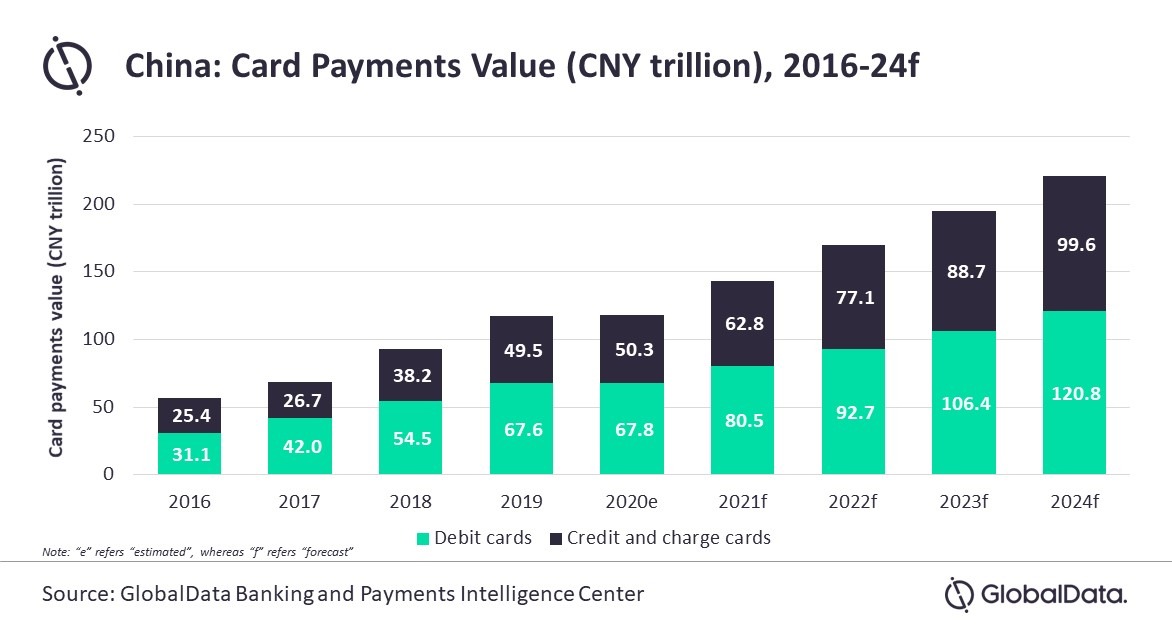

Card payments in China have been on sustained growth for the last few years

Here’s when China’s card payments are set to rebound. Source: shutterstock.com

According to GlobalData, while the growth in China was affected by the COVID-19 pandemic last year, it is set to rebound with a 21.3% growth in 2021.

The data explains that card payments are expected to rise as economic activities gather pace and consumer spending improves in the wake of the COVID-19 vaccination program. The value of card payments is forecast to register a CAGR of 16.9% between 2020 and 2024 to reach $33.8 trillion.

GlobalData has also stated that the Chinese payment card space is dominated by debit cards, accounting for 57.4% of total card payments value in 2020 while credit and charge cards accounted for the remaining 42.6% share.

Nevertheless, the government is taking various measures to support the card market in collaboration with card issuers and schemes. One such initiative was the removal of interest rate upper and lower cap from 1 January 2021, which was previously set between 12.78% to 18.25%, respectively. This means the interest rate can now be determined by the issuer and cardholder through independent negotiation between them.

We’ve reported that Hongkongers are increasingly opting for online shopping.

SEE ALSO: