Stay ahead of the digital revolution while maintaining a personal touch

Digital Banking Age: how to remain competitive. Source: shutterstock.com

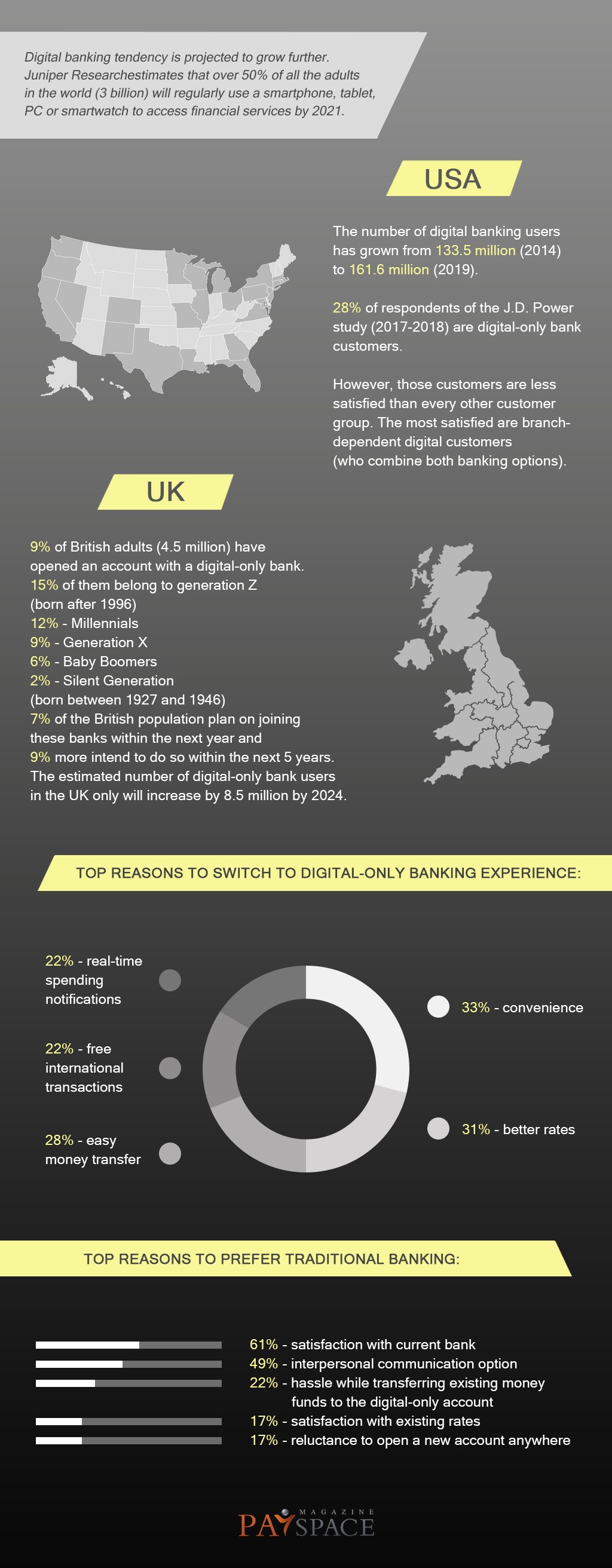

Digital banking tendency is projected to grow further. The following infographics clearly illustrate the digital banking tendencies of today.

Considering all the given facts, there is both bad and good news for traditional bank retailers all over the world.

Let’s start with the bad news. Digital banking is not going anywhere any time soon. You cannot simply wait until this tendency is over since it’s not a fleeting fancy. Digitalization is a new reality and you can’t hide from it behind your bricks-and-mortar walls. Every big or small bank needs to embrace rapidly developing technologies in order to ever succeed.

The good news, though, is that the physical branches are not yet giving up their positions. The portion of people who still need interpersonal communication embedded within their banking experience is huge. Moreover, people trust the old-established reputable financial organizations more than the recently emerging digital-only startups.

All in all, bank retailers still have good chances to remain competitive in this digital-driven banking market. However, they must adapt to new realities and face challenges.

Bank retailers still have good chances to remain competitive in this digital-driven banking market. Source: shutterstock.com

Here are the few tips to remain afloat in the sea of digital transactions.

How to remain competitive

- Put mobility first. Real-time access to their funds, immediate operations, effortless money transfers and account opening are what people want. A mobile banking app is not only a must but a priority. It has to be seamless, intuitive and engaging. It should compete with the habitual apps and social networks in its functionality. If you want to top expectations, make it stand out.

These are some of the already popular features that you should consider: real-time spending notifications and advice; omnichannel synchronization; budget manager; immediate money transfers; integration with shopping platforms, etc.

Use AI technologies or blockchain. Source: shutterstock.com

Yet there are no limits to one’s creativity. You can add up some entertaining features; make it a multi-functional super app; use AI technologies or blockchain; partner with third-party organizations to bring the app users certain benefits; create a user community similar to a social network; cooperate with charitable groups or activist movements via the app so that people can easily donate their funds to the good causes etc.

- Exceed in security. The PIN-code is only basic protection. In the age of cyber-crime, it is not even valid. Yet people value security a lot when it comes to their financial affairs. So, invest in encryption, biometric recognition, iris scanners and other high-tech equipment and measures of fraud prevention.

Do not allow security measures to complicate financial operations. Source: shutterstock.com

However, do not allow security measures to complicate financial operations, app navigation, or account access. A 10-step verification procedure is similar to the boring bureaucracy of the physical branches. Don’t lose your digital edge.

- Update your branches. Branches and their employees may stay in the same place, but they cannot keep the same pace. Modern customers need speed. Many operations can be transferred to the in-branch self-service panels, live chats with support, biometric authentication, etc. The branch workers should provide high-quality service, remaining customer-friendly, respecting diversity, giving prompt consultation and financial advice. In addition, they should be tech-savvy in order to guide new clients through digital banking options and apps.

- Cherish your customer base. Customize your offers. Develop a loyalty program. React to feedback and suggestions. Surpass service expectations.

Once you’ve got a client, they are not likely to switch banks if they are satisfied. Source: shutterstock.com

People do not like additional effort. They hate wasting time on opening new accounts, researching all interest rates, etc. Once you’ve got a client, they are not likely to switch banks if they are satisfied. Keep your fees competitive. Remember that many digital-only institutions provide most transactions free of charge. Think of ways to reduce customer expenses within your organization.

- Develop a parallel brand. You can leave a good old traditional banking option for the conservatives and the older generations. Meanwhile, it doesn’t hinder your company in developing a subsidiary, or parallel brand, that will provide a digital-only banking experience. This way, you can reach the widest target audience and slowly transition to the new digital environment. Your good reputation as a bricks-and-mortar institution will serve as a guarantee for safe mobile transactions. A brand name will attract new customers who are familiar with your service but prefer automated banking.

- Provide top IT solutions. Let innovation pave the way. Hire the best IT specialists, visionaries and blockchain experts to your team. Keep pace with technologies and trends, or even better, stay ahead of them. Together you can withstand the pressure of the fintech giants, popular startups and all the traditional competitors.