Startup companies which decrease inequality by providing financial services to BIPOC, immigrants, and LGBT community

5 neobanks to keep an eye on. Source: burst.shopify.com

Back in 2011, The World Bank named financial inclusion a key enabler in a fight against poverty and boosting prosperity. In today’s article, PaySpace Magazine shares how the newly arrived fintech startups are helping TWB achieve this goal by reducing financial inequality and improving people’s lives.

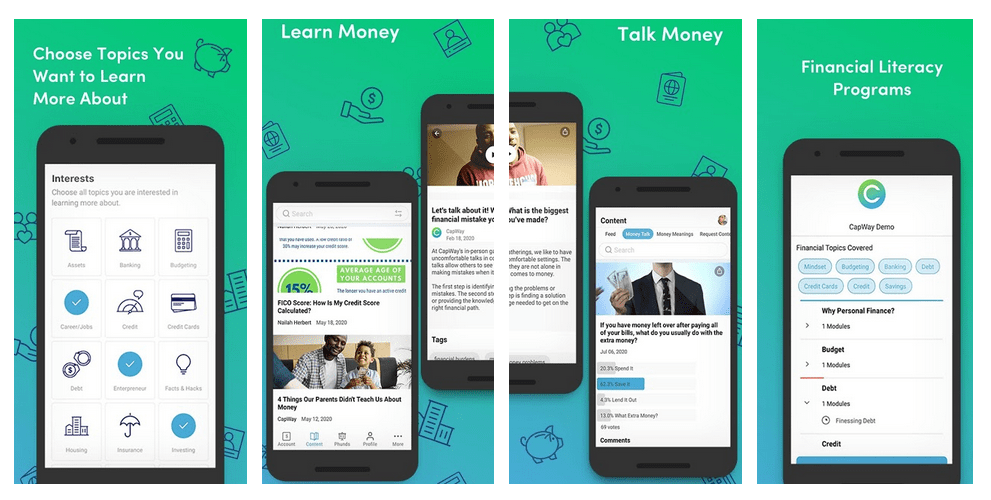

CapWay

Source: play.google.com

CapWay is a digital bank founded by the Black female entrepreneur Sheena Allen who grew up in a small town with only one bank. According to her, the main idea behind starting her own financial business is to restore trust and provide a fair opportunity to safely store, grow, and learn money. To attract consumers, CapWay focuses on the absence of hidden fees and transparency of its work.

“We work to remove any guessing or surprises when it comes to your money,” – states one of CapWay’s mottos.

The challenger bank offers clients a mobile deposit account with a Visa debit card, as well as free ATM withdrawals. Users can track their transactions, set financial goals, and pay their bills in the app with no minimum balance, overdraft, or monthly fees.

Greenwood

Source: bankgreenwood.com

After securing $3 million in seed funding from private investors, Greenwood, a mobile bank for Black and Latinx people (both individuals and entrepreneurs), had a launch this October.

The startup’s financial services include savings and spending accounts, mobile check deposits, debit and virtual card, P2P transfers, global ATM network, Apple, Samsung, and Android Pay, two-day early pay, and, of course, no hidden fees. Aside from that the bank supports the community by providing food and money to the needy people and organisations, including UNCF, Goodr or NAACP, just to name a few.

Being founded by the civil rights activist and former mayor of Atlanta Andrew J. Young, the rapper and activist in Black financial empowerment Michael ‘Killer Mike’ Render, and the founder of Bounce TV network Ryan Glover, Greenwood was named after the Greenwood District of Tulsa, Oklahoma, which was a center of African American enterprise, entertainment, skills, wealth, and investment capital during the early 20th century.

Tenth

Source: betenth.com

Another neobank for Black people, Tenth, got its name after the book “The Talented Tenth” written by civil rights activist W.E.B. DuBois who advocated for the most prominent African Americans to get education to benefit their community.

The mission of the startup is to erase the wealth gap for Black people through financial education. To achieve that, the bank offers its clients real-time financial tips and helps them to keep track of their expenses, make money savings, gain access to insurance and wealth management.

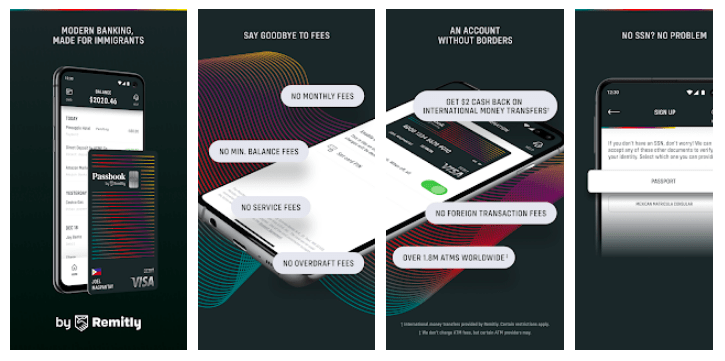

Passbook

Source: play.google.com

Earlier this year, the US money transfer startup Remitly launched a multicultural neobank named Passbook.

The users get access to a Visa debit card with a $2 cashback for each money transfer transaction using the Remitly service. Customers can open and use bank accounts even if they do not have a Social Security number or other proof of US residency. Instead, clients can use the passport of their country or any other document confirming their place of residence.

Passbook does not charge users with “typical” banking fees such as payment for minimum balance, maintenance, overdraft, ATM withdrawals, transfers, service charges, card reissues, and other services.

Daylight

Source: joindaylight.com

Daylight, the first digital bank for LGBT+ people, will have a beta release this December. The users will get a prepaid Visa card in their preferred name which may not match their ID data. Services for improving spending habits, personalized financial advice, as well and the ability to make direct donations to charities associated with LGBT+ community will also be available to clients.

No minimum balance, Apple Pay, Google Pay, and one free ATM withdrawal per month are on board as well.

Source: mastercard.us

Daylight is not the first company offering clients a bank card with a chosen name. In 2019, Mastercard introduced True Name which allows transgender and nonbinary people display their preferred name on the payment card. In the US, this feature is currently available for customers of Citi and BMO Harris Bank. In July 2020, Mastercard made this product available in Europe.

The emergence of neobanks, standing for financial equality, is quite a natural result caused by civil rights movements activity. The victory of Democrat Joe Biden in the US elections, followed by his appointment of Black female politician Kamala Harris as vice president, is expected to become another powerful impetus for the appearance of more inclusive financial players on the market.

SEE ALSO: