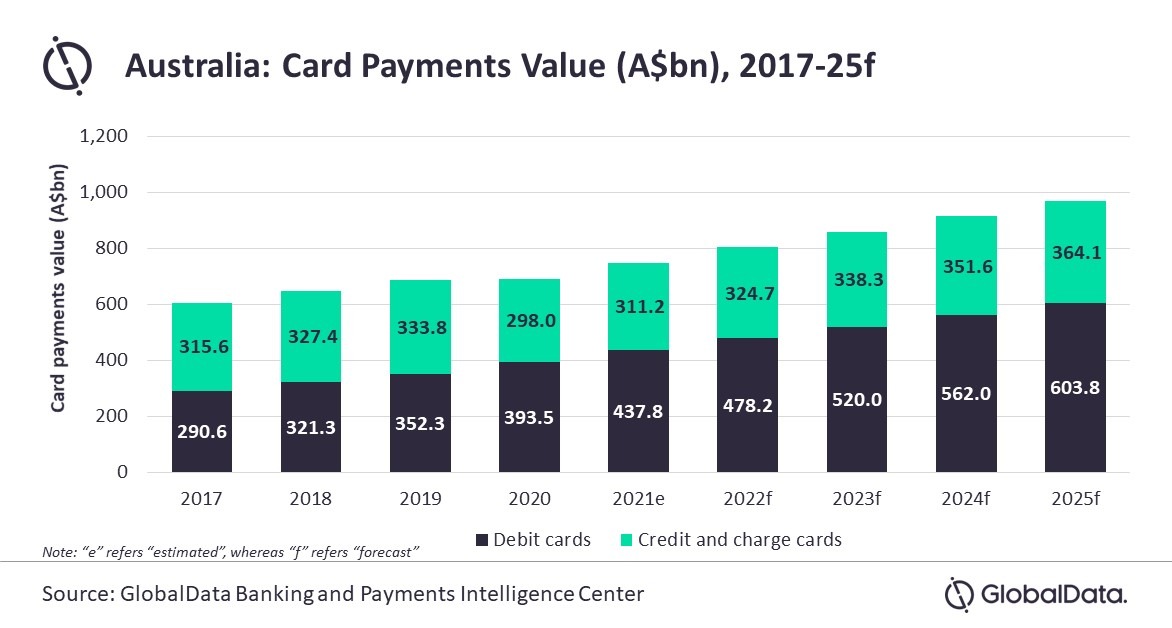

According to GlobalData, the payment card market in Australia is expected to grow 8.3% in 2021.

In fact, the volume of card payments in 2020 decreased by 0.8%, which is much less compared to 5.8% in 2019. As economic conditions improve and the vaccination program accelerates, the market for card payments will grow and reach A$749 billion (US$577.3 billion) in 2021.

The value of card payments is projected to continue to rise, with a compound annual growth rate of 6.6% from 2021 to 2025, reaching A$967.9 billion (US$746.1 billion) in 2025.

The report has found that the use of contactless cards and payments in e-commerce will drive the increase of card payments.

In fact, the use of contactless cards is on the rise as even smaller merchants now push for cashless and contactless payments amid hygiene concerns related to COVID-19.

Indeed, the contactless card payment limit has been increased from A$100 (US$77.08) to A$200 (US$154.16) from April 2020 to support it.

In addition to physical cards, payments via mobile wallets with stored debit and credit cards are also becoming more popular in Australia. According to the Commonwealth Bank, as of March 2021, over 40% of the bank’s contactless debit and credit card transactions were made through mobile wallets.

Furthermore, the drop in overall consumer spending during the pandemic has been offset by rising online spending as wary consumers stay at home and use the online channel.

Debit cards are the most preferred type of card for payments, accounting for 58.5% of total card payments in 2021. Meanwhile, credit and debit cards make up the remaining 41.5% of the share.

We’ve reported that Klarna hit 20 million customers in the US.

SEE ALSO: