Foreigners residing in Ukraine now have the opportunity to access financial services with greater ease, as Monobank, one of the country’s leading digital banks, also offers its services to non-Ukrainian residents. Monobank’s convenient mobile app and flexible financial tools make obtaining a card straightforward, even for those without Ukrainian citizenship. This article, brought to you by PaySpace Magazine Global, will guide you through how foreigners can apply for and receive a Monobank card, ensuring seamless access to banking in Ukraine.

How to apply for a Monobank bank account as a foreigner. Source: facebook.com

Monobank is a result of collaboration between Universal Bank JSC and the multiproduct fintech company Fintech Band. It is the most successful Ukrainian neobank with many innovative features and a user-friendly interface. The bank is quite popular locally and has almost ten million clients, with about 2 million of them being daily active users.

Documents

In order to prove you’re a temporary or permanent resident of Ukraine, you’ll need to provide one of the following sets of documents:

- permanent residence permit & Individual Tax Identification Number (ITIN);

- temporary residence permit (only if VALID INDEFINITELY) & ITIN;

- temporary identity card of a citizen of Ukraine & ITIN.

Only foreigners with valid Ukrainian residence permits can now set up a Monobank account. If you are interested in setting up a foreign bank account as a non-resident, you can check out how to set up a bank account in UAE for non-residents.

Application Process

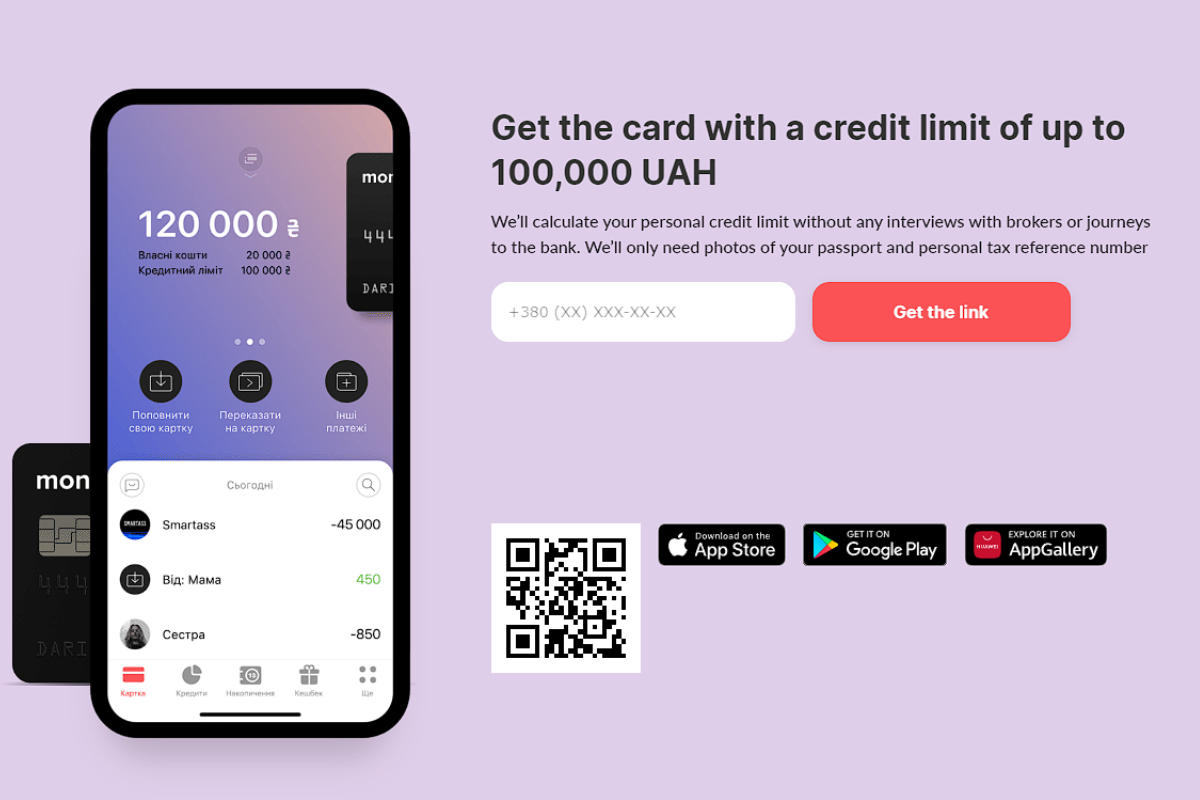

You can order a Monobank card in a few ways:

- at the official website

- via the Android or iOS Monobank app

- buy it in one of the partner stores (locations include some of the largest supermarket chains in Ukraine)

Monobank’s official website offers several registration options for new clients

The onboarding process is designed to be straightforward, requiring just a few simple steps:

- Fill out a short application form (Name, last name, phone number).

- If you order the card online, the virtual card is available immediately. To avail of a plastic card, you must choose a partner location, Nova Poshta office, or a distribution point where you’ll receive your plastic card. This information is unnecessary if you’ve already bought a physical card at one of the partner stores.

- The “Request” link will take you to the next stage, where you must upload pictures of your ID/residence permit and taxpayer’s ID (ITIN) and take a selfie for identification.

- The bank will ask additional questions about your job, salary, and other relevant details to tailor your credit offer to your needs. After you’ve filled out the form and a questionnaire, the app or the website will specify the terms (time and place) of receiving your plastic card.

- You arrive at the Nova Poshta office or a distribution point with your ID documents and get the card. If this option is applicable, you may also get your card delivered to the selected address.

- You download the app and start using Monobank services.

In case you’ve bought a Monobank card at one of the selected retailers, you need to do the following:

- Open the package

- Scan the QR code

- Download the app (if you haven’t already done it) and activate your card

- Follow the in-app instructions

International Shipping

Recently, Monobank updated its mobile application, adding a new function — international shipping of plastic cards abroad to over 180 countries. The client can order delivery through Ukrposhta International or Nova Poshta and choose the nearest branch/post office or delivery address available.

To order the card internationally, you will need to:

- Open the application, and on the main screen, swipe left to go to the card settings.

- Click “Issue a plastic card” and select the country and delivery method.

- Specify the recipient’s address and details.

- After registration, the money for delivery will be debited from your account.

- The application will receive a notification with a tracking number to track the delivery status.

Accounts & Currencies

Monobank customers may order a few debit/credit cards: Black, White, Platinum, Iron, and the Kids card.

The Black card is a basic retail offer with a credit limit of up to 500,000 UAH and generous cashback up to 20%.

The White card is a debit card that allows one to cash out salaries and payments for self-employed customers without commissions.

The platinum card is a private banking offer that makes you feel truly special. With a fast line at the airports, concierge services, a credit limit of up to 500,000 UAH, and a unique card design with increased privacy (the plastic card may be issued without the card number printed on it), you’ll enjoy a range of exclusive perks.

Iron cards are premium metal cards that may give their owners all the benefits that Visa Infinite and Mastercard World Elite offer.

The Kids card is an account for children under 16 years old.

All the basic accounts are in Ukrainian hryvnia. However, you can open additional USD and Euro accounts. Such accounts can be topped by cash at the partner banks or via your basic Monobank account in-app. Bank transfers are made through the SWIFT system. There’s no commission for cash deposits. When you top up the USD or Euro accounts from your UAH account, the currency is converted according to the bank’s rate.

Despite Ukraine being one of the most crypto-friendly countries in the world, as of now there is no option to open an account in cryptocurrency. However, the company is considering a crypto-banking project, as soon as local regulators permit such initiatives.

Regarding remittances, Monobank offers a wide range of services, allowing you to choose to overcome cross-border payment inefficiencies: SWIFT payments to Visa and Mastercard, SEPA transfers, Western Union, MoneyGram, and RIA. You can transfer funds from Payoneer to your USD or EUR Monobank account.

By the way, the 24/7 Monobank support is available via various messengers and speaks English. This means that the bank’s foreign customers can always find help, no matter the time zone or the issue that may arise.

This article was updated on Sept. 10, 2025, to include the most current details regarding the international shipment of credit cards and available currencies.